David Giroux, chief investment officer at T. Rowe Price Investment Management, shares his contrarian approach to investing and how it has led his Capital Appreciation Fund to outperform the market for 17 consecutive years. He explains his focus on valuation, avoiding overvalued stocks, and finding hidden opportunities in undervalued sectors like software and healthcare.

Top fund manager David Giroux didn't earn his reputation by following the hottest stocks in the market. 'Being a little contrarian and very, very valuation sensitive,' was Giroux's answer when Business Insider asked about his investing approach. By buying unloved areas of the market and not being afraid to let go of success stories once he thinks they're no longer fairly valued, Giroux has led the T.

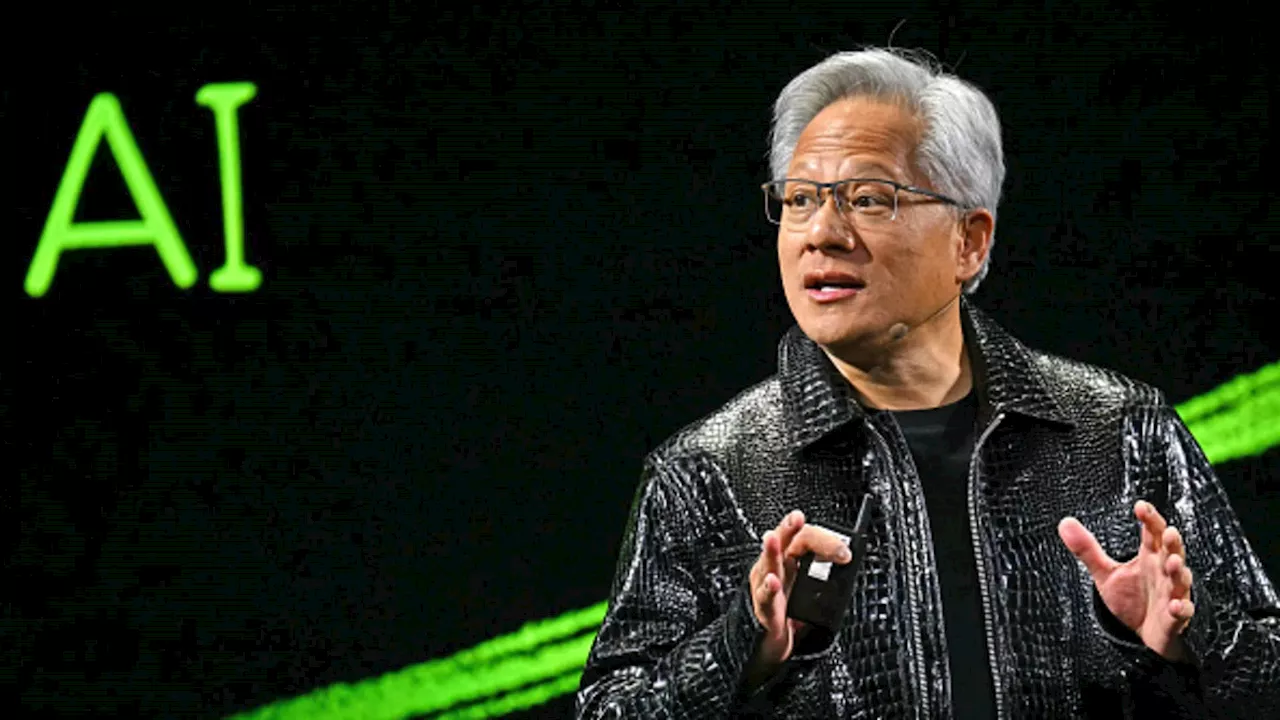

Rowe Price Capital Appreciation Fund (PRWCX) to beat its Morningstar Moderate Allocation peer group average performance for the last 17 years in a row — a record. T. Rowe Price compared Giroux's Capital Appreciation Fund to more than 3,000 US-domiciled funds in the Morningstar database going back to 1925 and found that no other fund has had a longer streak under the same portfolio manager. Morningstar independently verified the record. An investor who initially invested $100,000 in the Capital Appreciation Fund in 2008 would have seen their investment grow to $490,000 by the end of 2024. By comparison, the average return from the Morningstar US Fund Moderate Allocation category would have resulted in $253,000. That's 94% more than the category average. 'We don't own the market. We own four or five dozen stocks that we think are really, really attractive,' Giroux, who is also the chief investment officer for T. Rowe Price Investment Management, said. 'We owned Costco not too long ago when it traded for 35 times earnings, and now we don't,' he added. The wholesale retailer now trades at over 50 times earnings, a price that Giroux deems overvalued. As stock-market valuations and investor optimism remain relatively high, Giroux sees an opportunity to find hidden pockets of value. 'People are chasing stocks without regard to valuation, which is probably also a sign that there's a little bit of speculative success in the marketplace,' he said. Below, Giroux shares two trades that he's betting on to steer his fund in the direction of another year of outperformance. With the stock market having performed so well over the past two years, it may be tempting to bet on a third year of stellar returns. However, Giroux cautions against using the past to predict what's next. 'The future is far more uncertain than we think it is, so if you're putting a high value on stocks because you think the future is going to be great, it usually does not work out that way,' he said. That said, Giroux is pulling back his equity allocation and adding more fixed income. 'We have the ability as a multi-asset strategy to adjust our equity weight and our fixed-income rate,' he said. Giroux tends to hover in the ballpark of a 60/40 stock-to-bond portfolio. However, 'we're actually 300 to 400 basis points below what we think is normal equity exposure for us,' he said. Giroux has increased the fund's exposure to Treasurys instead, citing their safety and liquidity. Treasurys also tend to rally in times of market volatility, making them an ideal candidate for portfolio protection. The yield on the US 10-year, which is up almost a full percentage point since September to 4.5%, also remains at one of its highest levels in the last 25 years. The fund currently has around a 15% allocation to five- and 10-year Treasurys. Although the market is expensive, Giroux sees overlooked pockets of opportunity if you look outside the big names, like Nvidia. 'I don't think the outlook for Nvidia over the next three to five years is nearly as good as it has actually been in the last couple of years,' Giroux said. He expects increased competition in the chipmaking space could shrink Nvidia's market share. That's not to mention the recent tech selloff — including for Nvidia — in the wake of Chinese OpenAI competitor DeepSeek's debut. Giroux also isn't enthusiastic about financials, a sector of the market that Wall Street is betting will benefit greatly from President Donald Trump's deregulatory policies. 'When banks trade for 14- or 15-times earnings, that's kind of scary,' Giroux said. The sector has historically traded at a more muted 10- to 12-times earnings. Instead, Giroux is turning toward undervalued areas of the market like software, healthcare, and utilities. Software, in particular, has been overlooked by investors for more flashy names in the tech space, according to Giroux, making valuations cheap. He sees many names in the space with the potential to grow revenues at a rate of 10% or higher, especially if they begin utilizing AI. One of Giroux's top software picks is the human capital management company Workday (WDAY). He believes the company will achieve mid-teens revenue growth in the next few years. 'This is a best-in-class software business with 98% gross retention, a market leader in their space, a lot of margin expansion in front of us, trading at the lowest valuation it's ever traded for in the past,' Giroux said.

INVESTING STOCK MARKET CONTRARIAN VALUATION PERFORMANCE SOFTWARE HEALTHCARE FIXED INCOME TREASURIES OUTPERFORM

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Investment Manager Settles SEC Charges for Misuse of Fund ExpensesHendrik Jordaan, a former attorney and investment manager, agreed to pay a $250,000 civil penalty to the SEC after allegations of improperly charging business and personal expenses to two investment funds.

Investment Manager Settles SEC Charges for Misuse of Fund ExpensesHendrik Jordaan, a former attorney and investment manager, agreed to pay a $250,000 civil penalty to the SEC after allegations of improperly charging business and personal expenses to two investment funds.

Read more »

Fund manager reveals what needs to change for her to invest in luxury stocksHannah Gooch-Peters of Sanlam Investments explains why she’s cautious on luxury stocks like LVMH.

Fund manager reveals what needs to change for her to invest in luxury stocksHannah Gooch-Peters of Sanlam Investments explains why she’s cautious on luxury stocks like LVMH.

Read more »

AI Investment Theme to Continue Growing Through 2025: Hong Kong Tech Fund ManagerPando CMS Innovation ETF's CIO Beck Lee believes AI will be a long-term investment theme, citing Nvidia's CEO Jensen Huang's perspective on AI's evolution. The fund has seen significant gains in 2024, largely driven by its investments in AI companies like Nvidia and Spotify. Lee expects Nvidia to continue outperforming but cautions about its ability to maintain current profit margins. The fund's strategy combines top-down macroeconomic analysis with bottom-up company fundamental research.

AI Investment Theme to Continue Growing Through 2025: Hong Kong Tech Fund ManagerPando CMS Innovation ETF's CIO Beck Lee believes AI will be a long-term investment theme, citing Nvidia's CEO Jensen Huang's perspective on AI's evolution. The fund has seen significant gains in 2024, largely driven by its investments in AI companies like Nvidia and Spotify. Lee expects Nvidia to continue outperforming but cautions about its ability to maintain current profit margins. The fund's strategy combines top-down macroeconomic analysis with bottom-up company fundamental research.

Read more »

Hedge Fund Manager Scott Bessent Confirmed as Treasury SecretarySenate confirms Scott Bessent, a hedge fund manager with a focus on fiscal responsibility, as President Trump's Treasury Secretary. Bessent pledges to crack down on federal spending, extend the 2017 Tax Cuts and Jobs Act, and protect American businesses.

Hedge Fund Manager Scott Bessent Confirmed as Treasury SecretarySenate confirms Scott Bessent, a hedge fund manager with a focus on fiscal responsibility, as President Trump's Treasury Secretary. Bessent pledges to crack down on federal spending, extend the 2017 Tax Cuts and Jobs Act, and protect American businesses.

Read more »

Trump Appoints Controversial Hedge Fund Manager as Treasury SecretaryPresident Donald Trump has nominated Mark Bessent, a hedge fund manager, to serve as the next Treasury Secretary. Bessent faces scrutiny for his tax practices and policy positions, including his support for extending tax cuts for the wealthy and Trump's tariff threats. Despite opposition from some Democrats, Bessent's nomination has cleared the Senate Finance committee.

Trump Appoints Controversial Hedge Fund Manager as Treasury SecretaryPresident Donald Trump has nominated Mark Bessent, a hedge fund manager, to serve as the next Treasury Secretary. Bessent faces scrutiny for his tax practices and policy positions, including his support for extending tax cuts for the wealthy and Trump's tariff threats. Despite opposition from some Democrats, Bessent's nomination has cleared the Senate Finance committee.

Read more »

DeepSeek Founder Liang Wenfeng: From Hedge Fund Manager to China's AI HeroChinese startup DeepSeek and its founder Liang Wenfeng have taken the tech world by storm, rivaling ChatGPT's capabilities while spending a fraction of the cost. This has led to Liang being hailed as a national hero in China, with social media buzzing about his achievements and potential.

DeepSeek Founder Liang Wenfeng: From Hedge Fund Manager to China's AI HeroChinese startup DeepSeek and its founder Liang Wenfeng have taken the tech world by storm, rivaling ChatGPT's capabilities while spending a fraction of the cost. This has led to Liang being hailed as a national hero in China, with social media buzzing about his achievements and potential.

Read more »