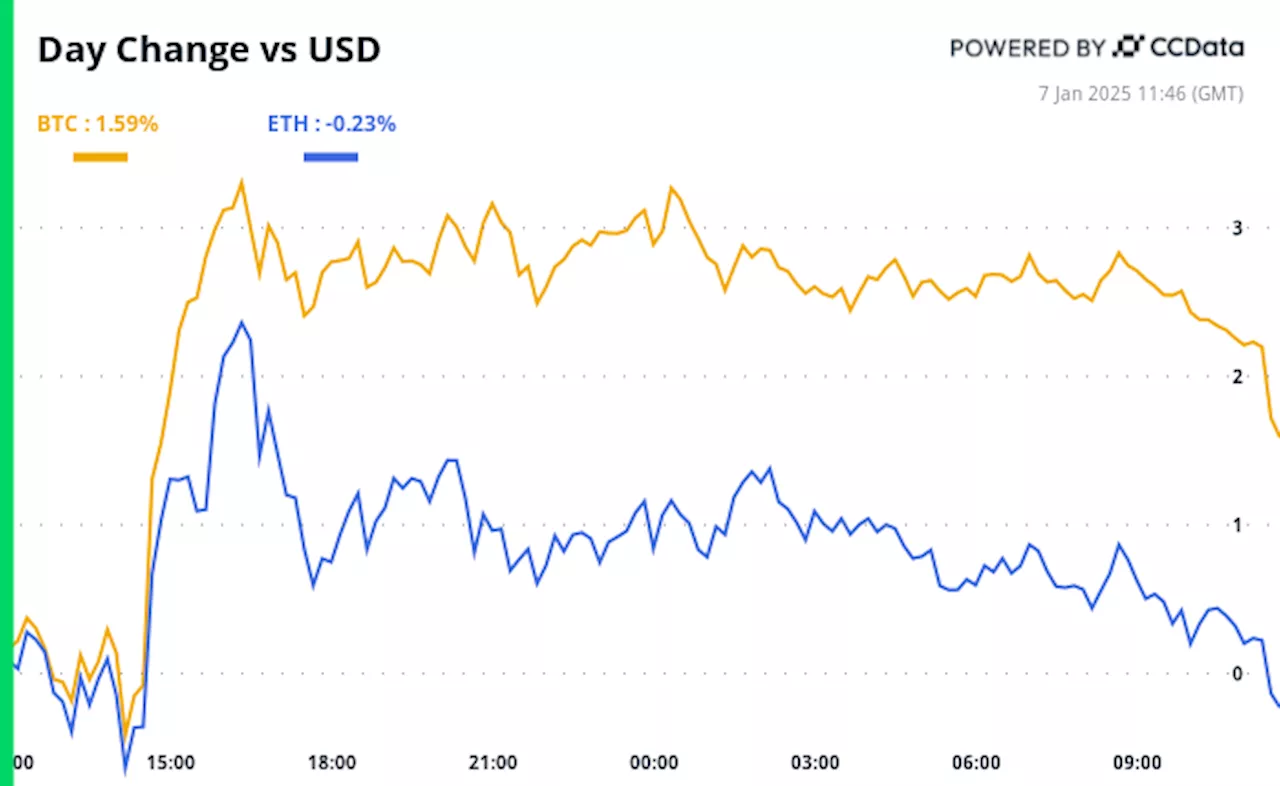

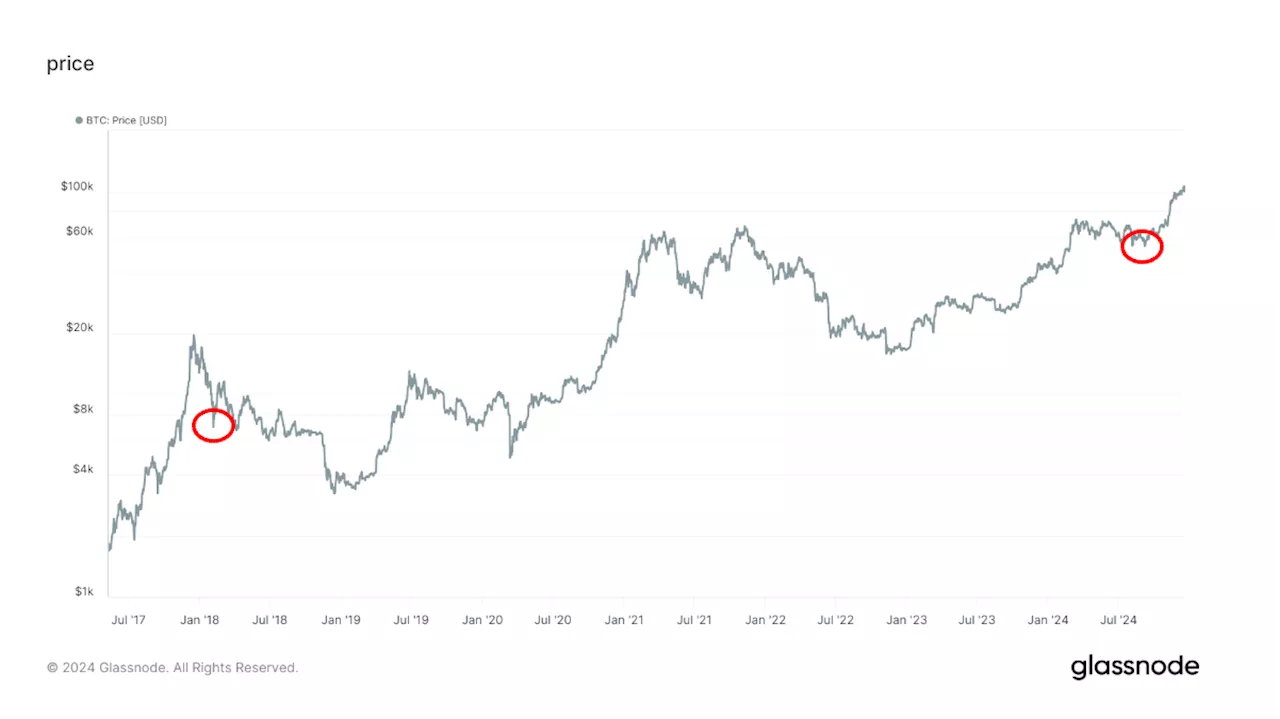

Crypto Daybook Americas reveals a significant divergence between Bitcoin and the S&P 500. While Bitcoin aims to stay above $100,000 with bullish options activity, the S&P 500 shows greater downside risk due to concerns surrounding President-elect Donald Trump's inauguration. This raises questions about Bitcoin's reaction to a potential market sell-off on January 20th.

You are viewing Crypto Daybook Americas, your new morning briefing on what happened in the crypto markets overnight and what's expected during the coming day. In the coming weeks, this daily update will replace the First Mover Americas newsletter, and arrive in your inbox at 7 a.m. ET to kickstart your morning with comprehensive insights.

"Broadly speaking, we see some cracks in the data and think that Trump’s inauguration later this month has a decent chance of being a ‘sell the news’ event after nearly three months of unbridled economic optimism across most sectors," Bruce J Clark, head of rates America at Informa Connect, said on LinkedIn.

"The Net Unrealized Profit and Loss for miners remains very positive, hovering around 0.5, suggesting that miners are still in a strong position, with substantial unrealized profits and a preference to hold onto their BTC at this stage," analysts at Bitfinex told CoinDesk. Jan. 12, 10:30 p.m.: Binance will halt Fantom token deposits and withdrawals and delist all FTM trading pairs. FTM tokens will be swapped for S tokens at a 1:1 ratio.

Bitcoin S&P 500 Cryptocurrency Donald Trump Inauguration

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

S&P 500: Do Economic Indicators Support Bullish 2025 Outlooks?Stocks Analysis by Lance Roberts covering: S&P 500, iShares Core U.S. Aggregate Bond ETF, Bitcoin US Dollar. Read Lance Roberts's latest article on Investing.com

S&P 500: Do Economic Indicators Support Bullish 2025 Outlooks?Stocks Analysis by Lance Roberts covering: S&P 500, iShares Core U.S. Aggregate Bond ETF, Bitcoin US Dollar. Read Lance Roberts's latest article on Investing.com

Read more »

S&P 500: Bullish Bias Remains But Key Fibonacci Levels Could Trigger Profit-TakingStocks Analysis by Fawad Razaqzada covering: S&P 500, Dow Jones Industrial Average, S&P 500 Futures, NASDAQ Composite. Read Fawad Razaqzada's latest article on Investing.com

S&P 500: Bullish Bias Remains But Key Fibonacci Levels Could Trigger Profit-TakingStocks Analysis by Fawad Razaqzada covering: S&P 500, Dow Jones Industrial Average, S&P 500 Futures, NASDAQ Composite. Read Fawad Razaqzada's latest article on Investing.com

Read more »

S&P 500: Wall Street’s Forecasts for 2025 May Be Too Bullish to Be TrueMarket Overview Analysis by Lance Roberts covering: S&P 500. Read Lance Roberts's latest article on Investing.com

S&P 500: Wall Street’s Forecasts for 2025 May Be Too Bullish to Be TrueMarket Overview Analysis by Lance Roberts covering: S&P 500. Read Lance Roberts's latest article on Investing.com

Read more »

ProShares Files for Three New Bitcoin-Linked ETFsProShares, an American ETP issuer, files for three new Bitcoin-linked ETFs, including the S&P 500 Bitcoin ETF, Nasdaq-100 Bitcoin ETF, and Gold Bitcoin ETF.

ProShares Files for Three New Bitcoin-Linked ETFsProShares, an American ETP issuer, files for three new Bitcoin-linked ETFs, including the S&P 500 Bitcoin ETF, Nasdaq-100 Bitcoin ETF, and Gold Bitcoin ETF.

Read more »

Market Volatility Spurs Bitcoin Dip and S&P 500 DeclineA 74% surge in the CBOE Volatility Index (VIX) triggered a market selloff, pushing Bitcoin below $100,000 and sending U.S. equities down 3%. Historical data suggests this spike in market fear could be followed by a rebound in both Bitcoin and the S&P 500.

Market Volatility Spurs Bitcoin Dip and S&P 500 DeclineA 74% surge in the CBOE Volatility Index (VIX) triggered a market selloff, pushing Bitcoin below $100,000 and sending U.S. equities down 3%. Historical data suggests this spike in market fear could be followed by a rebound in both Bitcoin and the S&P 500.

Read more »

Global Markets Wrap: Bitcoin Soars, Alibaba Cuts AI Prices, and S&P 500 StumblesCNBC Daily Open summarizes today's top market movers. Bitcoin hits $100,000, Alibaba slashes AI prices, and the S&P 500 finishes the year with lackluster growth.

Global Markets Wrap: Bitcoin Soars, Alibaba Cuts AI Prices, and S&P 500 StumblesCNBC Daily Open summarizes today's top market movers. Bitcoin hits $100,000, Alibaba slashes AI prices, and the S&P 500 finishes the year with lackluster growth.

Read more »