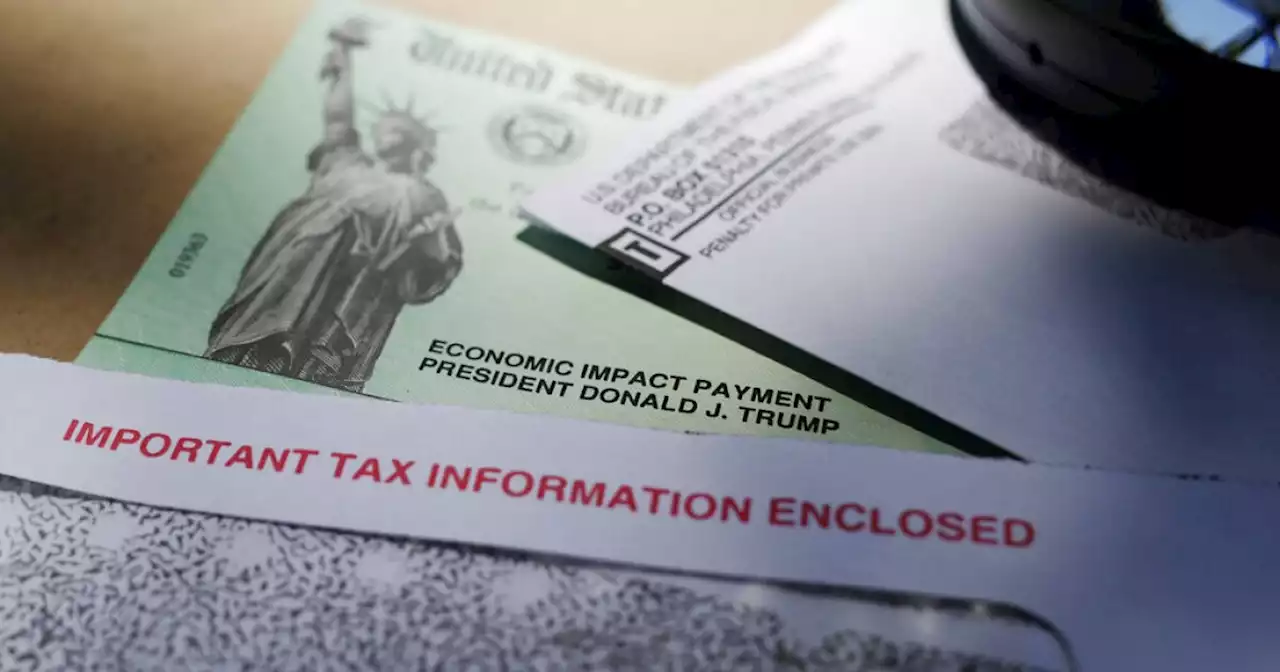

The IRS estimates the average taxpayer spends 13 hours filing taxes and pays an average of $250 to prepare to submit tax returns.

The promise of a free and simple tax filing from companies like TurboTax, is probably all over your TV right now.

According to Dorothy Brown, a law professor at Georgetown University Law Center, your filing status can also make returns tricky. Brown says for better or worse, tax breaks exist to incentivize certain behaviors like buying real state, having children or driving electric cars. "What Congress sees that high error rate, it assumes people are committing fraud. Therefore, there is this incentive to audit earned income tax credit recipients when the reality is it's one of the most complicated provisions in the code," Brown said.

The result is an intricate set of provisions that are designed to limit revenue loss or reduce taxpayer burden. But whether it’s effective is up for debate.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Wagner's Yevgeny Prigozhin made $250 million from oil, gas, gold, diamondsRussian mercenary leader Yevgeny Prigozhin's oil, gas, gold and diamond businesses generated $250 million in revenue despite sanctions, report says

Read more »

Why Keri Russell Did ‘Cocaine Bear’: ‘Why the F*ck’ Not?Keri Russell tells beastobsessed why she signed on for CocaineBear and explains what it was like to film the wild movie: “When I read it, I couldn’t believe a studio was going to make this movie. I still can’t. I feel like they might still pull it.”

Why Keri Russell Did ‘Cocaine Bear’: ‘Why the F*ck’ Not?Keri Russell tells beastobsessed why she signed on for CocaineBear and explains what it was like to film the wild movie: “When I read it, I couldn’t believe a studio was going to make this movie. I still can’t. I feel like they might still pull it.”

Read more »

Will you have to report your inflation-relief payment to the IRS?The IRS has offered guidance for residents of the 21 states that made direct payments to help people keep up with rising costs.

Will you have to report your inflation-relief payment to the IRS?The IRS has offered guidance for residents of the 21 states that made direct payments to help people keep up with rising costs.

Read more »

How to access your IRS transcripts for an accurate tax return — and faster refundWhether you’re filing a simple or complicated tax return, it’s critical to make sure it’s accurate and complete. Here's how IRS transcripts can help.

How to access your IRS transcripts for an accurate tax return — and faster refundWhether you’re filing a simple or complicated tax return, it’s critical to make sure it’s accurate and complete. Here's how IRS transcripts can help.

Read more »

IRS accused of using 'racial equity' for audits targeting White, Asian taxpayersThe conservative America First Legal Foundation is accusing the IRS of using 'racial equity' as a reason to target White and Asian Americans with tax audits.

IRS accused of using 'racial equity' for audits targeting White, Asian taxpayersThe conservative America First Legal Foundation is accusing the IRS of using 'racial equity' as a reason to target White and Asian Americans with tax audits.

Read more »