This morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Euro is unlikely to get back to 1.08 “Whether the French elections are a driver of the increased uncertainty and caution, or not, is hard to tell, but either way the lift the Euro was getting from positive economic surprises, is melting away.” “Meanwhile, a regression of EUR/USD against the OAT/Bund yield differential suggests that EUR/USD ought to be heading to parity.

That it isn’t, may tell us a market which is already long USD in a multitude of ways, and has bought into US exceptionalism hook, line and sinker, hasn’t got a great many more euros to sell.” “However, just as I might scratch an itch, even though I know it’s futile, I continue to draw these charts because they make me worry! At the very least, the topside for EUR/USD is very limited and while it has a bit of a Monday morning bid today, I doubt we’ll get back to EUR/USD 1.08, let alone higher.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

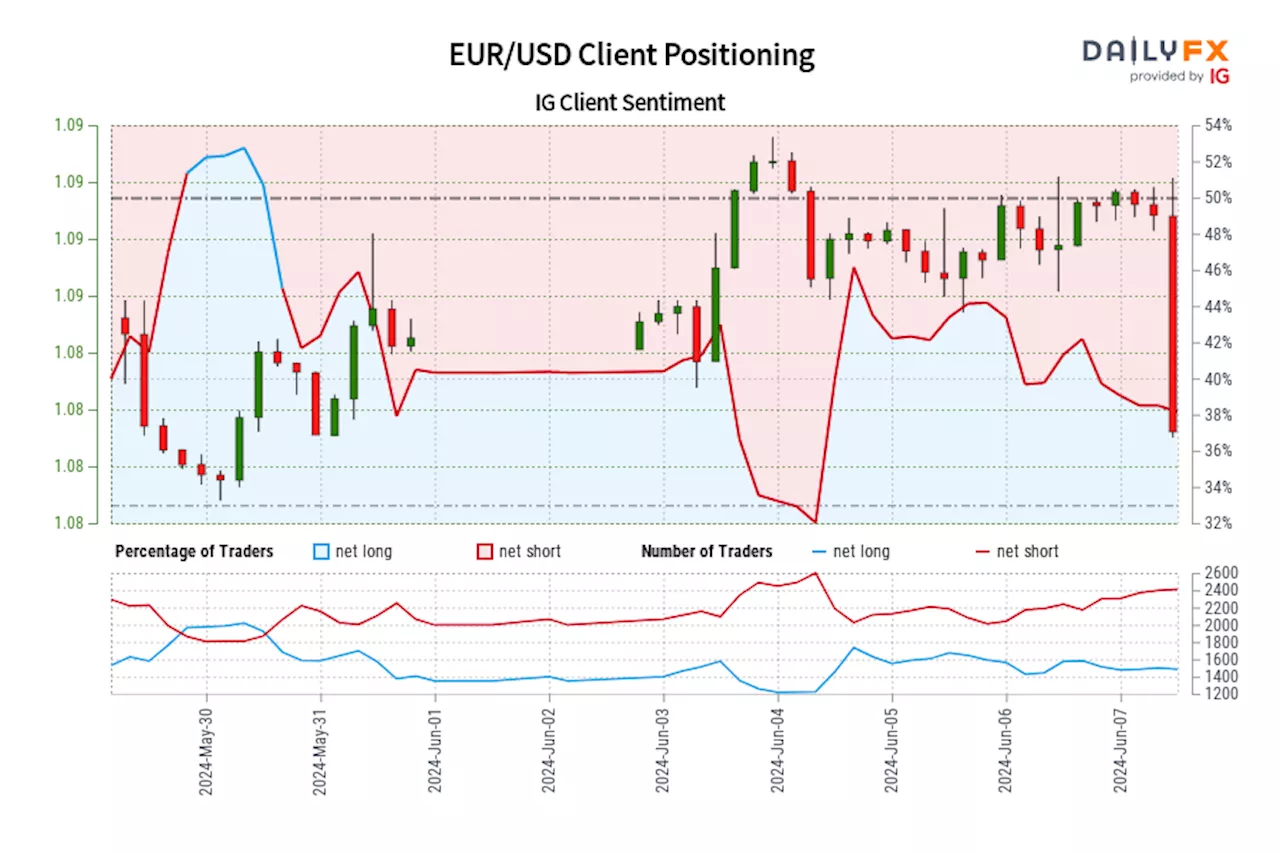

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

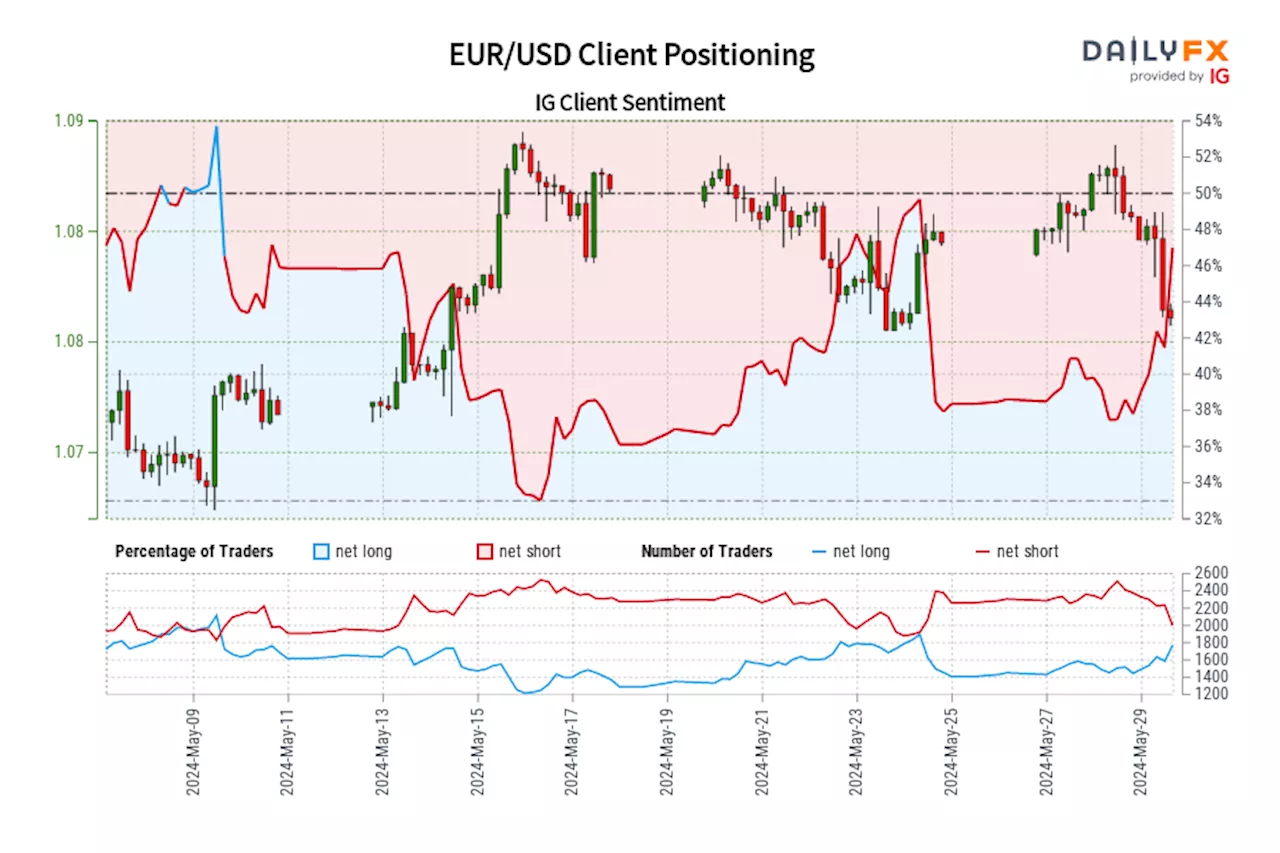

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

BoJ likely to raise policy rate in September – Societe GeneraleAs expected, the Bank of Japan (BoJ) kept the policy rate unchanged at Friday's meeting.

BoJ likely to raise policy rate in September – Societe GeneraleAs expected, the Bank of Japan (BoJ) kept the policy rate unchanged at Friday's meeting.

Read more »

EUR/USD Forecast: Improving risk mood could help Euro limit its lossesEUR/USD stays under modest bearish pressure and declines toward 1.0700 after posting small gains in the first three days of the week.

EUR/USD Forecast: Improving risk mood could help Euro limit its lossesEUR/USD stays under modest bearish pressure and declines toward 1.0700 after posting small gains in the first three days of the week.

Read more »

EUR/USD Forecast: Sellers taking over, break through 1.0700 at sightAfter failing to extend gains beyond the 1.0750 region, the EUR/USD pair eased on Thursday, falling to an intraday low of 1.0712 posted during European trading hours.

EUR/USD Forecast: Sellers taking over, break through 1.0700 at sightAfter failing to extend gains beyond the 1.0750 region, the EUR/USD pair eased on Thursday, falling to an intraday low of 1.0712 posted during European trading hours.

Read more »