The USD/CAD rallied to a three-week high above the 200-day moving average (DMA) of 1.3588, gaining 0.36% after bouncing off the daily lows of 1.3553.

USD/CAD climbs above 1.3588, fueled by BoC Governor Macklem's dovish comments and falling oil prices from Tropical Storm Francine. BoC hints at more aggressive rate cuts as Canadian economy slows and unemployment hits a seven-year peak. Investors anticipate US CPI data, which could bolster expectations for a Fed rate cut at the upcoming September 17-18 meeting. The USD/CAD rallied to a three-week high above the 200-day moving average of 1.3588, gaining 0.

Canadian Dollar FAQs What key factors drive the Canadian Dollar? The key factors driving the Canadian Dollar are the level of interest rates set by the Bank of Canada , the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD holds steady above mid-1.3500s, eyes 200-day SMA amid modest USD strengthThe USD/CAD pair attracts some buyers during the Asian session on Tuesday, albeit lacks follow-through and remains confined in the previous day's trading range.

USD/CAD holds steady above mid-1.3500s, eyes 200-day SMA amid modest USD strengthThe USD/CAD pair attracts some buyers during the Asian session on Tuesday, albeit lacks follow-through and remains confined in the previous day's trading range.

Read more »

USD/CAD Price Forecast: Consolidates around 23.6% Fibo., 200-day SMA holds the key for bullsThe USD/CAD pair struggles to capitalize on Friday's strong intraday rally of over 100 pips and oscillates in a narrow trading band, above mid-1.3500s through the first half of the European session on Monday.

USD/CAD Price Forecast: Consolidates around 23.6% Fibo., 200-day SMA holds the key for bullsThe USD/CAD pair struggles to capitalize on Friday's strong intraday rally of over 100 pips and oscillates in a narrow trading band, above mid-1.3500s through the first half of the European session on Monday.

Read more »

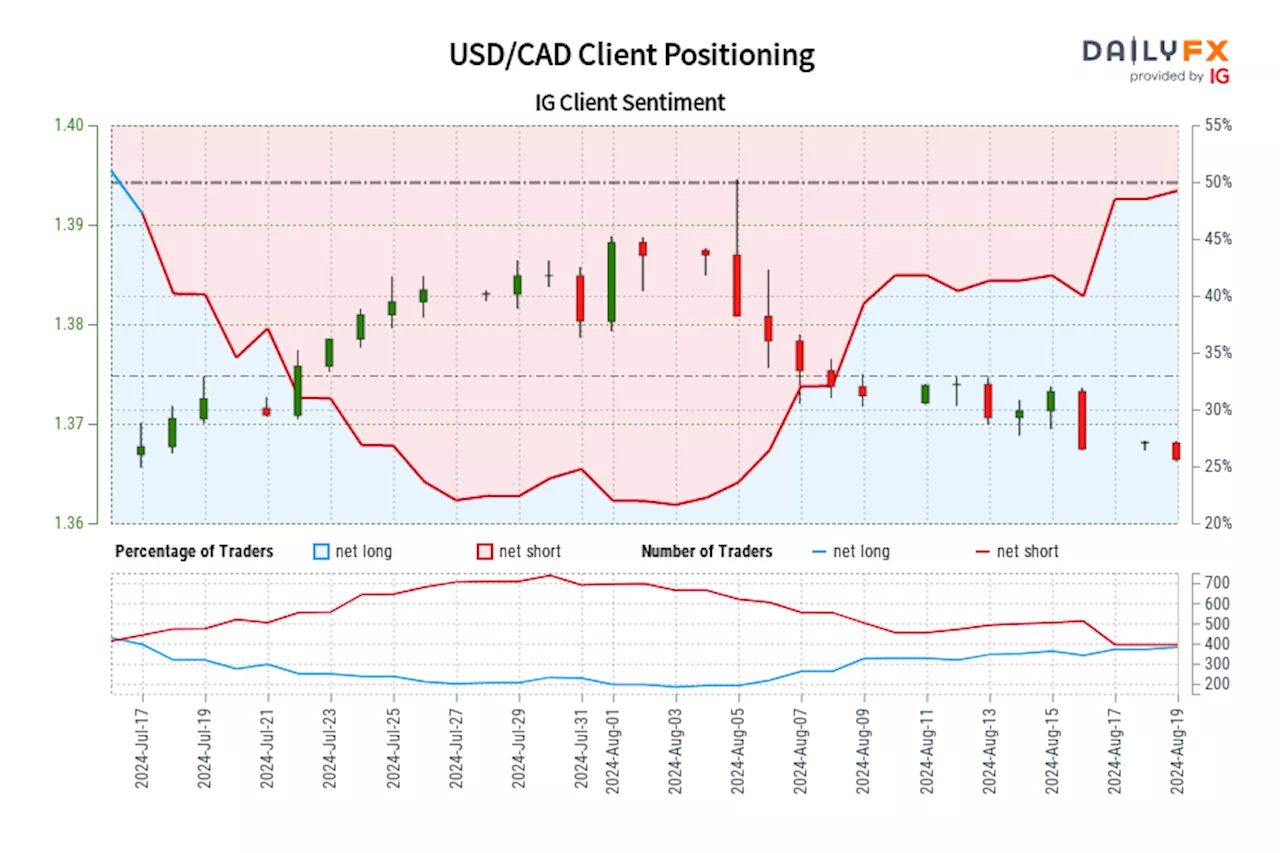

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »

USD/CAD falls to near 1.3500 ahead of employment data from both nationsUSD/CAD continues to lose ground for the third successive day, trading around 1.3500 during the Asian session on Friday.

USD/CAD falls to near 1.3500 ahead of employment data from both nationsUSD/CAD continues to lose ground for the third successive day, trading around 1.3500 during the Asian session on Friday.

Read more »

USD/CAD: May try to test the 1.3475 supportThe Canadian Dollar (CAD) is trading a bit off its overnight peak around 1.3575 but retains a generally firm undertone.

USD/CAD: May try to test the 1.3475 supportThe Canadian Dollar (CAD) is trading a bit off its overnight peak around 1.3575 but retains a generally firm undertone.

Read more »

USD/CAD weakens near 1.3500 as Fed’s Powell signals September interest rate cutThe USD/CAD pair remains under some selling pressure around 1.3510 on Monday during the Asian trading hours.

USD/CAD weakens near 1.3500 as Fed’s Powell signals September interest rate cutThe USD/CAD pair remains under some selling pressure around 1.3510 on Monday during the Asian trading hours.

Read more »