A new state law requiring Texas counties to audit homestead exemptions every five years has led to confusion and a surge in inquiries from property owners. Tarrant Appraisal District officials are working to clarify the process and minimize the burden on homeowners.

The Tarrant Appraisal District Office has been bustling with activity due to a recently enacted state law mandating counties to audit homestead exemption holders every five years. This previously obscure law, highlighted by FOX 4 last week, has sparked a wave of inquiries from property owners seeking clarification. TAD is actively working to alleviate confusion among Tarrant County homeowners.

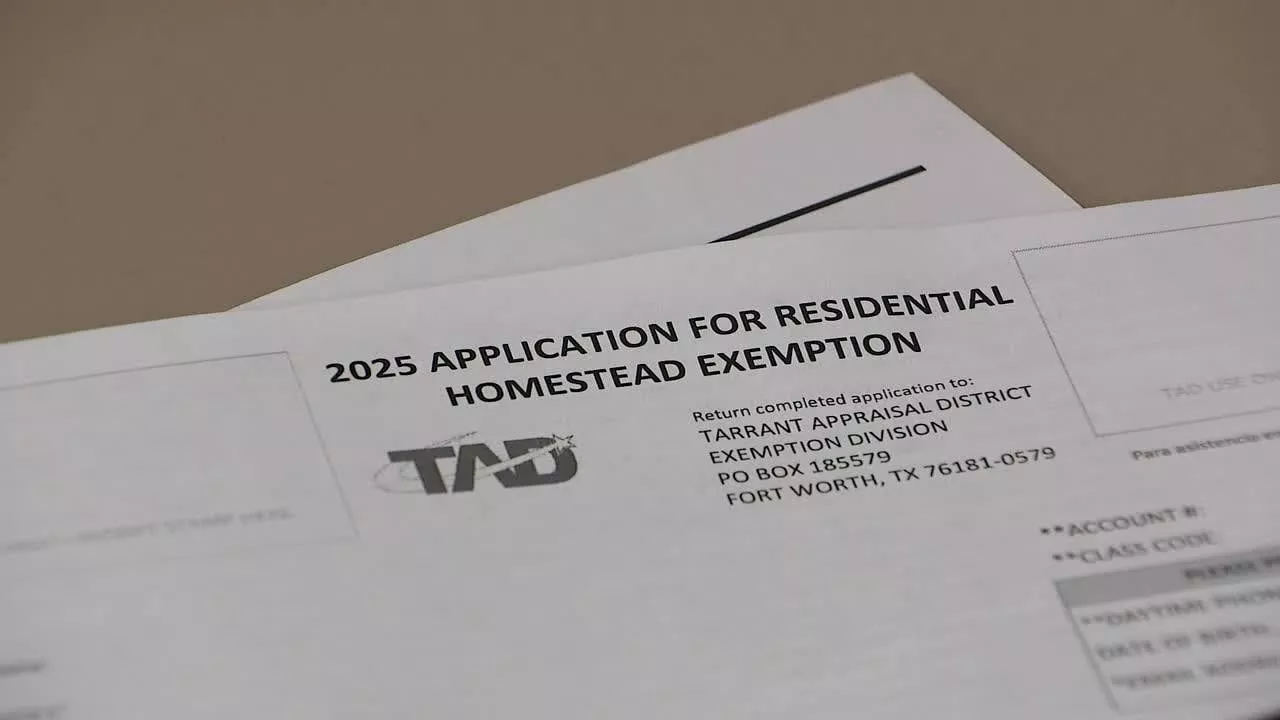

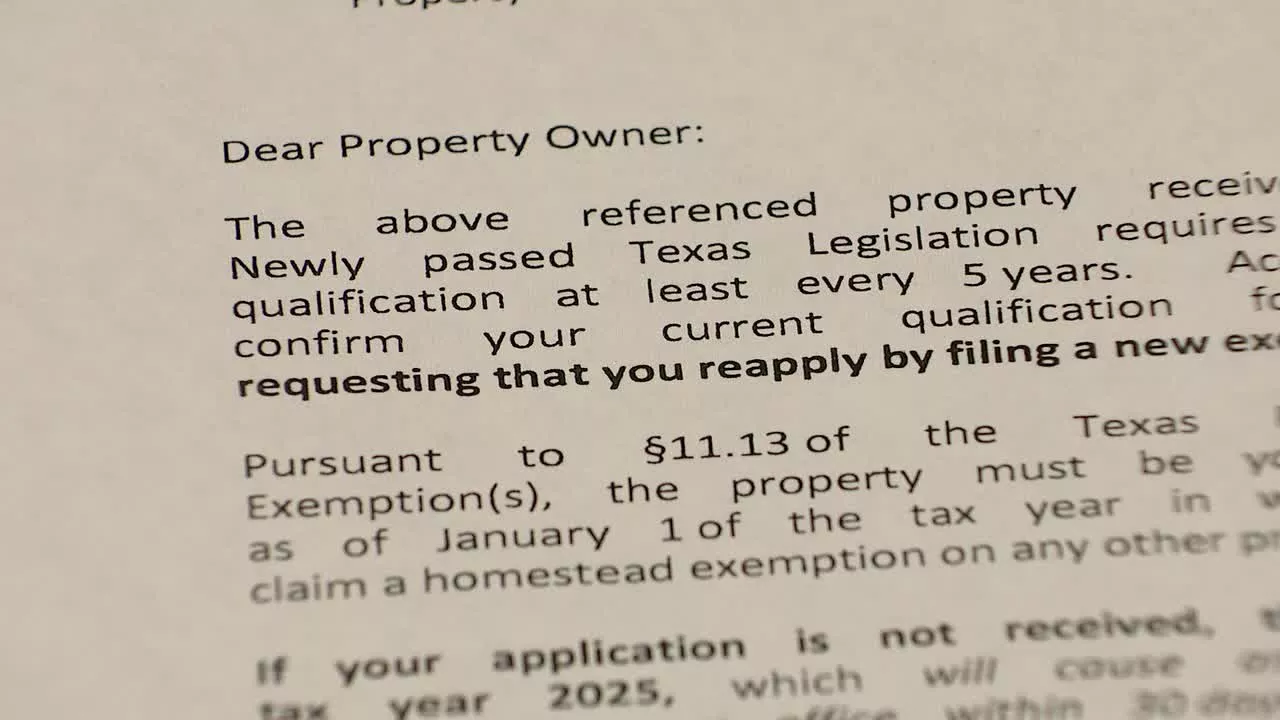

In Texas, homeowners enjoy a tax break known as the homestead exemption, allowing their property taxes to be calculated at a lower rate than their appraised or market value. Until recently, this exemption was generally considered a set-and-forget arrangement. However, state legislators passed a law in 2023 requiring appraisal districts in Texas counties to assess the continued eligibility of homeowners for this exemption at least once every five years. According to TAD, a significant number of homeowners claiming the exemption may not actually qualify.Tarrant Chief Appraiser Joe Don Bobbit stated, 'Right now, there’s about 30,000 that have hit on radar that may not qualify that we have to look into.' He added, 'Usually about ¾ of 1% are actually erroneous. That doesn’t sound like much. But it usually ends up being multi-million dollars to the entities.' Rather than requiring all homestead exemption holders to reapply every five years, Tarrant appraisal officials are utilizing an outside contractor to identify homeowners with questionable statuses. Bobbitt explained, 'Right now, most of it is confusion between Dallas County and Tarrant County. They heard everybody has to re-apply. That’s what the law basically says: that you have to validate your homestead once every five years. What we’re trying to do is alleviate that burden or minimize it as much as possible for Tarrant County residents and only have them re-apply if there’s a reason why we think they are no longer eligible.' David Lube, a Tarrant County property owner, visited TAD on Monday to verify his status. He commented, 'It’s confusing. But anyway, I’ve got my little letter, so I’m okay.' Homeowners who receive a letter like Lube's may simply need to confirm their residency at the exempted property. Failure to respond to two mailings could result in the homestead exemption being revoked. Bobbitt elaborated, 'They can find if people live in other places or if people have passed away. They can also look at voter registration, vehicle registration, mailing address. So if it looks like somebody lives in another place besides the home that we have, then we can research that more to find out where they actually live.' Homeowners can check the status of their homestead exemption by visiting their county's appraisal district website. A list of all county appraisal district websites is available at https://comptroller.texas.gov/taxes/property-tax/county-directory/. A simple property search should reveal valid exemptions. If your status is revoked, you will likely need to pay taxes on the higher assessed value. However, you can contact your county's appraisal district to apply for a refund of the difference if you are eligible

HOMESTEAD EXEMPTION PROPERTY TAX TEXAS LAW APPRAISAL DISTRICT CONFUSION

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Texas Homeowners Must Reapply for Homestead Exemption Every Five YearsA new Texas law requires homeowners to reapply for their homestead exemption every five years. Failure to respond to verification notices could result in losing the exemption and paying higher property taxes. The law aims to ensure that homeowners still qualify for the exemption, which reduces property tax rates based on appraised or market value. Homeowners can check the status of their exemption online and reapply through their county's appraisal district website.

Texas Homeowners Must Reapply for Homestead Exemption Every Five YearsA new Texas law requires homeowners to reapply for their homestead exemption every five years. Failure to respond to verification notices could result in losing the exemption and paying higher property taxes. The law aims to ensure that homeowners still qualify for the exemption, which reduces property tax rates based on appraised or market value. Homeowners can check the status of their exemption online and reapply through their county's appraisal district website.

Read more »

Texas Homeowners Face New Homestead Exemption Verification RequirementA new Texas law requires homeowners to verify their homestead exemption every five years, potentially leading to higher property taxes if they fail to respond to reapplication notices.

Texas Homeowners Face New Homestead Exemption Verification RequirementA new Texas law requires homeowners to verify their homestead exemption every five years, potentially leading to higher property taxes if they fail to respond to reapplication notices.

Read more »

Texas Homeowners Face New Homestead Exemption RequirementA new Texas law mandates that every county appraisal district verify homestead exemptions at least every five years. Homeowners who fail to respond to verification notices risk losing their exemption and paying higher taxes. The law requires homeowners to reaffirm their eligibility for the exemption, which lowers property tax calculations based on appraised or market value. Several resources are available to homeowners, including county appraisal district websites and contact information.

Texas Homeowners Face New Homestead Exemption RequirementA new Texas law mandates that every county appraisal district verify homestead exemptions at least every five years. Homeowners who fail to respond to verification notices risk losing their exemption and paying higher taxes. The law requires homeowners to reaffirm their eligibility for the exemption, which lowers property tax calculations based on appraised or market value. Several resources are available to homeowners, including county appraisal district websites and contact information.

Read more »

Florida Homestead Exemption Offers Relief From Rising Housing CostsFloridians facing soaring homeowners association fees and insurance costs can apply for the state's homestead exemption, a tax benefit that can save them up to $50,000 on their property taxes.

Florida Homestead Exemption Offers Relief From Rising Housing CostsFloridians facing soaring homeowners association fees and insurance costs can apply for the state's homestead exemption, a tax benefit that can save them up to $50,000 on their property taxes.

Read more »

North Texas vs. Texas State Predictions: Over is the Play in First Responder BowlBoth North Texas and Texas State are high-scoring teams that can put up big numbers, but opt-outs and transfers have impacted both rosters. The article analyzes the impact of these departures and predicts a high-scoring game in the First Responder Bowl.

North Texas vs. Texas State Predictions: Over is the Play in First Responder BowlBoth North Texas and Texas State are high-scoring teams that can put up big numbers, but opt-outs and transfers have impacted both rosters. The article analyzes the impact of these departures and predicts a high-scoring game in the First Responder Bowl.

Read more »

Texas State and North Texas to Face Off in First Responder BowlCoaches GJ Kinne and Eric Morris have a history together, with Kinne receiving advice from Morris before taking the head coaching position at Incarnate Word.

Read more »