The Fed on Silicon Valley Bank Collapse: We May Have Dropped the Ball There

This might not come as a huge surprise but one of the key takeaways from the Fed’s report is that SVB was not a particularly well run bank. The report notes that the bank’s board of directors and its managers were not very good at negotiating—or communicating about—the risks in the bank’s business strategy. At the same time, the bank is said to have not had any real plan for if things went south—like they ended up doing last month.

Silicon Valley Bank was a highly vulnerable firm in ways that both its board of directors and senior management did not fully appreciate.

The Federal Reserve did not appreciate the seriousness of critical deficiencies in the firm’s governance, liquidity, and interest rate risk management. These judgments meant that Silicon Valley Bank remained wellrated, even as conditions deteriorated and significant risk to the firm’s safety and soundness emerged.see red flags, it was slow to act on them:

Overall, the supervisory approach at Silicon Valley Bank was too deliberative and focused on the continued accumulation of supporting evidence in a consensus-driven environment.In other words, federal regulators felt they needed to have an open-and-shut case before taking action against SVB.One of the reasons that SVB got away with making so many dumb decisions is that the banking industry has slowly been deregulated over the past several years, largely at the behest of corporate lobbyists.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

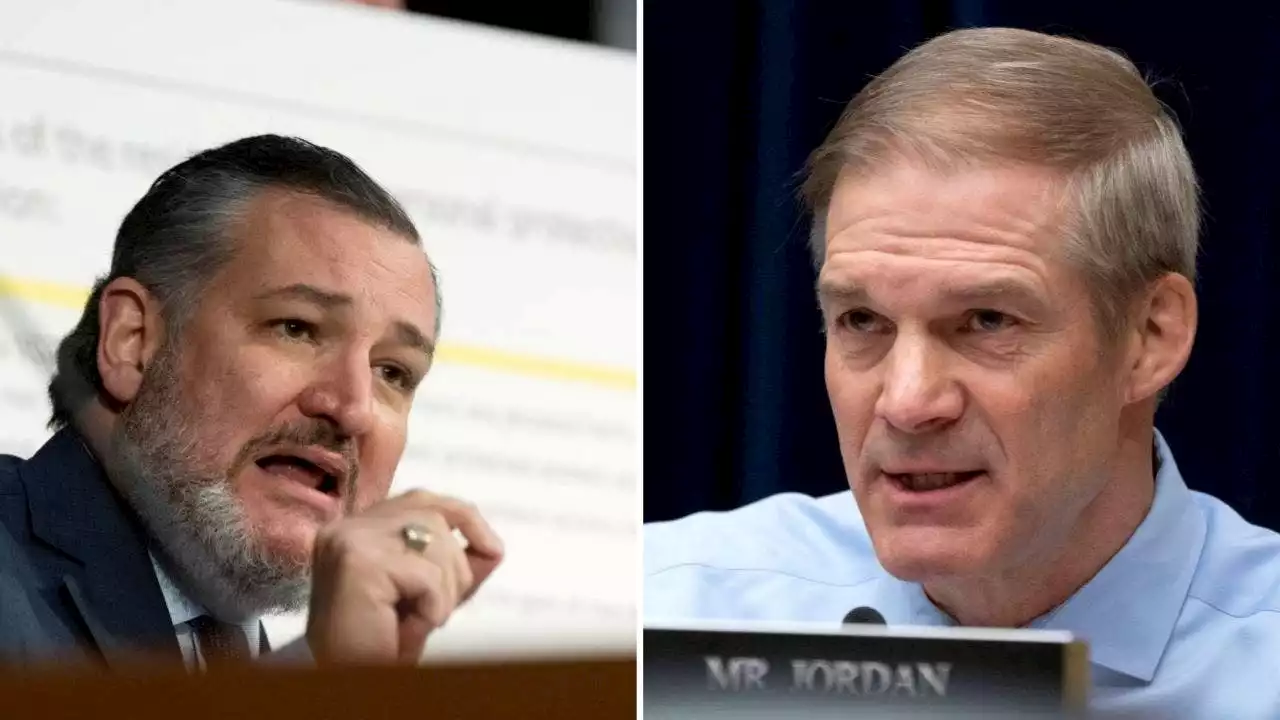

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Read more »

![]() Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Read more »

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank CollapseMichael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. He also called for revamping a range of rules for midsize banks.

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank CollapseMichael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. He also called for revamping a range of rules for midsize banks.

Read more »

![]() Fed report on Silicon Valley Bank collapse blames mismanagement, weak government oversightThe Federal Reserve on Friday released its report on what led to the collapse of Silicon Valley Bank, placing blame on the lender's management and calling for better regulation.

Fed report on Silicon Valley Bank collapse blames mismanagement, weak government oversightThe Federal Reserve on Friday released its report on what led to the collapse of Silicon Valley Bank, placing blame on the lender's management and calling for better regulation.

Read more »

![]() Silicon Valley Bank failure: Fed partly blames itself for collapseSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Silicon Valley Bank failure: Fed partly blames itself for collapseSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Read more »

Banks, consumers being tested in the wake of Silicon Valley Bank's collapseMore than one month after banking alarms sounded across the globe with the collapse of Silicon Valley Bank and Signature Bank, lending institutions are still reeling, and consumers are skeptical. MORE ⬇️

Banks, consumers being tested in the wake of Silicon Valley Bank's collapseMore than one month after banking alarms sounded across the globe with the collapse of Silicon Valley Bank and Signature Bank, lending institutions are still reeling, and consumers are skeptical. MORE ⬇️

Read more »