Mortgage rates surge to 7%, marking the highest level since May 2024, despite the Federal Reserve's efforts to lower interest rates. This development poses a significant challenge for home buyers already grappling with affordability issues. The article analyzes the reasons behind this rate increase, explores its impact on the housing market, and offers strategies for prospective home buyers navigating this challenging landscape.

Mortgage rates hit 7% for the first time since May 2024 on Thursday, adding to the affordability challenges already faced by many Americans. This increase comes even after the Federal Reserve cut interest rates by a full percentage point in recent months, which had raised hopes among home buyers for lower financing costs. However, mortgage rates have climbed instead.

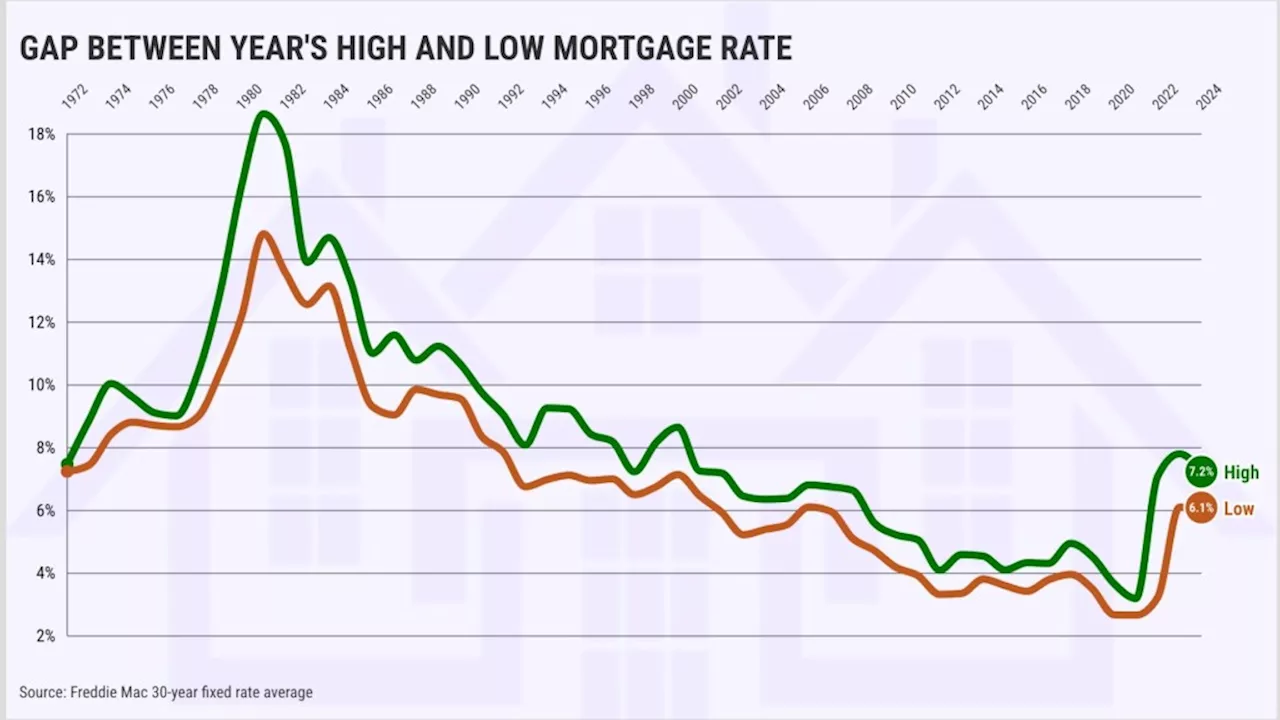

Why are mortgage rates increasing despite the Fed's cuts? The answer lies in the fact that the Fed sets short-term interest rates, while mortgage rates are primarily influenced by the yield on 10-year Treasury bonds. This yield has surged in recent months due to factors such as persistent inflation, a strong economy, and the anticipation of further rate cuts by the Fed. Although 7% might seem high compared to the 2.65% low reached in early 2021, it's not historically unusual. Rates were often at 6% or 7% or even higher during the 1990s and early 2000s, and they reached double digits in the 1970s and 1980s. Nevertheless, this increase, coupled with a 50% rise in the median sales price of an existing home over the past five years, presents a significant challenge for home buyers accustomed to recent low rates. Experts generally agree that mortgage rates are unlikely to return to their previous lows. They anticipate a decline but predict a new normal range of 6% to 7% due to strong economic growth and stable inflation. The Fed's projections of only two further interest rate cuts this year suggest that bond yields will likely remain elevated, keeping mortgage rates higher. This spells bad news for home buyers seeking affordable financing.High mortgage rates add to the existing headwinds facing the housing market as it attempts to recover from a difficult year. Elevated mortgage rates, coupled with low inventory and a surge in home buying during the pandemic, have contributed to slow sales. Mortgage Bankers Association President and CEO Bob Broeksmit stated that the upward trend in mortgage rates is dampening homebuyer demand, with mortgage applications for home purchases down 2% from the previous year. Despite these challenges, Federal Reserve Chair Jerome Powell believes that the strong economy will allow home prices and the real estate market to withstand the higher rate environment. He also anticipates that a large segment of renters, particularly those in their mid-thirties and early forties, with the financial means to purchase, will enter the market, fueling latent demand.For prospective home buyers, navigating this challenging market requires careful planning and consideration. One crucial step is to shop around with various mortgage lenders to secure the best possible rate. Comparing offers from multiple lenders can significantly impact the monthly mortgage payment. Another strategy is to broaden the search area and explore different neighborhoods or locations within the metropolitan area to find more affordable options. By being proactive and exploring all available avenues, home buyers can increase their chances of finding a suitable property in this competitive market

Mortgage Rates Housing Market Federal Reserve Interest Rates Home Buying Affordability 10-Year Treasury Bonds Inflation

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mortgage Rates Reach Highest Level Since May 2024Mortgage rates edged up last week, reaching their highest point since May 2024. Despite the higher rates, mortgage demand has been stronger this year compared to last year. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 7.09% from 6.99%. Applications for a mortgage to purchase a home were down slightly compared to last year, while applications to refinance increased significantly.

Mortgage Rates Reach Highest Level Since May 2024Mortgage rates edged up last week, reaching their highest point since May 2024. Despite the higher rates, mortgage demand has been stronger this year compared to last year. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 7.09% from 6.99%. Applications for a mortgage to purchase a home were down slightly compared to last year, while applications to refinance increased significantly.

Read more »

Mortgage Rates Surge to Highest Level Since July 2024U.S. mortgage rates continue their upward climb, reaching 6.99% last week, the highest point since July 2024. This trend, coupled with rising debt service costs, discourages homebuyers and pushes application volumes down.

Mortgage Rates Surge to Highest Level Since July 2024U.S. mortgage rates continue their upward climb, reaching 6.99% last week, the highest point since July 2024. This trend, coupled with rising debt service costs, discourages homebuyers and pushes application volumes down.

Read more »

Fed's Third Rate Cut in 2024: Impact on Mortgage Interest RatesThe Federal Reserve cuts its benchmark interest rate for the third time this year, bringing it down to a range of 4.25% to 4.50%. While this move is intended to stimulate the economy, it's unclear how it will affect mortgage rates.

Fed's Third Rate Cut in 2024: Impact on Mortgage Interest RatesThe Federal Reserve cuts its benchmark interest rate for the third time this year, bringing it down to a range of 4.25% to 4.50%. While this move is intended to stimulate the economy, it's unclear how it will affect mortgage rates.

Read more »

Mortgage rates rise to close out 2024Rooted in fact-based, transparent reporting, Newsy is an award-winning opinion-free network owned by the E.W. Scripps Company that is relentlessly focused on “the why” of every story and seeks to enable a more intimate and immersive understanding of the issues that matter.

Mortgage rates rise to close out 2024Rooted in fact-based, transparent reporting, Newsy is an award-winning opinion-free network owned by the E.W. Scripps Company that is relentlessly focused on “the why” of every story and seeks to enable a more intimate and immersive understanding of the issues that matter.

Read more »

Mortgage Rates in 2024: A Year of NormalcyDespite the volatility in 2023, 2024 saw relatively stable mortgage rates. The average rate for the year was 6.72%, placing it within a typical historical range. The article analyzes the fluctuations throughout the year, highlighting the impact of Federal Reserve policy and investor sentiment on mortgage pricing.

Mortgage Rates in 2024: A Year of NormalcyDespite the volatility in 2023, 2024 saw relatively stable mortgage rates. The average rate for the year was 6.72%, placing it within a typical historical range. The article analyzes the fluctuations throughout the year, highlighting the impact of Federal Reserve policy and investor sentiment on mortgage pricing.

Read more »

Mortgage Rates Climb to Highest Point Since July 2024, Fueling Demand DropRising mortgage rates for the fourth week in a row have driven down mortgage applications to their lowest point since February 2024. Economic factors like persistent inflation and a strong job market are contributing to the high rates.

Mortgage Rates Climb to Highest Point Since July 2024, Fueling Demand DropRising mortgage rates for the fourth week in a row have driven down mortgage applications to their lowest point since February 2024. Economic factors like persistent inflation and a strong job market are contributing to the high rates.

Read more »