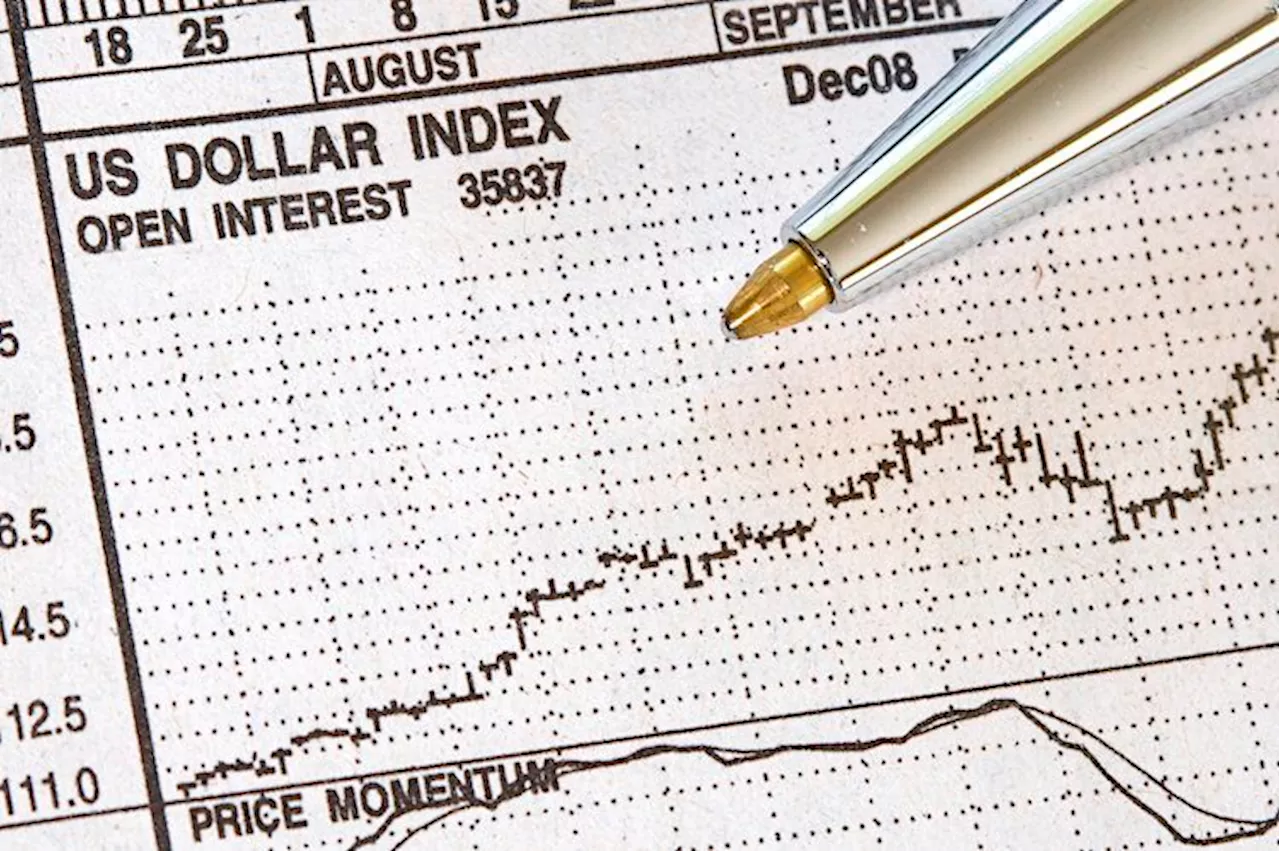

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, is going nowhere and consolidates below the 108.00 mark in the European trading session on Wednesday. However, selling pressure persists after US President

The US Dollar flatlines on Wednesday after two days of losses. Marketsmeasuring theimpact of the 10% levy over Chinese goods President Trump announced on Tuesday. The US Dollar Index tests the 108.00 mark and is set to head to the lower end of 107.00 The US Dollar Index , which tracks the Greenback’s value against six major currencies, is going nowhere and consolidatesbelow the 108.00 mark in the European trading session on Wednesday.

Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve , the European Central Bank or the Bank of England , the mandate is to keep inflation close to 2%.

Macroeconomics Unitedstates SEO Tradewar

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Freeland Promises to Match Trump Tariffs for Canada 'dollar-for-dollar'Chrystia Freeland has called for economic retaliation if President-elect Trump follows through with his threat to impose tariffs.

Freeland Promises to Match Trump Tariffs for Canada 'dollar-for-dollar'Chrystia Freeland has called for economic retaliation if President-elect Trump follows through with his threat to impose tariffs.

Read more »

Meme Index: The First Decentralized Meme Coin Index Investing PlatformMeme Index is revolutionizing meme coin investing with a decentralized platform that allows users to buy baskets of meme coins grouped by volatility. The platform offers a unique advantage over individual meme coins by positioning itself as a meme coin infrastructure investment.

Meme Index: The First Decentralized Meme Coin Index Investing PlatformMeme Index is revolutionizing meme coin investing with a decentralized platform that allows users to buy baskets of meme coins grouped by volatility. The platform offers a unique advantage over individual meme coins by positioning itself as a meme coin infrastructure investment.

Read more »

Dollar Index Soars to Two-Year HighThe US Dollar Index reached a new two-year high on the first trading day of the new year, driven by strong US economic performance, expectations of continued interest rate hikes, and a flight to safety amid global uncertainty.

Dollar Index Soars to Two-Year HighThe US Dollar Index reached a new two-year high on the first trading day of the new year, driven by strong US economic performance, expectations of continued interest rate hikes, and a flight to safety amid global uncertainty.

Read more »

Dollar Index Hovers Near Key Resistance as Markets Await Non-Farm Payrolls ReportThe Dollar Index faces key resistance levels ahead of the Non-Farm Payrolls report. Markets are cautiously anticipating the data, with forecasts suggesting a potential slowdown in job growth. A strong report could solidify the dollar's rally, while weaker data might trigger speculation about a Fed policy pivot.

Dollar Index Hovers Near Key Resistance as Markets Await Non-Farm Payrolls ReportThe Dollar Index faces key resistance levels ahead of the Non-Farm Payrolls report. Markets are cautiously anticipating the data, with forecasts suggesting a potential slowdown in job growth. A strong report could solidify the dollar's rally, while weaker data might trigger speculation about a Fed policy pivot.

Read more »

Dollar Index Strengthens, Euro Dips, and Markets Show Mixed SignalsThe Dollar Index remains strong above key support levels, with potential for further gains towards 110-111. The Euro is expected to decline towards 1.03 or lower. Other currency pairs show volatility, while USDJPY has the potential to rise past 160. Bonds and stock markets exhibit mixed performance, with US Treasury yields rising sharply and the Dow Jones declining.

Dollar Index Strengthens, Euro Dips, and Markets Show Mixed SignalsThe Dollar Index remains strong above key support levels, with potential for further gains towards 110-111. The Euro is expected to decline towards 1.03 or lower. Other currency pairs show volatility, while USDJPY has the potential to rise past 160. Bonds and stock markets exhibit mixed performance, with US Treasury yields rising sharply and the Dow Jones declining.

Read more »

USD/CAD rises above 1.4400 as US Dollar Index rallies toward two-year highsUSD/CAD continues its winning streak for the fourth successive session, trading around 1.4420 during the Asian hours on Friday.

USD/CAD rises above 1.4400 as US Dollar Index rallies toward two-year highsUSD/CAD continues its winning streak for the fourth successive session, trading around 1.4420 during the Asian hours on Friday.

Read more »