A new survey reveals that nearly half of Americans with credit cards are in debt, with many struggling to keep up with everyday expenses and emergencies. The survey highlights the growing reliance on credit cards for essential needs and the dangers of accumulating high-interest debt.

About half of Americans with credit cards are in debt, and about half of those folks have been in debt for over a year, according toAnd much of that credit card debt is fueled by emergency expenses or simply day-to-day living.

“The conventional wisdom is that they're being irresponsible,” Rossman said of people who accumulate credit card debt. “But I want to refute that and point to survey data that shows that it's usually practical stuff.” The new survey found 28% of credit card users with debt got underwater from groceries, child care, utilities or other day-to-day expenses.

Credit Card Debt Personal Finance Inflation Emergency Expenses Consumer Spending

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Holiday Debt: Americans Turn to Credit Cards, Facing High CostsA recent report reveals that 36% of Americans incurred debt during the holiday season. Experts warn that relying on credit cards for gifts can lead to significant financial strain due to high interest rates. Inflation continues to impact consumer spending, forcing many to borrow to afford holiday expenses.

Holiday Debt: Americans Turn to Credit Cards, Facing High CostsA recent report reveals that 36% of Americans incurred debt during the holiday season. Experts warn that relying on credit cards for gifts can lead to significant financial strain due to high interest rates. Inflation continues to impact consumer spending, forcing many to borrow to afford holiday expenses.

Read more »

Credit Card Debt Soars as Americans Wrestle with Holiday Spending and InflationA recent survey reveals a concerning trend of rising credit card debt among Americans as holiday spending and persistent inflation put a strain on household finances. Many are struggling to afford necessities, leading to increased reliance on credit and potential long-term financial difficulties.

Credit Card Debt Soars as Americans Wrestle with Holiday Spending and InflationA recent survey reveals a concerning trend of rising credit card debt among Americans as holiday spending and persistent inflation put a strain on household finances. Many are struggling to afford necessities, leading to increased reliance on credit and potential long-term financial difficulties.

Read more »

Americans Face Credit Card Debt Burden After Holiday Spending SpreeAs the holiday season concludes, many Americans are grappling with increased credit card debt due to inflated prices. Surveys reveal a growing number of consumers are struggling to manage essential expenses, leading to greater reliance on credit cards and alternative financing options. This trend is exacerbating financial strain, with experts warning of potential long-term consequences.

Americans Face Credit Card Debt Burden After Holiday Spending SpreeAs the holiday season concludes, many Americans are grappling with increased credit card debt due to inflated prices. Surveys reveal a growing number of consumers are struggling to manage essential expenses, leading to greater reliance on credit cards and alternative financing options. This trend is exacerbating financial strain, with experts warning of potential long-term consequences.

Read more »

Credit Card Debt Climbs as Americans Face Holiday Spending HangoverThe holiday season has left many Americans struggling with credit card debt as inflation continues to impact finances. A survey reveals that 83% of Americans with credit cards faced difficulties making ends meet this year, leading many to rely on credit cards, personal loans, and buy-now-pay-later options. Household debt has reached $17.94 trillion, with credit card balances alone increasing by $24 billion, reaching $1.17 trillion.

Credit Card Debt Climbs as Americans Face Holiday Spending HangoverThe holiday season has left many Americans struggling with credit card debt as inflation continues to impact finances. A survey reveals that 83% of Americans with credit cards faced difficulties making ends meet this year, leading many to rely on credit cards, personal loans, and buy-now-pay-later options. Household debt has reached $17.94 trillion, with credit card balances alone increasing by $24 billion, reaching $1.17 trillion.

Read more »

Medical Debt Removal Rule to Impact Millions of Americans' Credit ScoresThe Consumer Financial Protection Bureau finalized a rule to erase unpaid medical bills from consumer credit reports, potentially boosting credit scores by an average of 20 points for 15 million Americans. This change aims to improve economic opportunities for those affected by medical debt, making it easier to obtain loans and credit.

Medical Debt Removal Rule to Impact Millions of Americans' Credit ScoresThe Consumer Financial Protection Bureau finalized a rule to erase unpaid medical bills from consumer credit reports, potentially boosting credit scores by an average of 20 points for 15 million Americans. This change aims to improve economic opportunities for those affected by medical debt, making it easier to obtain loans and credit.

Read more »

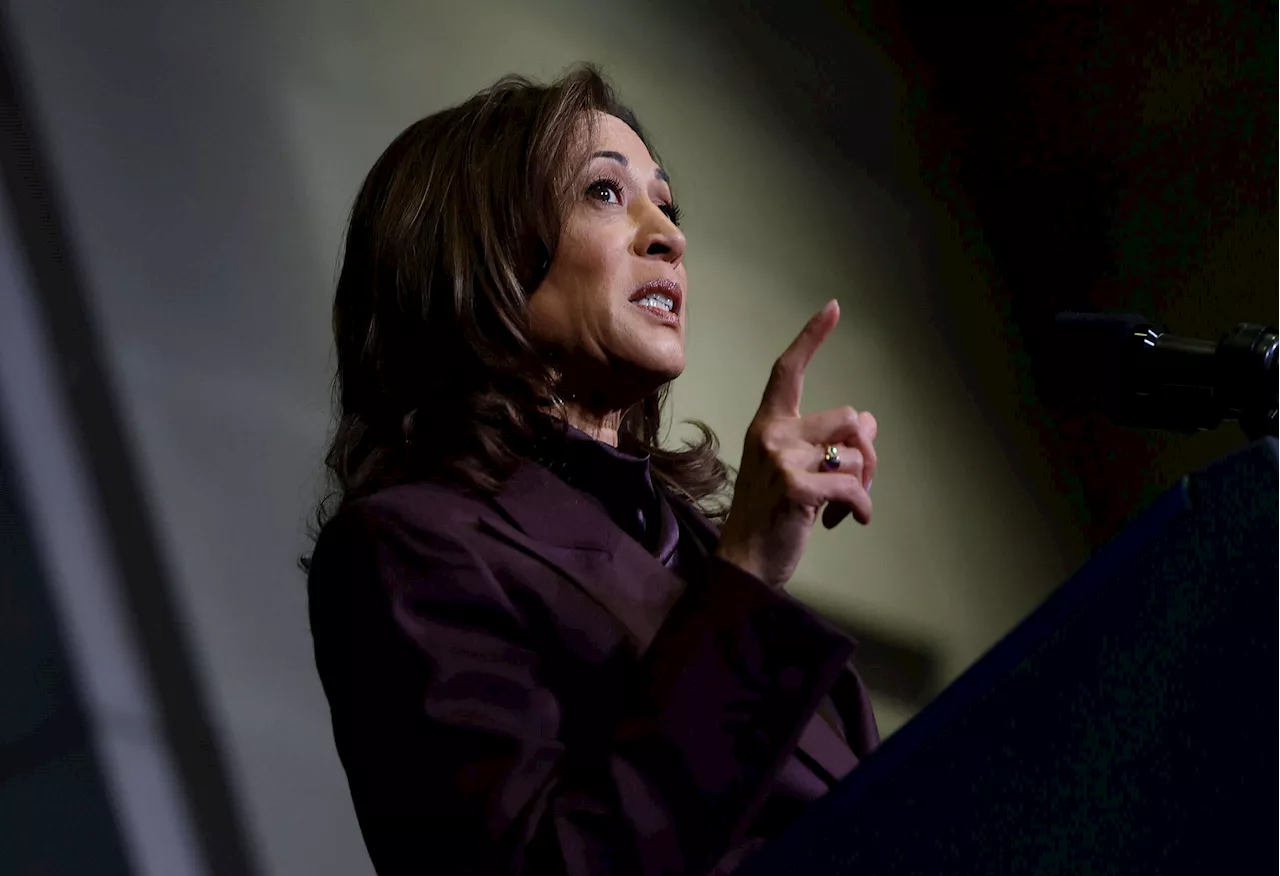

Medical Debt Removed From Credit Reports for All AmericansVice President Kamala Harris announced a final rule removing medical debt from consumer credit reports, impacting over 15 million Americans and raising their credit scores. The rule, aiming to improve economic opportunities, builds on states' use of ARP funds to eliminate over $1 billion in medical debt. Despite its potential benefits, the rule may face legal and political challenges.

Medical Debt Removed From Credit Reports for All AmericansVice President Kamala Harris announced a final rule removing medical debt from consumer credit reports, impacting over 15 million Americans and raising their credit scores. The rule, aiming to improve economic opportunities, builds on states' use of ARP funds to eliminate over $1 billion in medical debt. Despite its potential benefits, the rule may face legal and political challenges.

Read more »