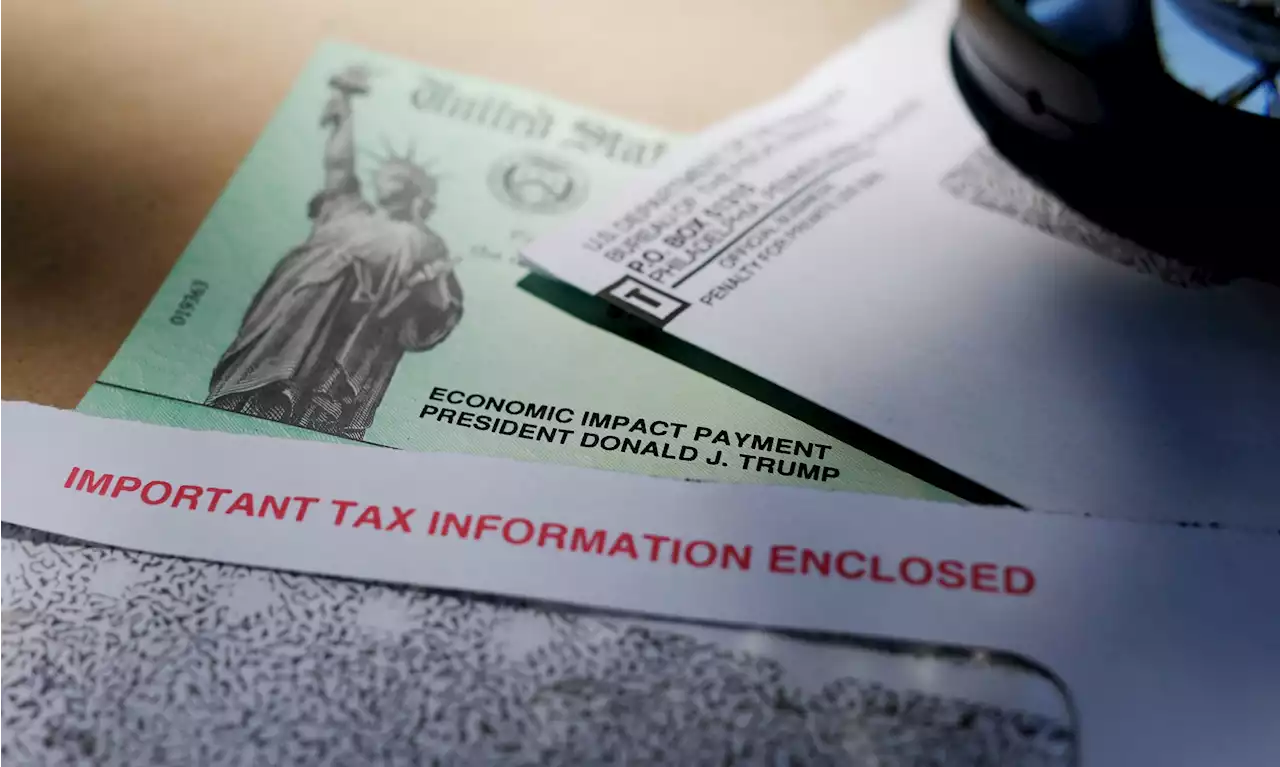

The IRS has offered guidance for residents of the 21 states that made direct payments to help people keep up with rising costs.

During the pandemic, 21 states made direct payments to residents to help them keep up with rising costs. The IRS recently addressed whether people would have to report those payments on their federal income-tax returns.

But there’s a wrinkle for residents of four states: Georgia, Massachusetts, South Carolina and Virginia. The IRS said there might be instances where taxpayers in these states will need to count the money as part of their income on their federal return. At a time when inflation is slowly coming off four-decade highs, anything that helps people hang on to their money is good news. And anything that keeps tax returns as simple as possible is always welcome.

In Virginia, where refunds were up to $250 for eligible individuals and $500 for married couples filing jointly, and in South Carolina, where refunds were up to $800, the money was pegged to 2021 state income-tax liabilities. In Georgia, where refunds were up to $250 for eligible individuals and $500 for married couples filing jointly, the money was linked to 2020 income taxes.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The IRS has advice about tax questions over the holiday“With the nation entering a peak period for filing taxes, the Internal Revenue Service urges taxpayers to use online tools to get answers quickly and avoid phone delays during a traditional peak period for IRS phone lines around Presidents Day,” the federal agency said in an advisory released in advance of the holiday.

The IRS has advice about tax questions over the holiday“With the nation entering a peak period for filing taxes, the Internal Revenue Service urges taxpayers to use online tools to get answers quickly and avoid phone delays during a traditional peak period for IRS phone lines around Presidents Day,” the federal agency said in an advisory released in advance of the holiday.

Read more »

Project Veritas claimed James O’Keefe risked group’s nonprofit statusExclusive: James O’Keefe’s departure from Project Veritas came after the board of directors claimed to staff that O’Keefe had endangered the group’s nonprofit status, according to documents and people familiar with the situation.

Project Veritas claimed James O’Keefe risked group’s nonprofit statusExclusive: James O’Keefe’s departure from Project Veritas came after the board of directors claimed to staff that O’Keefe had endangered the group’s nonprofit status, according to documents and people familiar with the situation.

Read more »

A Stanford collaboration with the Department of the Treasury admits Black taxpayers are targeted for audit more than others - New York Amsterdam NewsAccording to Stanford RegLab, Black taxpayers receive IRS audit notices at least 2.9 times more frequently than non-Black taxpayers and possibly as much as 4.7 times more often.

A Stanford collaboration with the Department of the Treasury admits Black taxpayers are targeted for audit more than others - New York Amsterdam NewsAccording to Stanford RegLab, Black taxpayers receive IRS audit notices at least 2.9 times more frequently than non-Black taxpayers and possibly as much as 4.7 times more often.

Read more »

How to Negotiate With Creditors to Reduce Your DebtWhether it’s the IRS, hospitals or credit-card companies or mortgage lenders, there are ways to get better terms—and maybe even reduce the amount owed

How to Negotiate With Creditors to Reduce Your DebtWhether it’s the IRS, hospitals or credit-card companies or mortgage lenders, there are ways to get better terms—and maybe even reduce the amount owed

Read more »

Is my state stimulus payment taxable?The IRS has decided that taxpayers in 17 states will not need to report special payments on their 2022 tax returns. Payments from four other states may or may not be reportable.

Is my state stimulus payment taxable?The IRS has decided that taxpayers in 17 states will not need to report special payments on their 2022 tax returns. Payments from four other states may or may not be reportable.

Read more »

Just how bad were holiday sales? The world's biggest retailers are about to tell usSome of the biggest retail chains report this week, after concerns about inflation and holiday-season demand.

Just how bad were holiday sales? The world's biggest retailers are about to tell usSome of the biggest retail chains report this week, after concerns about inflation and holiday-season demand.

Read more »