BREAKING: Silicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday in a highly-anticipated review.

File - Federal Reserve Board of Governors Vice Chair for Supervision Michael Barr testifies at a House Financial Services Committee hearing on Capitol Hill, Wednesday, March 29, 2023, in Washington. Barr was selected by Fed Chair Jerome Powell to lead the central bank's review of its supervision of Silicon Valley Bank, which failed in March.

WASHINGTON — Silicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

The report, authored by Federal Reserve staff and Michael Barr, the Fed’s vice chair for supervision, takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The report also points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

“The Federal Reserve did not appreciate the seriousness of critical deficiencies in the firm’s governance, liquidity, and interest rate risk management. These judgments meant that Silicon Valley Bank remained well-rated, even as conditions deteriorated and significant risk to the firm’s safety and soundness emerged,” the report said.

Silicon Valley Bank was the go-to bank for venture capital firms and technology start-ups for years, but failed spectacularly in March, setting off a crisis of confidence for the banking industry. Federal regulators

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

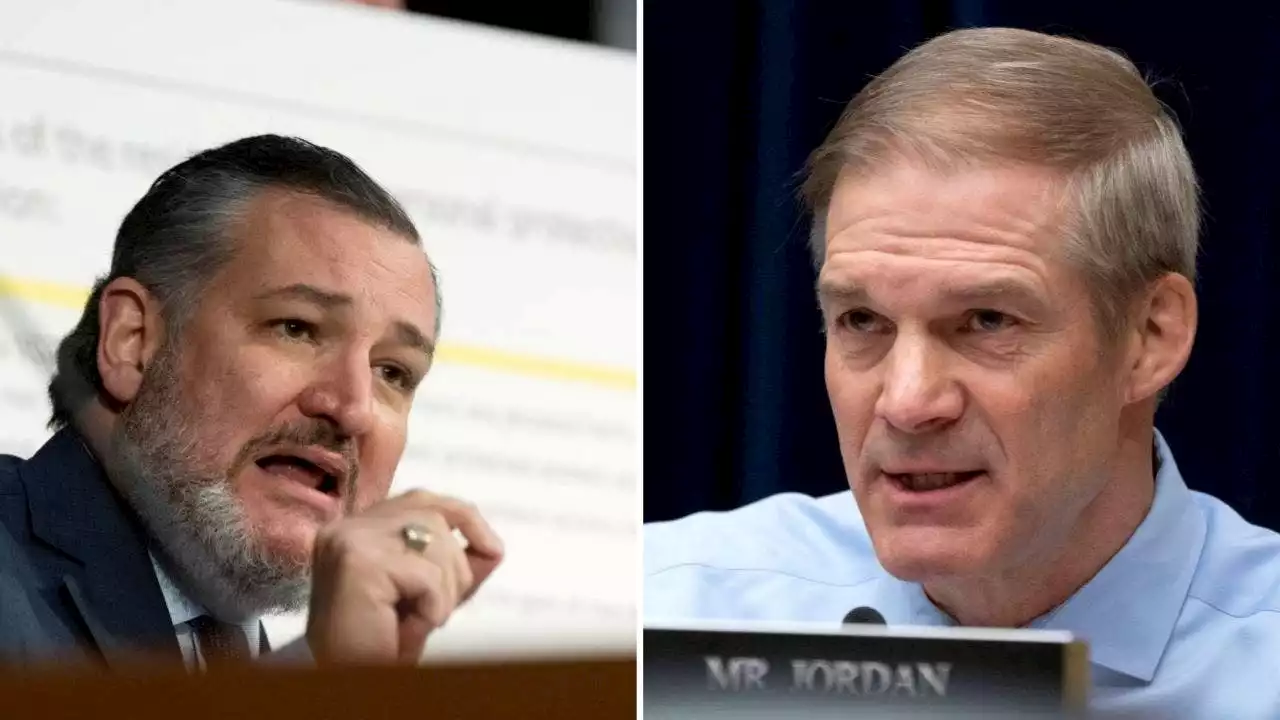

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »

![]() Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Read more »

![]() Regulators to Publish Postmortems on Silicon Valley Bank, Signature FailuresWashington regulators plan to release Friday postmortems of their oversight of Silicon Valley Bank and Signature Bank before they abruptly collapsed last month

Regulators to Publish Postmortems on Silicon Valley Bank, Signature FailuresWashington regulators plan to release Friday postmortems of their oversight of Silicon Valley Bank and Signature Bank before they abruptly collapsed last month

Read more »

Banks, consumers being tested in the wake of Silicon Valley Bank's collapseMore than one month after banking alarms sounded across the globe with the collapse of Silicon Valley Bank and Signature Bank, lending institutions are still reeling, and consumers are skeptical. MORE ⬇️

Banks, consumers being tested in the wake of Silicon Valley Bank's collapseMore than one month after banking alarms sounded across the globe with the collapse of Silicon Valley Bank and Signature Bank, lending institutions are still reeling, and consumers are skeptical. MORE ⬇️

Read more »

Fed report on SVB collapse faults bank's managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory failures, compounded by a dose of social media frenzy.

Fed report on SVB collapse faults bank's managers — and central bank regulatorsThe Fed blamed failures on mismanagement and supervisory failures, compounded by a dose of social media frenzy.

Read more »

![]() Silicon Valley high schooler nearly moves debate judge to tearsNewsweek Mightier supports the next generation of American leaders as they try to find common ground in our fractious, sometimes toxic, national conversation. Read about one SVUDL high schooler whose passion for debate made a judge emotional:

Silicon Valley high schooler nearly moves debate judge to tearsNewsweek Mightier supports the next generation of American leaders as they try to find common ground in our fractious, sometimes toxic, national conversation. Read about one SVUDL high schooler whose passion for debate made a judge emotional:

Read more »