BREAKING NEWS: Fed report on Silicon Valley Bank collapse blames mismanagement, weak government oversight

Seaport Securities founder Ted Weisberg and The Cow Guy Group founder Scott Shellady discuss if the fallout from the SVB collapse will be long-lasting and bigger than initially thought on The Claman Countdown.

The Federal Reserve released its assessment Friday of what led to Silicon Valley Bank's collapse, saying the lender's failure was due to a "textbook case of mismanagement" and calling for greater supervision by regulators.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Read more »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Read more »

![]() Fed Faults Silicon Valley Bank Execs — And Itself — In Bank FailureThe report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

Fed Faults Silicon Valley Bank Execs — And Itself — In Bank FailureThe report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

Read more »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureThe report, authored by Federal Reserve staff and Michael Barr, the Fed’s vice chair for supervision, takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size.

Fed faults Silicon Valley Bank execs, itself in bank failureThe report, authored by Federal Reserve staff and Michael Barr, the Fed’s vice chair for supervision, takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size.

Read more »

![]() Fed faults Silicon Valley Bank execs and itself in bank failureThe report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse.

Fed faults Silicon Valley Bank execs and itself in bank failureThe report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse.

Read more »

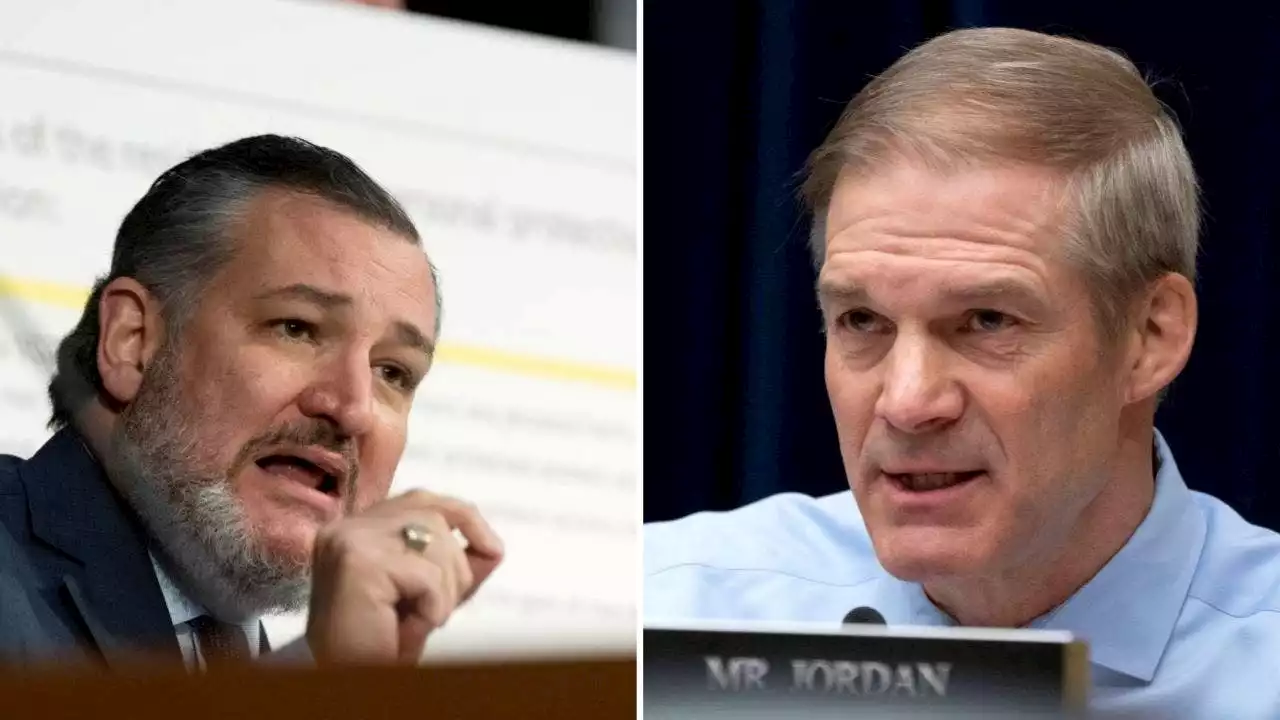

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »