The EUR/USD pair prolongs its recent corrective slide from the vicinity of mid-1.0900s, or a four-month high touched last week, and remains under some selling pressure for the second straight day on Wednesday.

EUR/USD drifts lower for the second straight day and drops to a nearly two-week low. The ECB ’s dovish outlook continues to undermine the Euro and exerts some pressure. September Fed rate cut bets cap the USD and should lend support ahead of flash PMI s. This also marks the fourth day of a negative move in the previous five and drags spot prices to a nearly two-week low, around the 1.0840 region during the Asian session.

Traders might also prefer to wait on the sidelines ahead of this week's key US macro data – the release of the Advance Q2 GDP print on Thursday and the Personal Consumption Expenditures Price Index data. In the meantime, the flash Eurozone/US PMIs will be looked upon for short-term trading opportunities later this Wednesday.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Read more »

EUR/USD stays below 1.0900 ahead of Eurozone Consumer ConfidenceEUR/USD retraces its recent gains, trading around 1.0870 during the European session on Tuesday.

EUR/USD stays below 1.0900 ahead of Eurozone Consumer ConfidenceEUR/USD retraces its recent gains, trading around 1.0870 during the European session on Tuesday.

Read more »

EUR/USD caught in chart churn ahead of Wednesday’s HCOB PMIs, US ADP jobs figureEUR/USD spent Tuesday in a churning pattern, cycling just below 1.075 as the pair grapples with finding momentum.

EUR/USD caught in chart churn ahead of Wednesday’s HCOB PMIs, US ADP jobs figureEUR/USD spent Tuesday in a churning pattern, cycling just below 1.075 as the pair grapples with finding momentum.

Read more »

EUR/USD corrects in the countdown to Eurozone’s HICP and Fed Powell’s speechEUR/USD edges lower but holds the crucial support of 1.0700 in Tuesday’s European session, correcting down from a more than two-week high near 1.0770 recorded on Monday.

EUR/USD corrects in the countdown to Eurozone’s HICP and Fed Powell’s speechEUR/USD edges lower but holds the crucial support of 1.0700 in Tuesday’s European session, correcting down from a more than two-week high near 1.0770 recorded on Monday.

Read more »

EUR/USD gains on US Dollar’s correction and sticky Eurozone service inflationEUR/USD jumps higher to near 1.0770 in Wednesday’s European session after a strong recovery from the round-level support of 1.0700 on Tuesday.

EUR/USD gains on US Dollar’s correction and sticky Eurozone service inflationEUR/USD jumps higher to near 1.0770 in Wednesday’s European session after a strong recovery from the round-level support of 1.0700 on Tuesday.

Read more »

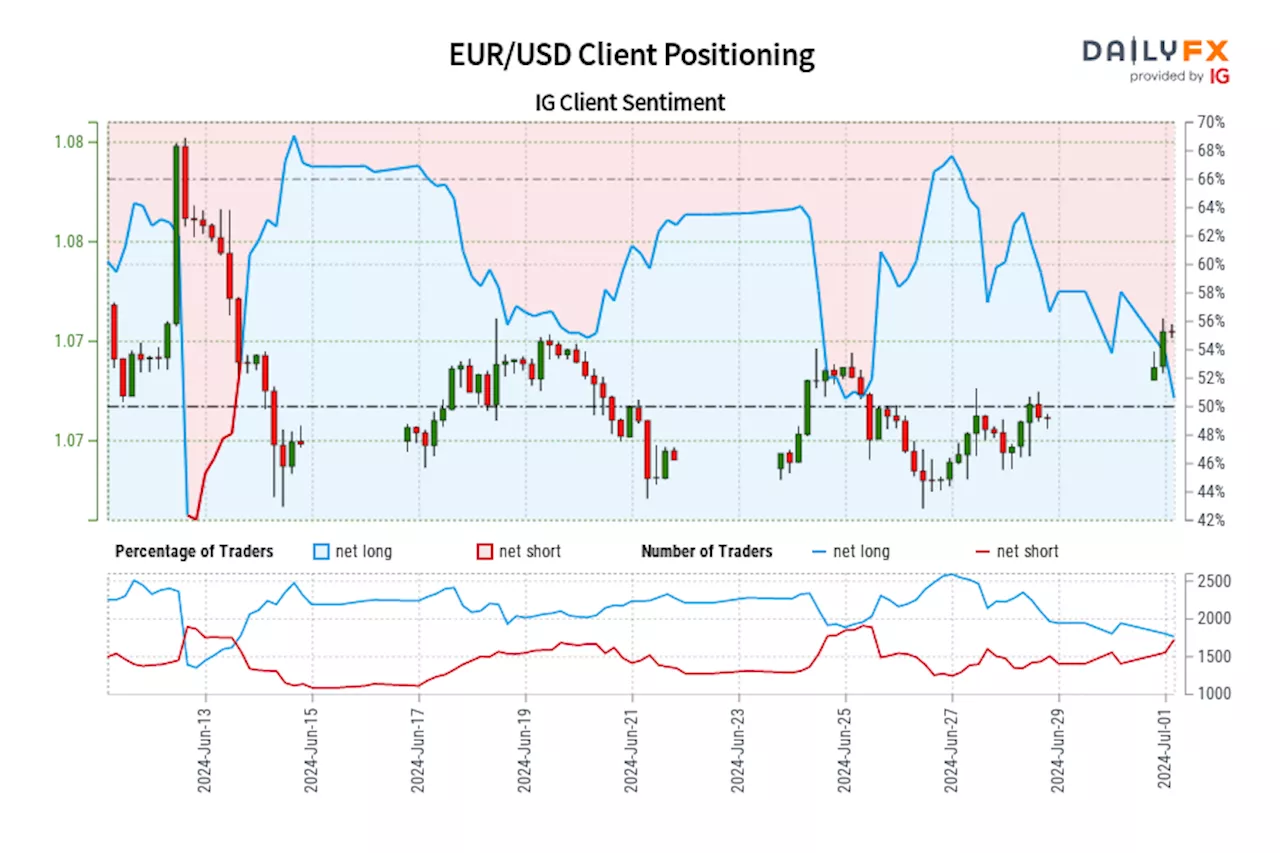

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »