The USD/CAD pair attracts some buyers during the Asian session on Tuesday, albeit lacks follow-through and remains confined in the previous day's trading range.

USD/CAD regains some positive traction amid some follow-through USD buying interest. Subdued Crude Oil prices undermine the Loonie and further lend support to the major. Traders now look to BoC Governor Macklem's speech ahead of the US CPI on Wednesday. The USD/CAD pair attracts some buyers during the Asian session on Tuesday, albeit lacks follow-through and remains confined in the previous day's trading range. Spot prices currently hover around the 1.3565 region, up less than 0.

This, in turn, is seen as another factor lending some support to the USD/CAD pair, though the lack of follow-through buying warrants some caution for bulls ahead of BoC Governor Tiff Macklem's speech later during the early North American session. Investors might also prefer to move to the sidelines ahead of the US inflation figures, which will play a key role in influencing the Greenback.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD Price Forecast: Consolidates around 23.6% Fibo., 200-day SMA holds the key for bullsThe USD/CAD pair struggles to capitalize on Friday's strong intraday rally of over 100 pips and oscillates in a narrow trading band, above mid-1.3500s through the first half of the European session on Monday.

USD/CAD Price Forecast: Consolidates around 23.6% Fibo., 200-day SMA holds the key for bullsThe USD/CAD pair struggles to capitalize on Friday's strong intraday rally of over 100 pips and oscillates in a narrow trading band, above mid-1.3500s through the first half of the European session on Monday.

Read more »

USD/CAD trades with modest losses around mid-1.3500s amid rebounding Oil pricesThe USD/CAD pair struggles to capitalize on Friday's strong intraday rally of over 100 pips and trades with a mild negative bias around mid-1.3500s during the Asian session on Monday.

USD/CAD trades with modest losses around mid-1.3500s amid rebounding Oil pricesThe USD/CAD pair struggles to capitalize on Friday's strong intraday rally of over 100 pips and trades with a mild negative bias around mid-1.3500s during the Asian session on Monday.

Read more »

USD/CAD hovers around 50-day SMA, remains on the defensive below mid-1.3700sThe USD/CAD pair struggles to capitalize on a two-day-old recovery from sub-1.3700 levels, or a nearly one-month low touched earlier this week and attracts fresh sellers during the Asian session on Friday.

USD/CAD hovers around 50-day SMA, remains on the defensive below mid-1.3700sThe USD/CAD pair struggles to capitalize on a two-day-old recovery from sub-1.3700 levels, or a nearly one-month low touched earlier this week and attracts fresh sellers during the Asian session on Friday.

Read more »

AUD/USD Price Forecast: The 200-day SMA holds the downside so farThe US Dollar (USD) came back roaring from Monday’s Labor Day holiday, hurting the risk complex and thus sparking quite a pronounced decline in AUD/USD on Tuesday.

AUD/USD Price Forecast: The 200-day SMA holds the downside so farThe US Dollar (USD) came back roaring from Monday’s Labor Day holiday, hurting the risk complex and thus sparking quite a pronounced decline in AUD/USD on Tuesday.

Read more »

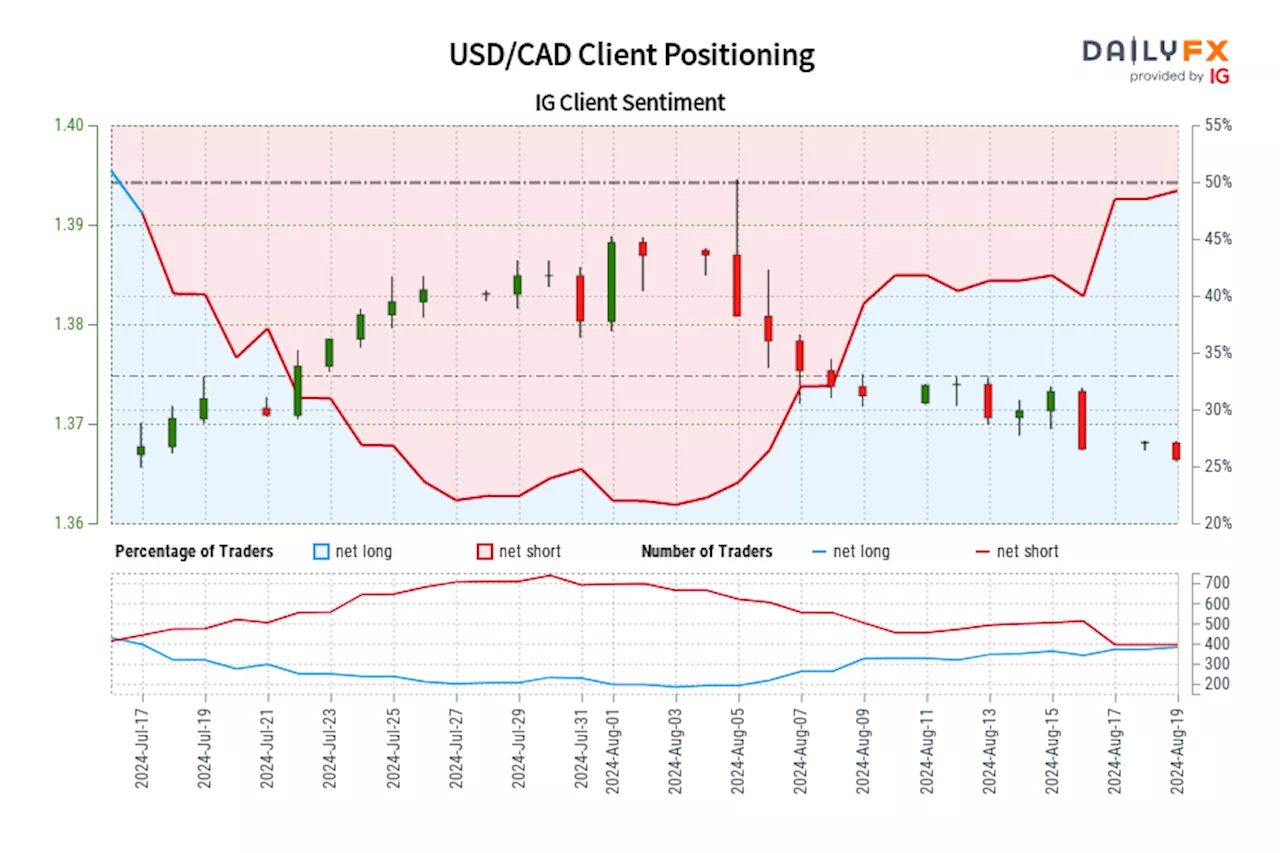

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Jul 18, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Read more »

GBP/JPY shrugs off strong UK data, pulls back from 200-day SMAGBP/JPY pauses in its recovery rally after touching the 200-day Simple Moving Average (SMA) and pulls back almost half a percent on Friday to trade in the 190.60s, despite the release of broadly positive data out of the UK.

GBP/JPY shrugs off strong UK data, pulls back from 200-day SMAGBP/JPY pauses in its recovery rally after touching the 200-day Simple Moving Average (SMA) and pulls back almost half a percent on Friday to trade in the 190.60s, despite the release of broadly positive data out of the UK.

Read more »