A new survey reveals that approximately half of Americans with credit cards are in debt, with many carrying balances for over a year. While some debt is attributed to emergencies, a significant portion stems from everyday costs like groceries and childcare, highlighting the financial strain many face. The survey emphasizes the importance of responsible credit card use and the need for emergency savings.

About half of Americans with credit cards are in debt, and about half of those folks have been in debt for over a year, according toAnd much of that credit card debt is fueled by emergency expenses or simply day-to-day living.

“The conventional wisdom is that they're being irresponsible,” Rossman said of people who accumulate credit card debt. “But I want to refute that and point to survey data that shows that it's usually practical stuff.” The new survey found 28% of credit card users with debt got underwater from groceries, child care, utilities or other day-to-day expenses.

Credit Card Debt Personal Finance Emergency Savings Inflation Consumer Spending

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Half of Americans With Credit Cards Carry Debt, Often Due to EmergenciesA new survey reveals that nearly half of Americans with credit cards are in debt, with many struggling to keep up with everyday expenses and emergencies. The survey highlights the growing reliance on credit cards for essential needs and the dangers of accumulating high-interest debt.

Half of Americans With Credit Cards Carry Debt, Often Due to EmergenciesA new survey reveals that nearly half of Americans with credit cards are in debt, with many struggling to keep up with everyday expenses and emergencies. The survey highlights the growing reliance on credit cards for essential needs and the dangers of accumulating high-interest debt.

Read more »

Credit Card Debt Soars: Half of Holders Carry BalancesA new report reveals that nearly half of credit cardholders are struggling with month-to-month debt, with many facing years of repayment. High inflation and interest rates are contributing factors, pushing the average balance to $6,380. Experts advise consolidation strategies to manage the growing burden.

Credit Card Debt Soars: Half of Holders Carry BalancesA new report reveals that nearly half of credit cardholders are struggling with month-to-month debt, with many facing years of repayment. High inflation and interest rates are contributing factors, pushing the average balance to $6,380. Experts advise consolidation strategies to manage the growing burden.

Read more »

Spare Underwear: A Growing Trend Among AmericansA recent poll reveals that nearly half of Americans carry spare underwear for unexpected situations.

Spare Underwear: A Growing Trend Among AmericansA recent poll reveals that nearly half of Americans carry spare underwear for unexpected situations.

Read more »

New bill would mandate gyms to carry equipment for Americans with disabilitiesCongressional Democrats are pushing for a massive overhaul to regulatory policy concerning Americans with disabilities.

New bill would mandate gyms to carry equipment for Americans with disabilitiesCongressional Democrats are pushing for a massive overhaul to regulatory policy concerning Americans with disabilities.

Read more »

Holiday Debt: Americans Turn to Credit Cards, Facing High CostsA recent report reveals that 36% of Americans incurred debt during the holiday season. Experts warn that relying on credit cards for gifts can lead to significant financial strain due to high interest rates. Inflation continues to impact consumer spending, forcing many to borrow to afford holiday expenses.

Holiday Debt: Americans Turn to Credit Cards, Facing High CostsA recent report reveals that 36% of Americans incurred debt during the holiday season. Experts warn that relying on credit cards for gifts can lead to significant financial strain due to high interest rates. Inflation continues to impact consumer spending, forcing many to borrow to afford holiday expenses.

Read more »

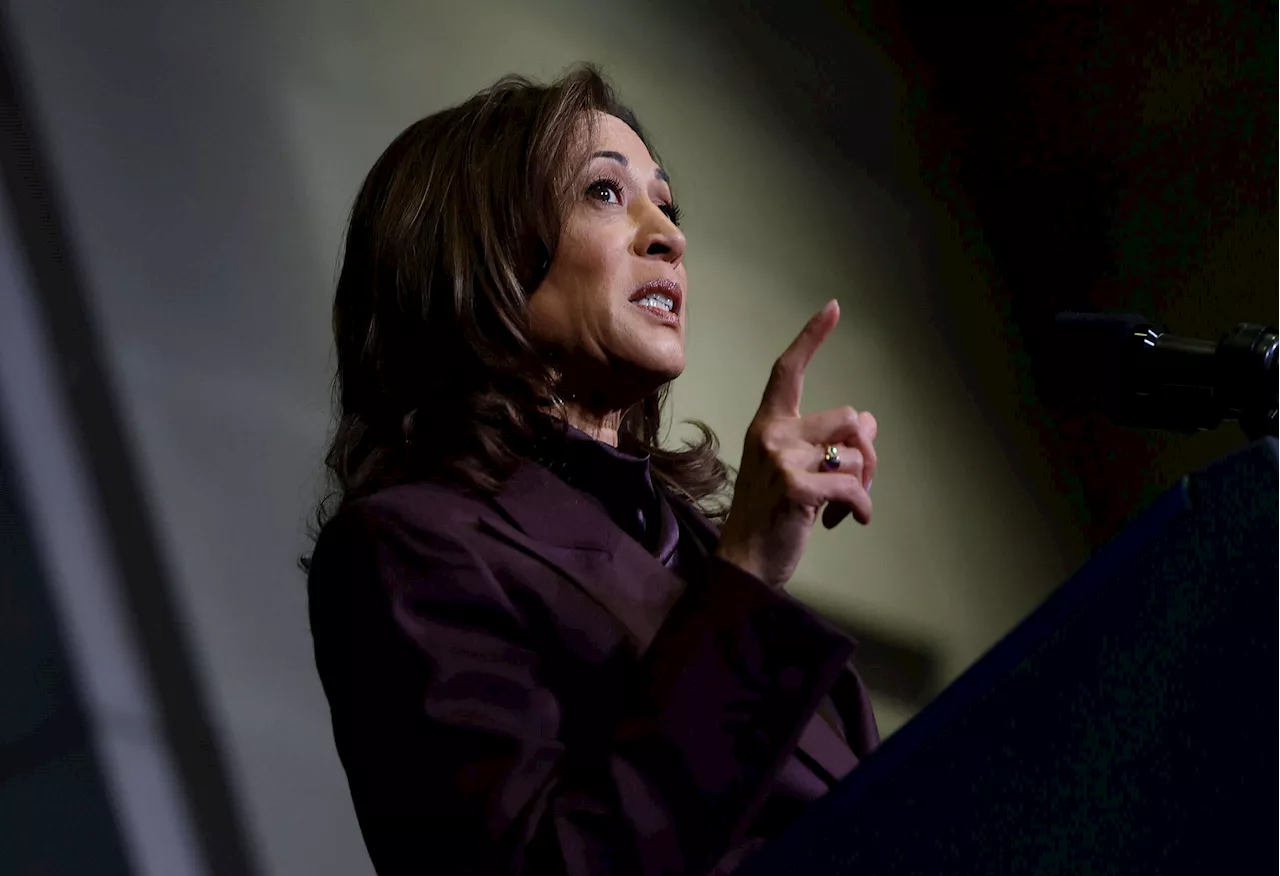

Medical Debt Removed From Credit Reports for All AmericansVice President Kamala Harris announced a final rule removing medical debt from consumer credit reports, impacting over 15 million Americans and raising their credit scores. The rule, aiming to improve economic opportunities, builds on states' use of ARP funds to eliminate over $1 billion in medical debt. Despite its potential benefits, the rule may face legal and political challenges.

Medical Debt Removed From Credit Reports for All AmericansVice President Kamala Harris announced a final rule removing medical debt from consumer credit reports, impacting over 15 million Americans and raising their credit scores. The rule, aiming to improve economic opportunities, builds on states' use of ARP funds to eliminate over $1 billion in medical debt. Despite its potential benefits, the rule may face legal and political challenges.

Read more »