The Fed's hotly anticipated report on the collapse of Silicon Valley Bank reveals a mountain of losses and grave mismanagement by executives

In a hotly anticipated report released Friday morning, the Fed, which is SVB’s primary regulator, took responsibility for its own lapses, saying that supervisors “did not fully appreciate the extent of the vulnerabilities as Silicon Valley Bank grew in size and complexity” and “did not take sufficient steps” to ensure that SVB address its problems quickly. It recommended a sweeping re-evaluation of its regulatory and supervisory functions.

“Following Silicon Valley Bank’s failure, we must strengthen the Federal Reserve’s supervision and regulation based on what we have learned,” said Michael Barr, the Fed’s vice chair for supervision. “This review represents a first step in that process.” At the time of its failure, SVB had 31 unaddressed “safe and soundness supervisory warnings” — triple the average number of peer banks, the Fed said in a press release. This story is developing. It will be updated.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

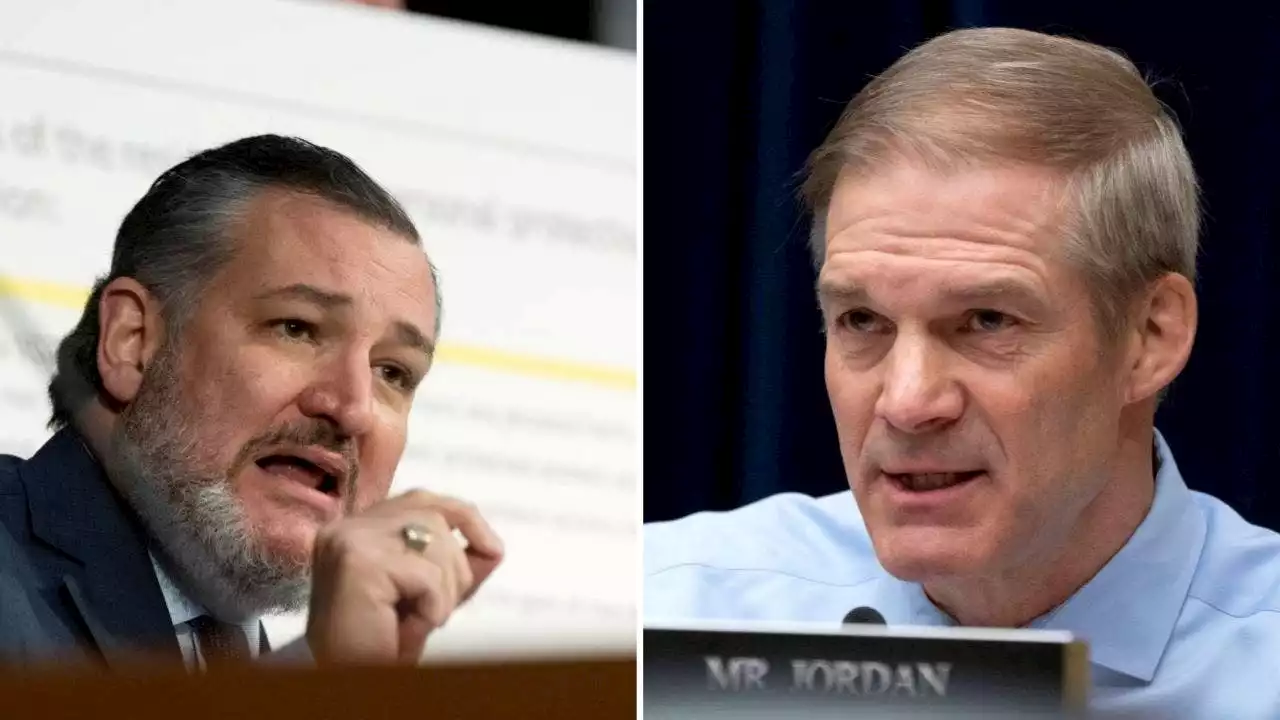

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »

![]() Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Read more »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Read more »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Read more »

![]() Fed Faults Silicon Valley Bank Execs — And Itself — In Bank FailureThe report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

Fed Faults Silicon Valley Bank Execs — And Itself — In Bank FailureThe report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

Read more »

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank CollapseMichael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. He also called for revamping a range of rules for midsize banks.

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank CollapseMichael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. He also called for revamping a range of rules for midsize banks.

Read more »