EUR/USD edges lower but holds the crucial support of 1.0700 in Tuesday’s European session, correcting down from a more than two-week high near 1.0770 recorded on Monday.

EUR/USD corrects to near 1.0720 as the US Dollar recovers despite weak US Manufacturing PMI data. The Euro remains on tenterhooks ahead of the preliminary Eurozone HICP report for June. Investors await Fed Powell’s speech for fresh guidance on interest rates. The major currency pair is expected to remain volatile as investors shift focus to the preliminary Eurozone Harmonized Index of Consumer Prices data for June, which will be published at 09:00 GMT.

The major currency pair rebounded last week after discovering strong buying interest near the upward-sloping border of the Symmetrical Triangle formation on a daily timeframe near 1.0666, which is marked from 3 October 2023 low at 1.0448. The downward-sloping border of the above-mentioned chart pattern is plotted from 18 July 2023 high at 1.1276. The Symmetrical Triangle formation exhibits a sharp volatility contraction, which indicates low volume and narrow ticks.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Read more »

EUR/USD edges higher as traders brace for US inflation, Fed’s decisionEUR/USD edges higher to 1.0750 in Wednesday’s European session ahead of the United States (US) Consumer Price Index (CPI) data for May and the Federal Reserve’s (Fed) interest rate decision, which are scheduled for the American session.

EUR/USD edges higher as traders brace for US inflation, Fed’s decisionEUR/USD edges higher to 1.0750 in Wednesday’s European session ahead of the United States (US) Consumer Price Index (CPI) data for May and the Federal Reserve’s (Fed) interest rate decision, which are scheduled for the American session.

Read more »

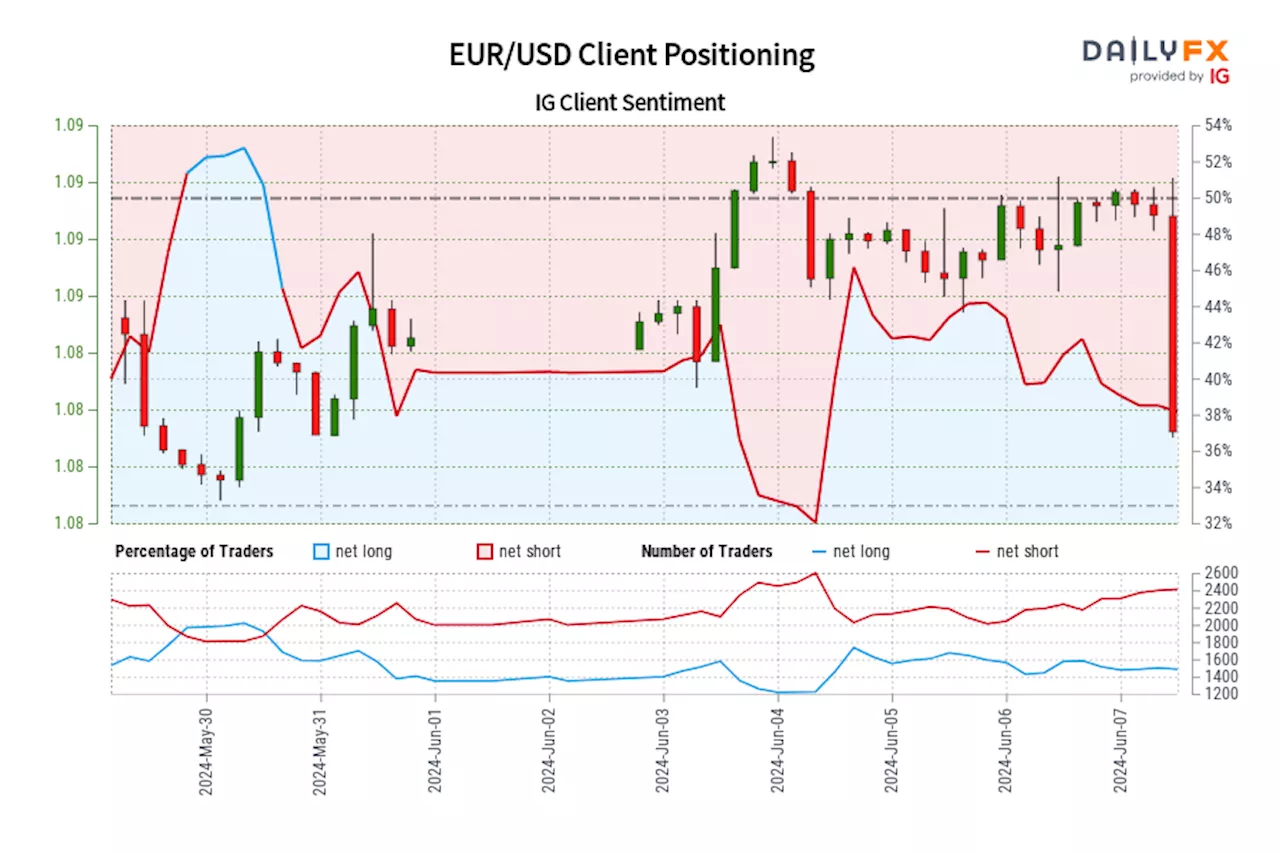

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

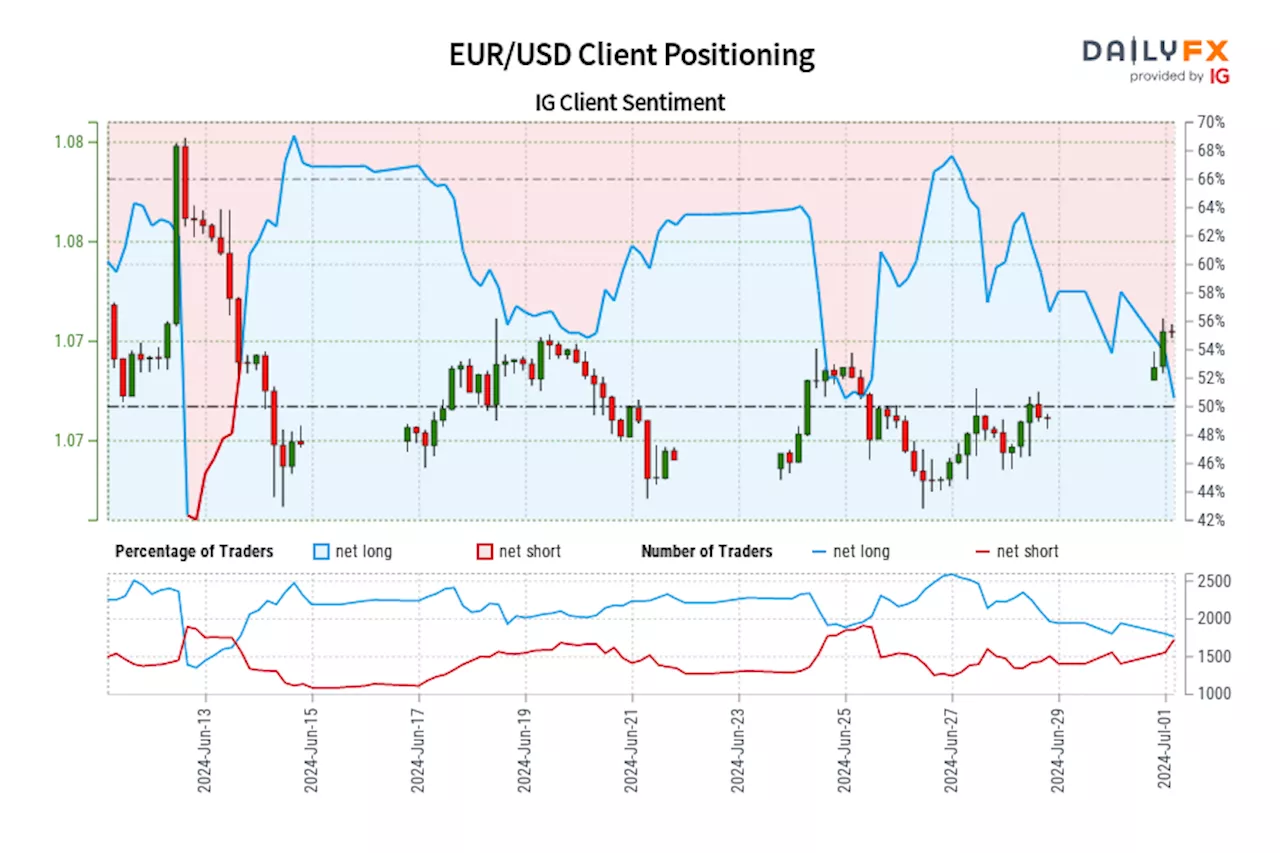

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

EUR/USD rises to near 1.0750 due to heightened expectations of the Fed’s rate cutsEUR/USD extends its gains for the third successive day, trading around 1.0750 during the Asian hours on Monday.

EUR/USD rises to near 1.0750 due to heightened expectations of the Fed’s rate cutsEUR/USD extends its gains for the third successive day, trading around 1.0750 during the Asian hours on Monday.

Read more »