Report identifies Fed failures before bank collapse but also blames bad management, weakened regulations and lax supervision

staff and Michael Barr, the Fed’s vice-chair for supervision, takes a critical look at what the Fed missed as SVB grew quickly in size in the years leading up to its collapse. The report also points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

“While higher supervisory and regulatory requirements may not have prevented the firm’s failure, they would likely have bolstered the resilience of Silicon Valley Bank,” the report said. The nation’s banks are regulated by a troika of regulators: the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation. All have been criticized for potentially missing signs that Silicon Valley Bank and Signature Bank might be in trouble.

Silicon Valley Bank was the go-to bank for venture capital firms and technology startups for years, but failed spectacularly in March, setting off a crisis of confidence for the banking industry. Federal regulators seized Silicon Valley Bank on 10 March after customers withdrew tens of billions of dollars in deposits in a matter of hours.of New York.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Federal government refines aged care policyThe Federal Government has announced it will refine its aged care pledge to have a mandatory nurse in residential nursing homes at all times. The nursing sector is already facing widespread shortages, and the new reforms could force more homes to shut down. To address this issue, the University of Wollongong has been contracted for six months to develop alternative arrangements for when a nurse is unavailable.

Federal government refines aged care policyThe Federal Government has announced it will refine its aged care pledge to have a mandatory nurse in residential nursing homes at all times. The nursing sector is already facing widespread shortages, and the new reforms could force more homes to shut down. To address this issue, the University of Wollongong has been contracted for six months to develop alternative arrangements for when a nurse is unavailable.

Read more »

ASX to fall, US bank stocks drop, Microsoft surgesAustralian shares are set to open lower. First Republic Bank plunges again. Oil drops, gold slips. Bitcoin leaps towards $US30,000.

ASX to fall, US bank stocks drop, Microsoft surgesAustralian shares are set to open lower. First Republic Bank plunges again. Oil drops, gold slips. Bitcoin leaps towards $US30,000.

Read more »

ASX LIVE: Australian shares to fall, First Republic Bank plunges anewAlpha Live coverage happening now; Australian shares are poised to fall; Air NZ lifts profit forecast; Sandfire copper production falls in March quarter. Follow updates here.

ASX LIVE: Australian shares to fall, First Republic Bank plunges anewAlpha Live coverage happening now; Australian shares are poised to fall; Air NZ lifts profit forecast; Sandfire copper production falls in March quarter. Follow updates here.

Read more »

‘People can’t just get used to it’: Wolverhampton reacts to Bank of England commentsLocal authority with highest fuel poverty rate in England is angry at economist’s comment Britons ‘need to accept’ being worse off

‘People can’t just get used to it’: Wolverhampton reacts to Bank of England commentsLocal authority with highest fuel poverty rate in England is angry at economist’s comment Britons ‘need to accept’ being worse off

Read more »

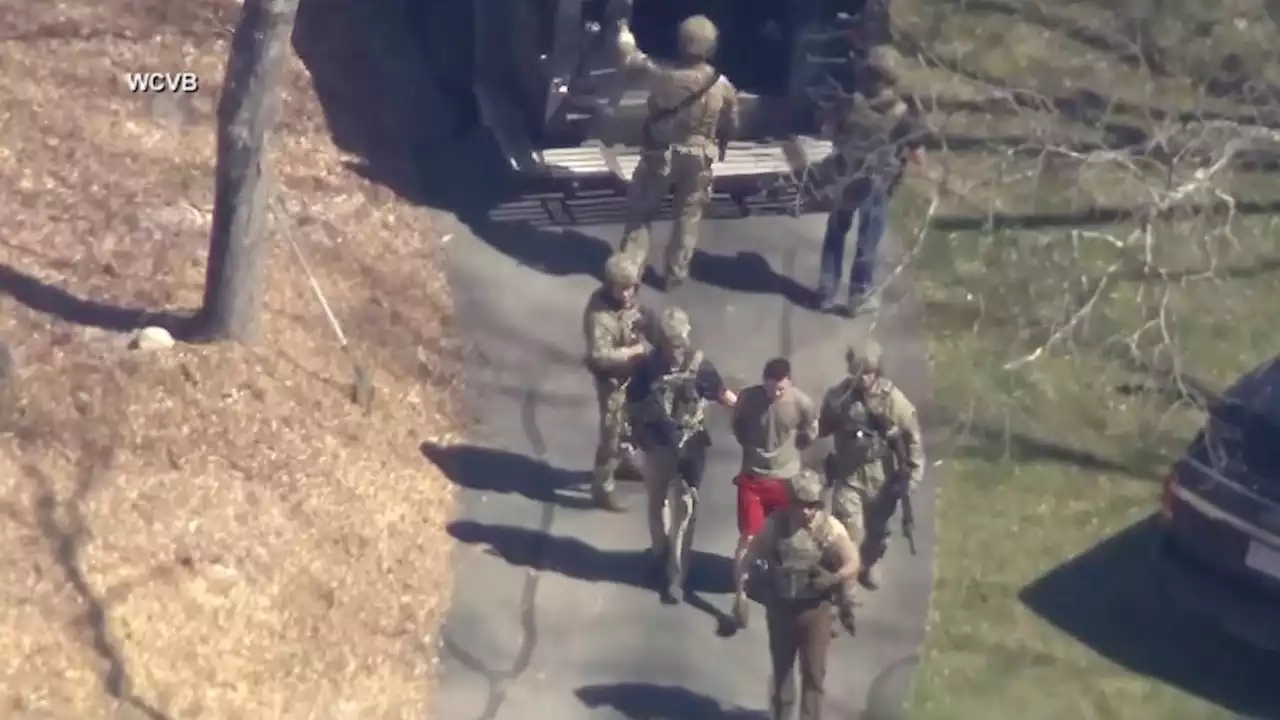

US federal prosecutors say leak suspect may still have access to national defence secretsUS Justice Department lawyers say releasing Massachusetts Air National Guardsman Jack Teixeira as he awaits trial would be a grave threat to America's national security.

US federal prosecutors say leak suspect may still have access to national defence secretsUS Justice Department lawyers say releasing Massachusetts Air National Guardsman Jack Teixeira as he awaits trial would be a grave threat to America's national security.

Read more »

Jarden co-founder Dane FitzGibbon exits bank amid staff exodusOne of the founding partners of Jarden’s Australian business, Dane FitzGibbon, is leaving the bank – the most senior departure to date.

Jarden co-founder Dane FitzGibbon exits bank amid staff exodusOne of the founding partners of Jarden’s Australian business, Dane FitzGibbon, is leaving the bank – the most senior departure to date.

Read more »