Citigroup delivered impressive fourth-quarter earnings, significantly surpassing analysts' estimates. The bank's strong performance was driven by growth across several key business units, including investment banking and markets. CEO Jane Fraser highlighted the progress made in executing the company's turnaround strategy.

Citigroup announced a fourth-quarter net income of $2.86 billion, a significant improvement from the net loss of $1.84 billion recorded in the same period last year. The previous year's results were negatively impacted by charges incurred during the final quarter of 2023 as Citigroup undertook a restructuring of its business.

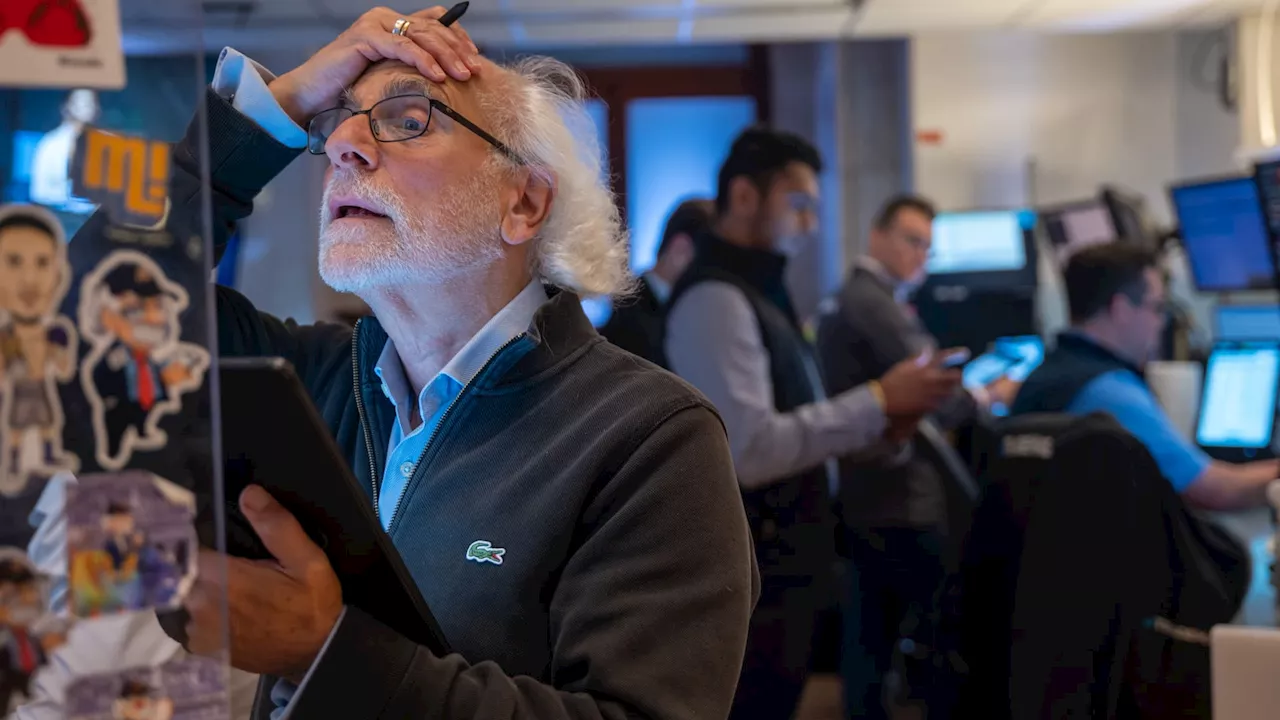

Shares surged on Wednesday after fourth-quarter earnings surpassed analysts' expectations on both the top and bottom lines, reflecting robust performance across the banking institution. CEO Jane Fraser expressed confidence in the company's strategic direction, stating, '2024 was a critical year and our results show our strategy is delivering as intended and driving stronger performance in our businesses. Our net income was up nearly 40% to $12.7 billion and we exceeded our full-year revenue target, including record years in Services, Wealth and U.S. Personal Banking.'The bank's performance was particularly strong in investment banking, where revenue soared 35% year-over-year to $925 million. Citigroup attributed this growth to sustained momentum in the issuance of investment-grade corporate debt. Total banking revenue climbed 12%, expanding to 27% when factoring in the impact of loan hedges. Markets revenue jumped 36% year-over-year to $4.58 billion, with both the fixed income and equity businesses experiencing growth. Fixed income markets revenue reached $3.48 billion, significantly exceeding the $2.95 billion projected by analysts. Citigroup's cost of credit for the quarter was $2.59 billion, down from $3.55 billion in the previous year and $2.68 billion in the third quarter. The bank added a net $203 million to its allowance for credit losses, also down from previous periods. Investors will be closely watching for progress updates on Fraser's turnaround efforts during the analyst call scheduled for later Wednesday. Fraser, who assumed leadership of the bank in March 2021, has been focused on streamlining the company, including the sale of some international units. Citigroup's stock demonstrated strong performance in 2024, rising nearly 37% for the year. Entering Wednesday, the stock had already gained more than 4% for the year.

CITIGROUP EARNINGS INVESTMENT BANKING MARKETS TURNAROUNDSTRATEGY

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Wall Street Bets on Citigroup and US Bancorp as Earnings Season Kicks OffBig banks begin reporting quarterly earnings, providing insights into the economy and consumer spending. Wall Street analysts favor Citigroup and US Bancorp, citing strong performance and growth potential.

Wall Street Bets on Citigroup and US Bancorp as Earnings Season Kicks OffBig banks begin reporting quarterly earnings, providing insights into the economy and consumer spending. Wall Street analysts favor Citigroup and US Bancorp, citing strong performance and growth potential.

Read more »

Earnings playbook: Stocks set to make the biggest moves this week on earningsThese stocks could see sharp moves on the back of their latest earnings results, including a large group of banks.

Earnings playbook: Stocks set to make the biggest moves this week on earningsThese stocks could see sharp moves on the back of their latest earnings results, including a large group of banks.

Read more »

Market Buzz: CPI Cool-Down, Strong Earnings, and Analyst TakesMarkets reacted positively to the December CPI report, which came in cooler than expected, fueling a surge in stock futures and a decline in bond yields. Several financial institutions, including JPMorgan Chase, Wells Fargo, BlackRock, Goldman Sachs, and Citigroup, reported better-than-expected fourth-quarter earnings, showcasing strong performance across various sectors. Meanwhile, analysts weighed in on a range of stocks, offering insights and recommendations on companies like SLB, Devon Energy, Lam Research, Eli Lilly, and Meta Platforms.

Market Buzz: CPI Cool-Down, Strong Earnings, and Analyst TakesMarkets reacted positively to the December CPI report, which came in cooler than expected, fueling a surge in stock futures and a decline in bond yields. Several financial institutions, including JPMorgan Chase, Wells Fargo, BlackRock, Goldman Sachs, and Citigroup, reported better-than-expected fourth-quarter earnings, showcasing strong performance across various sectors. Meanwhile, analysts weighed in on a range of stocks, offering insights and recommendations on companies like SLB, Devon Energy, Lam Research, Eli Lilly, and Meta Platforms.

Read more »

Wall Street has high hopes for strong earnings in 2025, but plenty of hurdles awaitStrategists hope to see earnings broaden out beyond megacap tech, but tariffs, tax reform and interest rates could shape the results.

Wall Street has high hopes for strong earnings in 2025, but plenty of hurdles awaitStrategists hope to see earnings broaden out beyond megacap tech, but tariffs, tax reform and interest rates could shape the results.

Read more »

T-Mobile's Stock Price Plummets Despite Strong EarningsT-Mobile's stock has experienced a significant decline despite reporting strong earnings and growth. While the company is projecting continued success, analysts are expressing concerns about the sustainability of its growth rate and potential risks in the future.

T-Mobile's Stock Price Plummets Despite Strong EarningsT-Mobile's stock has experienced a significant decline despite reporting strong earnings and growth. While the company is projecting continued success, analysts are expressing concerns about the sustainability of its growth rate and potential risks in the future.

Read more »

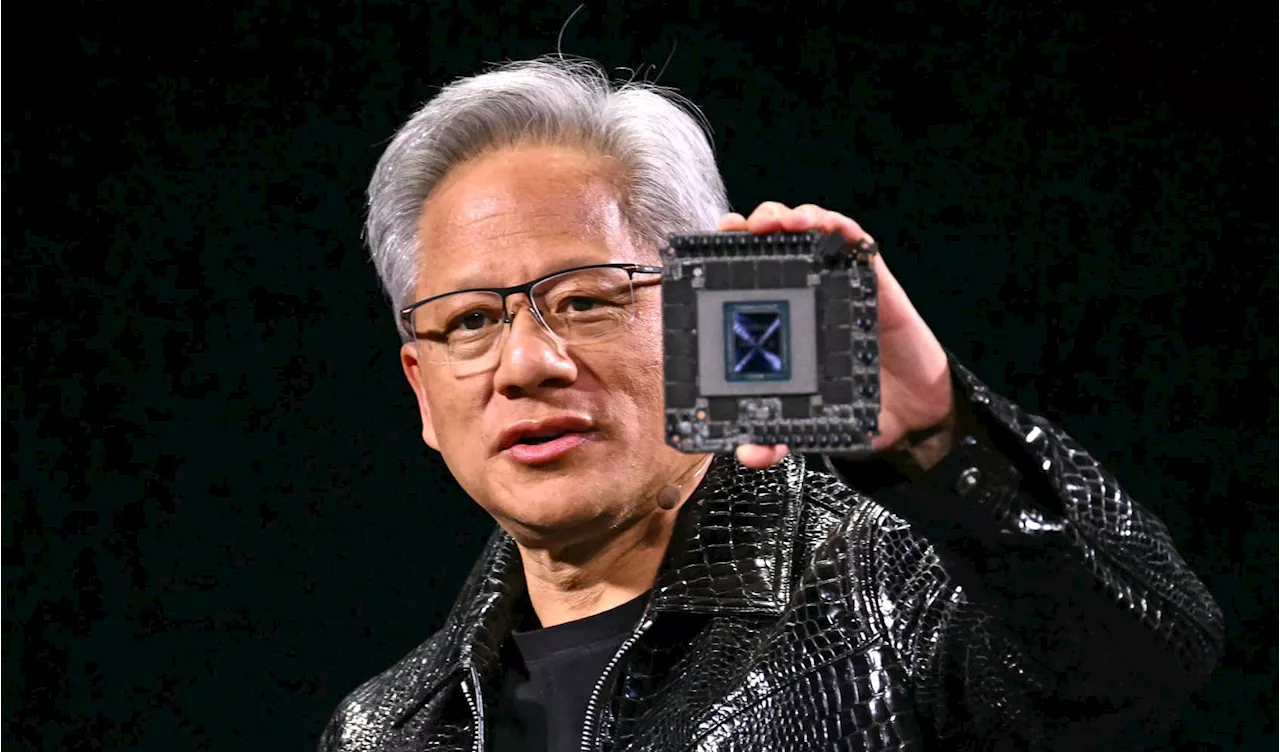

AI Stocks Surge on Strong Earnings and InvestmentNvidia's AI chips continue to drive strong performance, with record revenue reported by Foxconn. Semiconductor stocks rise as AI investment remains robust. Meanwhile, the Dow Jones Industrial Average dips after earlier gains fueled by potential tariff softening.

AI Stocks Surge on Strong Earnings and InvestmentNvidia's AI chips continue to drive strong performance, with record revenue reported by Foxconn. Semiconductor stocks rise as AI investment remains robust. Meanwhile, the Dow Jones Industrial Average dips after earlier gains fueled by potential tariff softening.

Read more »