The S&P 500 climbed to a strong finish on Friday, driven by bullish investor sentiment ahead of Donald Trump's inauguration. While concerns remain regarding potential trade tariffs, Trump's positive phone call with Chinese President Xi Jinping on Friday eased anxieties. The market also awaits earnings reports from major tech, industrials, and consumer companies next week.

Investing.com-- The S&P 500 ended a strong week on a high Friday, as bullish bets on stocks continued just days ahead of President-elect Donald Trump inauguration on Monday, which marks the transfer of presidential power.Investors remain confident, but are now awaiting the inauguration of President-elect Donald Trump on Jan. 20, amid heightened speculation over his plans to impose trade tariffs on major economies, particularly China.

That said, Trump said earlier Friday, in a Truth Social post, that he had spoken on the phone with Chinese President Xi Jinping on Friday, calling the call"a very good one for both China and the USA.”

STOCK MARKET TRUMP CHINA TRADE WAR EARNINGS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

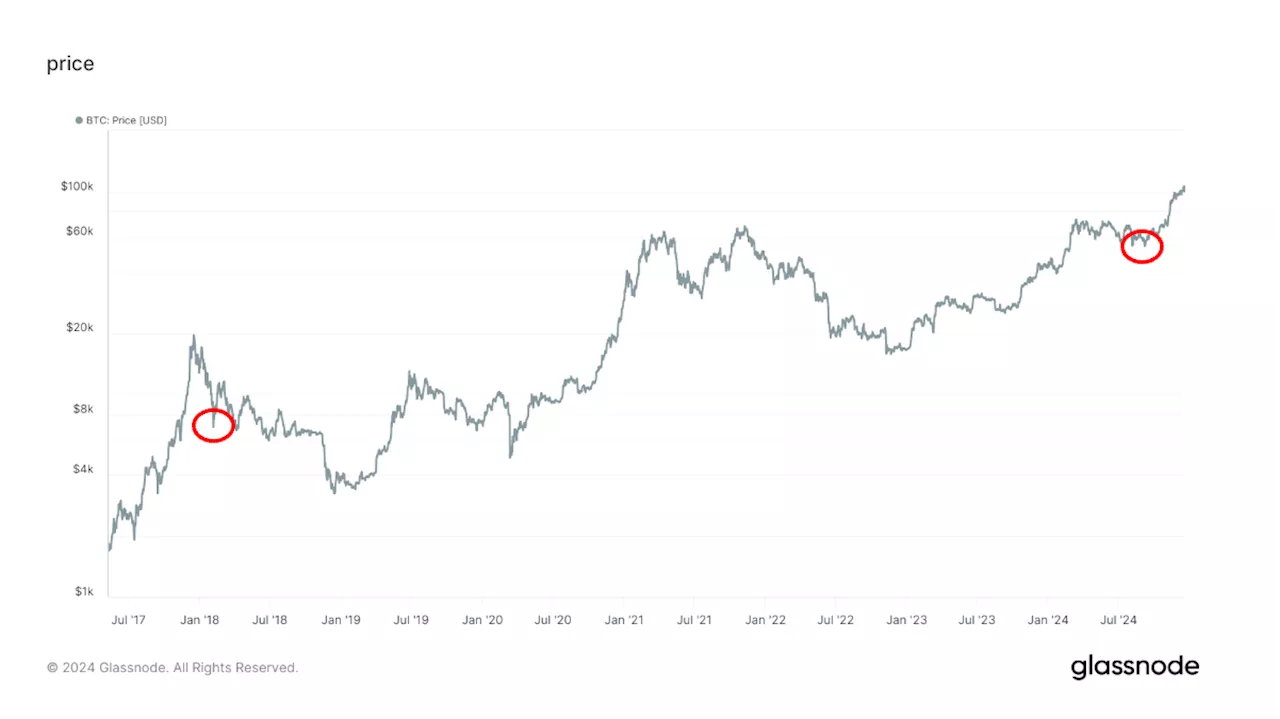

Bitcoin's Bullish Bias vs. S&P 500's Defensive Positioning Ahead of Trump's InaugurationCrypto Daybook Americas reveals a significant divergence between Bitcoin and the S&P 500. While Bitcoin aims to stay above $100,000 with bullish options activity, the S&P 500 shows greater downside risk due to concerns surrounding President-elect Donald Trump's inauguration. This raises questions about Bitcoin's reaction to a potential market sell-off on January 20th.

Bitcoin's Bullish Bias vs. S&P 500's Defensive Positioning Ahead of Trump's InaugurationCrypto Daybook Americas reveals a significant divergence between Bitcoin and the S&P 500. While Bitcoin aims to stay above $100,000 with bullish options activity, the S&P 500 shows greater downside risk due to concerns surrounding President-elect Donald Trump's inauguration. This raises questions about Bitcoin's reaction to a potential market sell-off on January 20th.

Read more »

Wall Street Rallies to Gain Back Some of Week's Terrible LossesThe S&P 500 climbed 1.1 percent while the Dow Jones increased almost 500 points and the Nasdaq rose 1 percent on Friday.

Wall Street Rallies to Gain Back Some of Week's Terrible LossesThe S&P 500 climbed 1.1 percent while the Dow Jones increased almost 500 points and the Nasdaq rose 1 percent on Friday.

Read more »

Man Accused of Selling Fake Indianapolis 500 TicketsA central Indiana man, Fred Bear Jr., is facing multiple felony charges for allegedly selling counterfeit Indianapolis 500 season passes, parking passes, Snake Pit Wristbands, and Carb Day Passes. The scheme is believed to have cost the Indianapolis Motor Speedway over $150,000 in refunds and caused inconvenience for legitimate ticket holders.

Man Accused of Selling Fake Indianapolis 500 TicketsA central Indiana man, Fred Bear Jr., is facing multiple felony charges for allegedly selling counterfeit Indianapolis 500 season passes, parking passes, Snake Pit Wristbands, and Carb Day Passes. The scheme is believed to have cost the Indianapolis Motor Speedway over $150,000 in refunds and caused inconvenience for legitimate ticket holders.

Read more »

500 Drones to Replace Fireworks in New York City's New Year's Eve CelebrationsFor New Year's Eve 2025, the New York Road Runners Club is replacing its traditional fireworks display with a spectacular drone show featuring 500 drones. This decision is in response to the recent drought in New York City, and the drone show will be visible to participants of the club's midnight run.

500 Drones to Replace Fireworks in New York City's New Year's Eve CelebrationsFor New Year's Eve 2025, the New York Road Runners Club is replacing its traditional fireworks display with a spectacular drone show featuring 500 drones. This decision is in response to the recent drought in New York City, and the drone show will be visible to participants of the club's midnight run.

Read more »

Market Volatility Spurs Bitcoin Dip and S&P 500 DeclineA 74% surge in the CBOE Volatility Index (VIX) triggered a market selloff, pushing Bitcoin below $100,000 and sending U.S. equities down 3%. Historical data suggests this spike in market fear could be followed by a rebound in both Bitcoin and the S&P 500.

Market Volatility Spurs Bitcoin Dip and S&P 500 DeclineA 74% surge in the CBOE Volatility Index (VIX) triggered a market selloff, pushing Bitcoin below $100,000 and sending U.S. equities down 3%. Historical data suggests this spike in market fear could be followed by a rebound in both Bitcoin and the S&P 500.

Read more »

Jim Cramer Buys CrowdStrike and Home Depot on S&P 500 Oversold SignalJim Cramer's Charitable Trust is buying more CrowdStrike and Home Depot, citing the S&P 500's oversold conditions as an opportunity. Cramer believes the market's recent pullback presents a buying opportunity, similar to the situation in October 2023.

Jim Cramer Buys CrowdStrike and Home Depot on S&P 500 Oversold SignalJim Cramer's Charitable Trust is buying more CrowdStrike and Home Depot, citing the S&P 500's oversold conditions as an opportunity. Cramer believes the market's recent pullback presents a buying opportunity, similar to the situation in October 2023.

Read more »