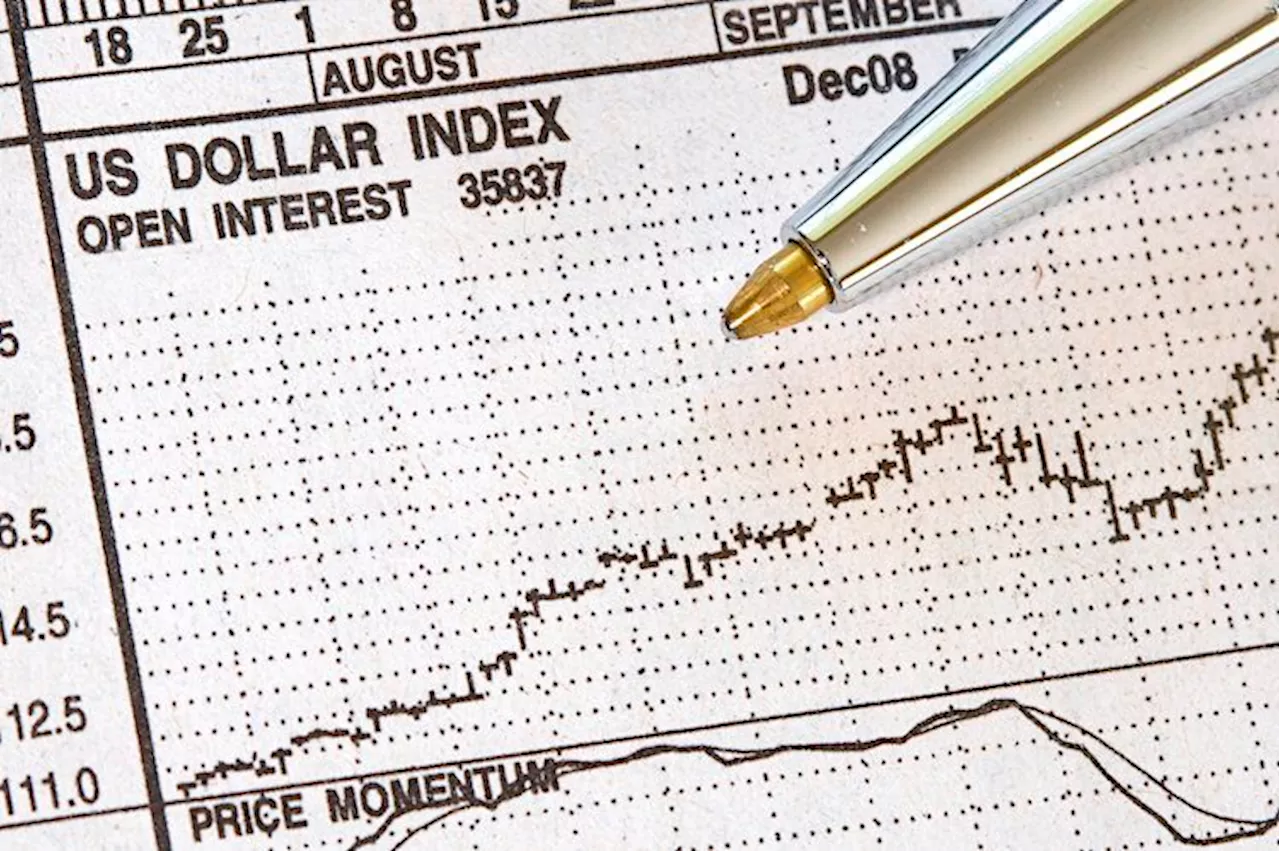

The Dollar Index faces key resistance levels ahead of the Non-Farm Payrolls report. Markets are cautiously anticipating the data, with forecasts suggesting a potential slowdown in job growth. A strong report could solidify the dollar's rally, while weaker data might trigger speculation about a Fed policy pivot.

The Dollar Index is hovering near key resistance levels of 109 and 107 as markets anticipate the crucial Non-Farm Payrolls report. The index recently eased to 108.90 after reaching a two-year high of 109.53, as traders prepare for this significant economic data release. This pullback suggests a cautious approach in a rally fueled by a hawkish Federal Reserve and global economic uncertainty. All attention is now focused on this week's report.

Economists forecast 154,000 jobs added in December, a substantial decline from November's 227,000. Any deviation from these projections could significantly impact the markets. Stronger-than-expected job growth would strengthen the Fed's argument for maintaining high interest rates, potentially propelling the dollar further upwards. Conversely, weaker data might reignite speculation about a policy shift, thereby moderating dollar strength.Although interest rates are slightly less restrictive, Fed Chair Jerome Powell emphasized a 'higher-for-longer' approach, dismissing hopes for early rate cuts. Other Fed officials, including Thomas Barkin and Governor Adriana Kugler, reiterated this firm stance, citing persistent economic uncertainty and inflation risks. They suggested no hasty easing of monetary policy. These hawkish signals continue to bolster the dollar's appeal.Adding another layer of uncertainty is the upcoming inauguration of Donald Trump. His proposed tax cuts, tariffs, and immigration policies have the potential to both stimulate and destabilize the dollar. While pro-growth initiatives could support the greenback, doubts regarding their implementation timeline are keeping markets on edge. Traders remain cautious, unsure how quickly Trump's policies will materialize or how closely they will align with expectations. This uncertainty contributes to the volatility surrounding the Dollar Index.Beyond US developments, the dollar's strength is further supported by global economic challenges

Dollar Index Non-Farm Payrolls Federal Reserve US Economy Global Markets

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Meme Index: The First Decentralized Meme Coin Index Investing PlatformMeme Index is revolutionizing meme coin investing with a decentralized platform that allows users to buy baskets of meme coins grouped by volatility. The platform offers a unique advantage over individual meme coins by positioning itself as a meme coin infrastructure investment.

Meme Index: The First Decentralized Meme Coin Index Investing PlatformMeme Index is revolutionizing meme coin investing with a decentralized platform that allows users to buy baskets of meme coins grouped by volatility. The platform offers a unique advantage over individual meme coins by positioning itself as a meme coin infrastructure investment.

Read more »

US Dollar Index rebounds to near 107.00 as US Retail Sales data loomThe US Dollar Index (DXY) posts modest gains to around 106.90 against major currencies during the early European session on Tuesday.

US Dollar Index rebounds to near 107.00 as US Retail Sales data loomThe US Dollar Index (DXY) posts modest gains to around 106.90 against major currencies during the early European session on Tuesday.

Read more »

Forex Market Analysis: Dollar Index Stability, EURINR Range, and US Fed MeetingThe Dollar Index remains stable above 106.75 with potential upside capped at 108. Euro needs to break past 1.0530/50 for further gains. EURINR requires a decisive move to indicate direction. Aussie is expected to test 0.63 before bottoming out. Markets await the US Federal Reserve meeting outcome, with a 25-bps rate cut anticipated. Key economic indicators and stock market performance are also analyzed.

Forex Market Analysis: Dollar Index Stability, EURINR Range, and US Fed MeetingThe Dollar Index remains stable above 106.75 with potential upside capped at 108. Euro needs to break past 1.0530/50 for further gains. EURINR requires a decisive move to indicate direction. Aussie is expected to test 0.63 before bottoming out. Markets await the US Federal Reserve meeting outcome, with a 25-bps rate cut anticipated. Key economic indicators and stock market performance are also analyzed.

Read more »

US Dollar Index Retreats as Fed Signals Cautious Future Rate CutsThe US Dollar Index (DXY) pulls back from its two-year peak following the Federal Reserve's (Fed) signals of fewer interest rate cuts in the future. Despite a 25-basis-point cut, the Fed projects a slower pace of easing, keeping the US rate advantage intact.

US Dollar Index Retreats as Fed Signals Cautious Future Rate CutsThe US Dollar Index (DXY) pulls back from its two-year peak following the Federal Reserve's (Fed) signals of fewer interest rate cuts in the future. Despite a 25-basis-point cut, the Fed projects a slower pace of easing, keeping the US rate advantage intact.

Read more »

Dollar Index Soars to Two-Year HighThe US Dollar Index reached a new two-year high on the first trading day of the new year, driven by strong US economic performance, expectations of continued interest rate hikes, and a flight to safety amid global uncertainty.

Dollar Index Soars to Two-Year HighThe US Dollar Index reached a new two-year high on the first trading day of the new year, driven by strong US economic performance, expectations of continued interest rate hikes, and a flight to safety amid global uncertainty.

Read more »

Dollar strength, Broadcom, Musk charges - what's moving marketsDollar strength, Broadcom, Musk charges - what's moving markets

Dollar strength, Broadcom, Musk charges - what's moving marketsDollar strength, Broadcom, Musk charges - what's moving markets

Read more »