The report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

WASHINGTON — Silicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Silicon Valley Bank was the go-to bank for venture capital firms and technology start-ups for years, but failed spectacularly in March, setting off a crisis of confidence for the banking industry. Federal regulators seized Silicon Valley Bank on March 10 after customers withdrew tens of billions of dollars in deposits in a matter of hours.

Although the withdrawals have abated at many banks, First Republic Bank in San Francisco appears to be in peril, even after receiving a $30 billion infusion of deposits from 11 major banks in March. The bank’s shares have plunged 57% this week after it revealed the extent to which customers pulled their deposits in the days after Silicon Valley Bank failed.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed report on SVB collapse faults bank's managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory failures, compounded by a dose of social media frenzy.

Fed report on SVB collapse faults bank's managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory failures, compounded by a dose of social media frenzy.

Read more »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Read more »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Read more »

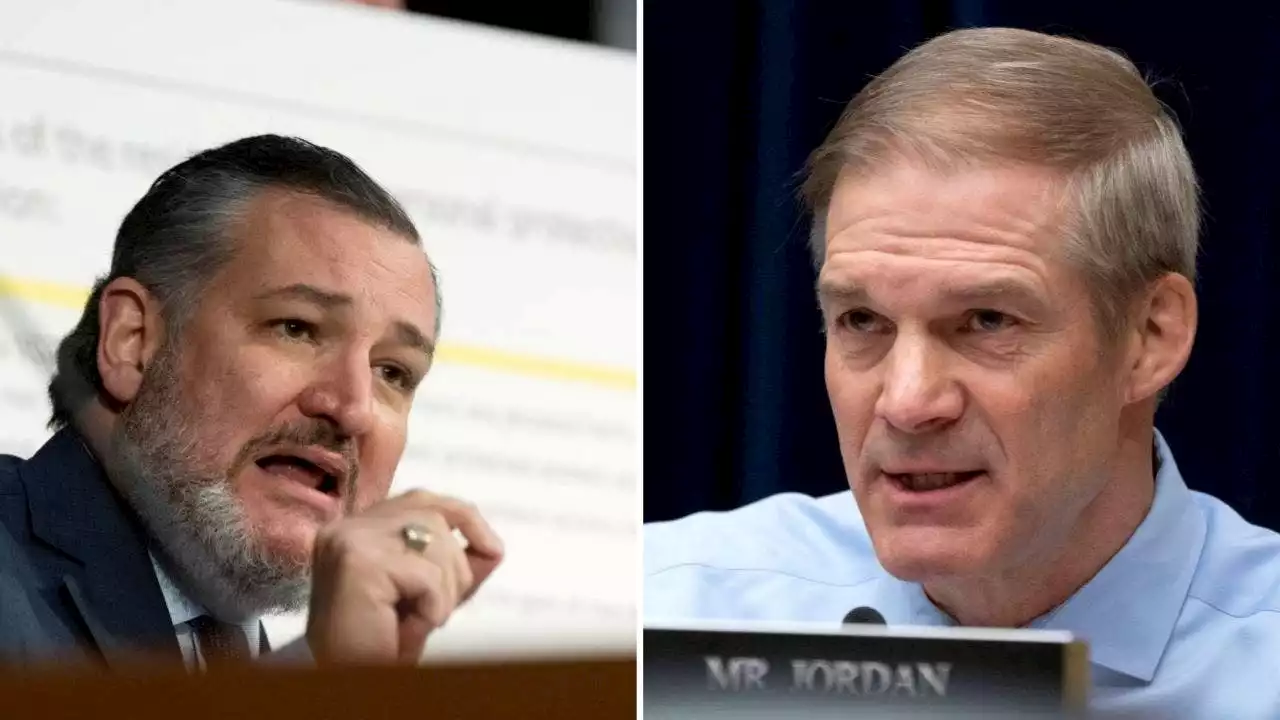

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »

Speed of US bank failures to play starring role in Fed, FDIC post-mortemsOf all the facts that have emerged about last month's two U.S. bank busts - the unanswered warning letters from regulators, the ignored interest-rate risk, the outsized levels of uninsured deposits - one data point in particular continues to stir deep-seated unease among finance officials: 36.

Speed of US bank failures to play starring role in Fed, FDIC post-mortemsOf all the facts that have emerged about last month's two U.S. bank busts - the unanswered warning letters from regulators, the ignored interest-rate risk, the outsized levels of uninsured deposits - one data point in particular continues to stir deep-seated unease among finance officials: 36.

Read more »

Bank borrowing from the Fed climbs for second straight weekU.S. banks increased borrowing from the Federal Reserve for the second week in a row, signaling that strains on the financial system haven't gone away.

Bank borrowing from the Fed climbs for second straight weekU.S. banks increased borrowing from the Federal Reserve for the second week in a row, signaling that strains on the financial system haven't gone away.

Read more »