The spring housing market is showing little signs of life, with both mortgage rates and home prices continuing to rise. Despite an increase in available listings, demand from homebuyers remains weak. Mortgage applications fell last week, and refinancing activity is still low.

Homebuyers are seeing little incentive to jump into the spring housing market , even with an uptick in available listings. Mortgage rates have remained largely stagnant in recent weeks, while home prices continue their upward trajectory. This sluggishness in demand is reflected in mortgage applications, which dropped 4% last week compared to the previous week, according to the Mortgage Bankers Association's seasonally adjusted index. Demand remained flat compared to the same week last year.

\'The average loan size for a purchase loan has increased since the start of the year and continued that trend last week with weaker government purchase activity, which reached $447,300, the highest level since October 2024,' said Joel Kan, vice president and deputy chief economist at the MBA. Despite this, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) dipped slightly to 6.97% from 7.02%. Points, however, increased to 0.64 from 0.63 (including the origination fee) for loans with a 20% down payment. Even with this slight decrease, it's still 17 basis points lower than the same week last year. \'Mortgage rates moved lower last week, consistent with lower Treasury yields following the FOMC meeting and a volatile week for the stock market. The 30-year fixed rate declined to its lowest level in six weeks,' added Kan. This slight decline in mortgage rates did spur some activity in the refinancing market, with applications rising 12% from the previous week and 17% from the same week last year. While these percentage increases appear substantial, they are largely attributed to historically low refinancing volumes. Most borrowers currently hold rates significantly lower than those offered today. Mortgage applications for home purchases are now 39% lower than they were in February 2019, pre-pandemic. Home sales are approaching a 30-year low, and house prices nationwide continue to reach record highs. More sellers are resorting to price reductions, with 15.6% in January compared to 14.7% in January of last year, according to Realtor.com. However, most sellers are still able to maintain their list prices due to sufficient competition. Meanwhile, the supply of homes for sale saw a 25% increase compared to a year ago, largely driven by longer time-on-market durations. The average time to sell a home in January was 54 days, the longest since March 2020, according to Redfin. Despite this increase, the supply of homes for sale remains 25% below January 2019 levels

Mortgage Rates Housing Market Homebuyers Refinancing Home Prices Interest Rates

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

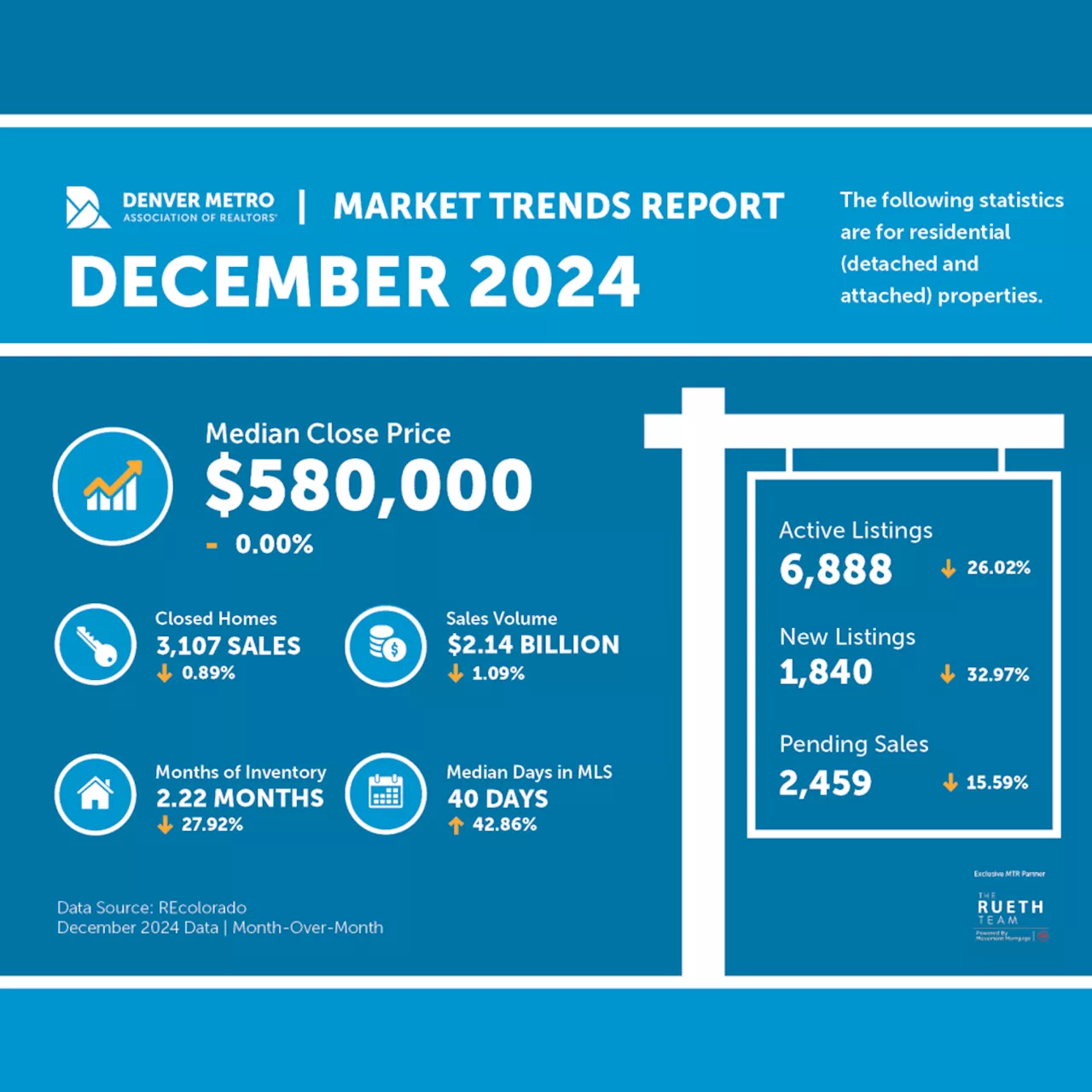

Denver Housing Market Remains Resilient Despite Mortgage RatesThe Denver housing market demonstrates resilience with increased buyer demand and rising home values despite high mortgage rates. Active listings remain low, but new inventory is entering the market.

Denver Housing Market Remains Resilient Despite Mortgage RatesThe Denver housing market demonstrates resilience with increased buyer demand and rising home values despite high mortgage rates. Active listings remain low, but new inventory is entering the market.

Read more »

Mortgage Rates Reach 7% for the First Time Since May 2024: Impact on the Housing MarketMortgage rates surge to 7%, marking the highest level since May 2024, despite the Federal Reserve's efforts to lower interest rates. This development poses a significant challenge for home buyers already grappling with affordability issues. The article analyzes the reasons behind this rate increase, explores its impact on the housing market, and offers strategies for prospective home buyers navigating this challenging landscape.

Mortgage Rates Reach 7% for the First Time Since May 2024: Impact on the Housing MarketMortgage rates surge to 7%, marking the highest level since May 2024, despite the Federal Reserve's efforts to lower interest rates. This development poses a significant challenge for home buyers already grappling with affordability issues. The article analyzes the reasons behind this rate increase, explores its impact on the housing market, and offers strategies for prospective home buyers navigating this challenging landscape.

Read more »

Mortgage Rates Surge Above 7%, Raising Concerns for Housing MarketRising mortgage rates threaten to prolong the housing market slump, making homes less affordable and hindering sales. Experts warn of continued volatility and potential affordability crisis.

Mortgage Rates Surge Above 7%, Raising Concerns for Housing MarketRising mortgage rates threaten to prolong the housing market slump, making homes less affordable and hindering sales. Experts warn of continued volatility and potential affordability crisis.

Read more »

Mortgage Rates Climb Above 7%, Raising Concerns for Housing MarketMortgage rates have surged back over 7%, marking the highest level since May, potentially exacerbating the ongoing housing affordability crisis. High interest rates, coupled with soaring home prices and insurance costs, are creating a challenging environment for buyers. Economists predict rates will remain elevated throughout 2025, fueled by inflation and uncertainties surrounding the Federal Reserve's monetary policy.

Mortgage Rates Climb Above 7%, Raising Concerns for Housing MarketMortgage rates have surged back over 7%, marking the highest level since May, potentially exacerbating the ongoing housing affordability crisis. High interest rates, coupled with soaring home prices and insurance costs, are creating a challenging environment for buyers. Economists predict rates will remain elevated throughout 2025, fueled by inflation and uncertainties surrounding the Federal Reserve's monetary policy.

Read more »

US Housing Market Shows Signs of Weakness Amid High Mortgage RatesPending home sales declined sharply in December, signaling a slowdown in the US housing market. The average rate on the 30-year fixed mortgage rose significantly during the month, potentially discouraging buyers. While new home sales saw gains, experts attribute this to aggressive rate buydowns by builders. High home prices and mortgage rates continue to impact affordability, particularly in the West and Northeast.

US Housing Market Shows Signs of Weakness Amid High Mortgage RatesPending home sales declined sharply in December, signaling a slowdown in the US housing market. The average rate on the 30-year fixed mortgage rose significantly during the month, potentially discouraging buyers. While new home sales saw gains, experts attribute this to aggressive rate buydowns by builders. High home prices and mortgage rates continue to impact affordability, particularly in the West and Northeast.

Read more »

Housing Market Stagnation: High Rates, Prices, and Lack of Inventory Dampen SalesThe US housing market experienced its slowest year for existing home sales since 1995, due to high mortgage rates, soaring prices, and limited inventory. Many homeowners are reluctant to sell their homes with low mortgage rates secured during previous periods of lower interest rates. Experts anticipate that the lock-in effect will gradually ease, potentially leading to increased inventory in 2025. However, the housing market remains volatile, with builders facing challenges in meeting demand while navigating rising costs and a tight labor market.

Housing Market Stagnation: High Rates, Prices, and Lack of Inventory Dampen SalesThe US housing market experienced its slowest year for existing home sales since 1995, due to high mortgage rates, soaring prices, and limited inventory. Many homeowners are reluctant to sell their homes with low mortgage rates secured during previous periods of lower interest rates. Experts anticipate that the lock-in effect will gradually ease, potentially leading to increased inventory in 2025. However, the housing market remains volatile, with builders facing challenges in meeting demand while navigating rising costs and a tight labor market.

Read more »