Pando CMS Innovation ETF's CIO Beck Lee believes AI will be a long-term investment theme, citing Nvidia's CEO Jensen Huang's perspective on AI's evolution. The fund has seen significant gains in 2024, largely driven by its investments in AI companies like Nvidia and Spotify. Lee expects Nvidia to continue outperforming but cautions about its ability to maintain current profit margins. The fund's strategy combines top-down macroeconomic analysis with bottom-up company fundamental research.

Artificial intelligence will be an investment theme that will continue to grow in 2025 and beyond, according to a tech fund manager that posted 80% gains in 2024. The Hong Kong-listed exchange traded fund Pando CMS Innovation ETF's Chief Investment Officer Beck Lee said the fund relies on proprietary research that combines macroeconomic factors with company fundamentals to make stock picks.

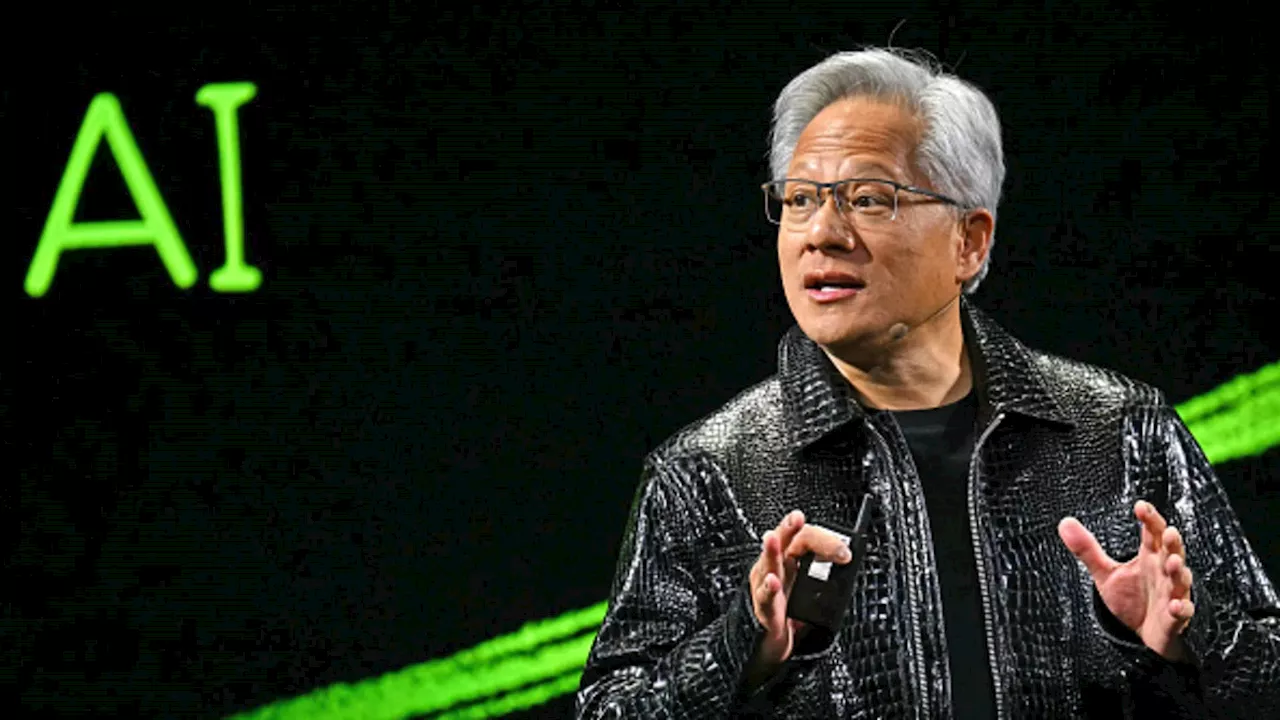

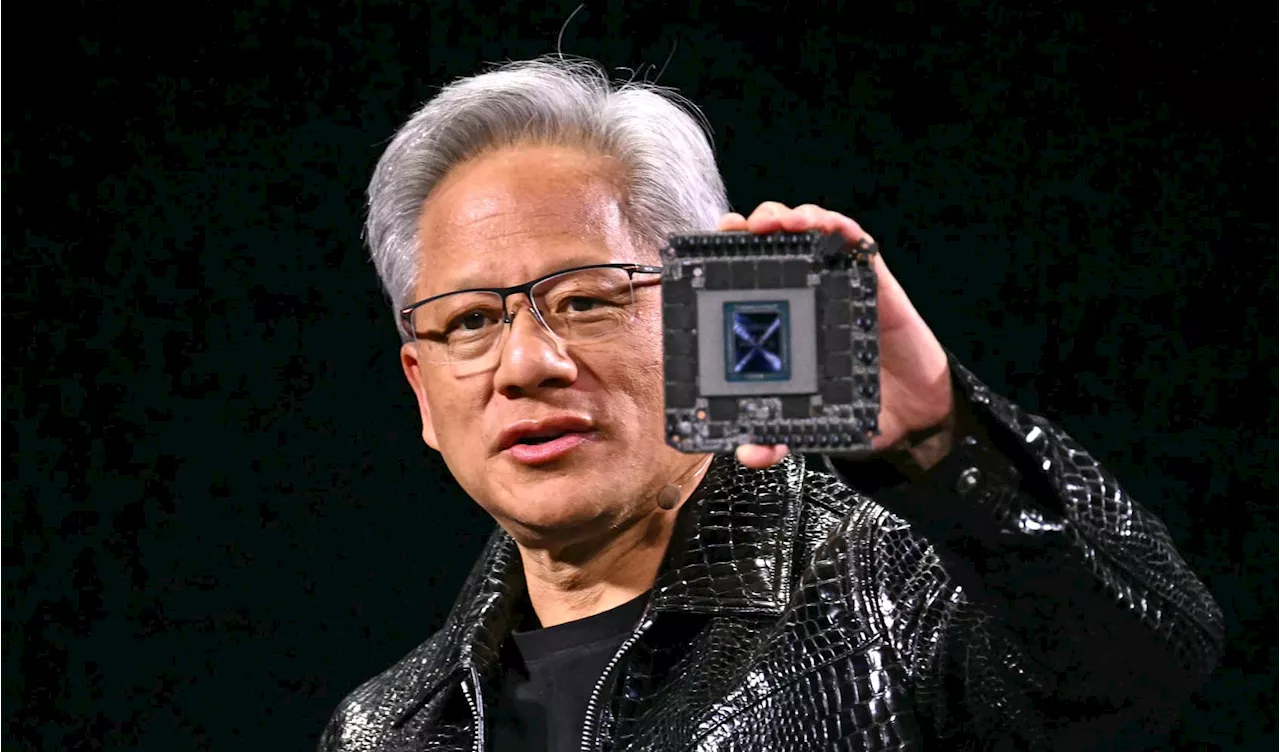

'In this ETF, we combine top-down and bottom-up research to construct this portfolio,' Lee told CNBC Pro from Hong Kong. 'The top-down approach helps us to identify themes like the impact of AI, and identify sectors like AI or cryptocurrency,' Lee added. 'The bottom-up approach helps us to identify the stocks with solid fundamentals.' Lee suggested the fund's strategy is geared toward long-term gains over short-term moves, especially in AI. The fund has held a stake in Nvidia since its inception in December 2022. 'AI is a long-term trend. Not just one year or two-year thing,' Lee explained. He pointed toward comments from Nvidia CEO Jensen Huang who said AI has evolved over many years to understand vision and text, and is set to enter the physical realm. The ETF manages a highly concentrated portfolio of 17 stocks including Microsoft, chipmaker Taiwan Semi, Spotify, Apple, Amazon, Netflix, Nvidia and Tesla among others, which have made the fund one of the best-performing actively managed ETFs in the world. The 17 stocks, on average, returned 75% last year on an unweighted basis. The fund, which manages $10 million in assets, invests mostly in U.S.-listed companies. Relatively new to the industry yet managing more than $500 million in assets, the fund's management firm Pando Finance was founded in 2021 in Hong Kong. Its executives, however, have many years of industry experience, including its chief executive and founder Junfei Ren, who was previously an executive at the German stock exchange Deutsche Boerse and ZhenFund, one of China's largest venture capital funds. The firm also manages ETFs that are focused on companies operating in blockchain technology. CIO Lee said it leveraged its expertise in the cryptocurrency sector to identify MicroStrategy and Coinbase as stocks to hold in the CMS Innovative fund. Shares of MicroStrategy, which gained 358% in 2024, are widely viewed as a Bitcoin proxy due to its leveraged holdings of the cryptocurrency. It's a top 10 holding in the Pando CMS Innovation ETF and contributed significantly to the fund's overall performance. Similarly, Nvidia and Spotify had triple-digit returns in 2024 and are among the top 10 stocks in the fund. Lee said he expects Nvidia to continue to outperform owing to the structural change it's enabling in the global economy through the widespread use of AI. However, he cautioned that the company will struggle to maintain its current gross profit margins of about 75% in the future as competitors take market share. 'I think the high margin of Nvidia is hard to maintain at 75%. I think it will to high 60. Maybe not next quarter, but maybe next year.' Lee said. 'But I think the margin will start to fall.' Microsoft, one of Nvidia's largest customers, has already begun diversifying the AI processors it uses. Analysts say the company has contracted significantly cheaper AI chips from Broadcom, a California-headquartered chip designer. Microsoft is Pando ETF's largest holding, with a 9.4% allocation, while Broadcom accounts for 2.9% of the fund. The fund has held the AI chip stock, as well as the chip maker Taiwan Semiconductor, since its inception. Among the fund performance's detractors were AMD and Adobe, which fell by 18% and 26%, respectively. Both stocks accounted for less than 2% of the fund by the end of 2024

Artificial Intelligence AI Investments Etfs Pando CMS Innovation ETF Technology Trends Nvidia Microsoft Cryptocurrency

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Nvidia Soars as AI Investment Fuels Record GrowthNvidia's stock reached a record high, driven by strong investor confidence in the company's AI capabilities. Foxconn's record revenue, largely attributed to AI server sales, further emphasizes the booming AI sector.

Nvidia Soars as AI Investment Fuels Record GrowthNvidia's stock reached a record high, driven by strong investor confidence in the company's AI capabilities. Foxconn's record revenue, largely attributed to AI server sales, further emphasizes the booming AI sector.

Read more »

AMD invests in GPU cloud provider Vultr at $3.5 billion valuationAMD's investment in Vultr comes after Nvidia backed GPU startup CoreWeave.

AMD invests in GPU cloud provider Vultr at $3.5 billion valuationAMD's investment in Vultr comes after Nvidia backed GPU startup CoreWeave.

Read more »

Squid Game Season 2 Lee Jung-Jae And Lee Seo-Hwan Interview'I think that it's parallel to the political sphere that we see nowadays. It's so polarized, it's just two sides, and they can't come to a compromise.'

Squid Game Season 2 Lee Jung-Jae And Lee Seo-Hwan Interview'I think that it's parallel to the political sphere that we see nowadays. It's so polarized, it's just two sides, and they can't come to a compromise.'

Read more »

Lee Hak Joo And Song Young Chang Turn Against Each Other In “Parole Examiner Lee”Lee Hak Joo and Song Young Chang are making their final push toward their goals in “Parole Examiner Lee”! “Parole Examiner Lee” is a tvN drama starring Go

Lee Hak Joo And Song Young Chang Turn Against Each Other In “Parole Examiner Lee”Lee Hak Joo and Song Young Chang are making their final push toward their goals in “Parole Examiner Lee”! “Parole Examiner Lee” is a tvN drama starring Go

Read more »

Mrs Momma Bear Partners With Flying Solo To Debut Its International ExpansionLee Evans Lee shares Mrs Momma Bear's expansion to Europe with Flying Solo.

Mrs Momma Bear Partners With Flying Solo To Debut Its International ExpansionLee Evans Lee shares Mrs Momma Bear's expansion to Europe with Flying Solo.

Read more »

Samsung Stock Rises Despite Disappointing Earnings on Hope of Nvidia RevivalThough Samsung reported fourth-quarter profit that missed market expectations, its stock price surged following optimistic comments from Nvidia CEO Jensen Huang. Investors are betting on a potential revival for Samsung in 2025, fueled by Nvidia's AI expansion, which Samsung has yet to fully capitalize on. Samsung's success hinges on its ability to secure certification from Nvidia for its high-bandwidth memory (HBM) chips, a crucial component for Nvidia's data center operations.

Samsung Stock Rises Despite Disappointing Earnings on Hope of Nvidia RevivalThough Samsung reported fourth-quarter profit that missed market expectations, its stock price surged following optimistic comments from Nvidia CEO Jensen Huang. Investors are betting on a potential revival for Samsung in 2025, fueled by Nvidia's AI expansion, which Samsung has yet to fully capitalize on. Samsung's success hinges on its ability to secure certification from Nvidia for its high-bandwidth memory (HBM) chips, a crucial component for Nvidia's data center operations.

Read more »