The most closely watched recession indicator is telling markets that a downturn won't materialize for another 2 years, Credit Suisse chief stock strategist says

But though a recession could be delayed, more pain is still coming for the economy, Golub said, predicting that the US will grapple with"stagflation lite" in the interim. —a dreaded combo of high inflation and low growth—has typically led to prices and unemployment rising into the double-digits, Golub said. He predicted inflation would hover around 3.5-4% over the next few years, while unemployment hovered around 3%-4%. Economic growth would also likely stay low at around 1%.

"It's kind of like an uninspiring economy. Annoying inflation, but nothing dramatic. Weak economic growth, but nothing that looks like a recession. Not really great for stocks," he said. Other market commentators have forecasted lackluster or dismal returns in stocks this year. On the more bearish end, Morgan Stanley's chief stock strategist warned of a

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Credit Suisse obtains key approval to launch wealth business in ChinaCredit Suisse has received regulatory green light from China after years of waiting to launch a full-fledged wealth management business in the world's second-biggest economy, according to a company memo reviewed by Reuters.

Credit Suisse obtains key approval to launch wealth business in ChinaCredit Suisse has received regulatory green light from China after years of waiting to launch a full-fledged wealth management business in the world's second-biggest economy, according to a company memo reviewed by Reuters.

Read more »

Credit Suisse equities business under the microscope after revenue crashAt the grandiose Fontainebleau Miami Beach hotel, Credit Suisse hosted its top clients in October amid growing doubts it was still in the securities trading game after a series of high-profile blunders.

Credit Suisse equities business under the microscope after revenue crashAt the grandiose Fontainebleau Miami Beach hotel, Credit Suisse hosted its top clients in October amid growing doubts it was still in the securities trading game after a series of high-profile blunders.

Read more »

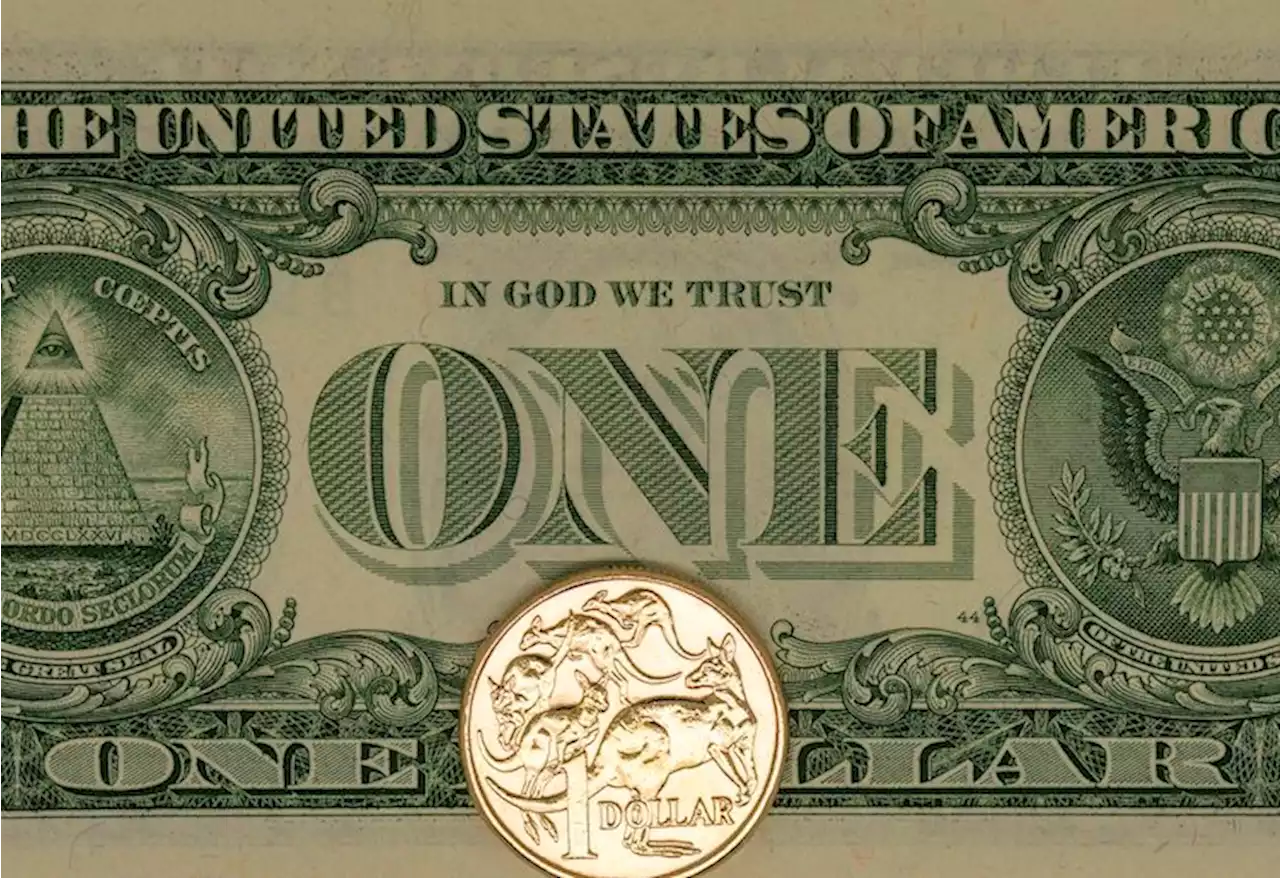

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

Read more »

Any signs of BoC complacency can drive USD/CAD to Oct highs near 1.4000 – Credit SuisseAs for today’s BoC decision, economists at Credit Suisse think markets can react to any signs of complacency in forward guidance by pushing USD/CAD to

Any signs of BoC complacency can drive USD/CAD to Oct highs near 1.4000 – Credit SuisseAs for today’s BoC decision, economists at Credit Suisse think markets can react to any signs of complacency in forward guidance by pushing USD/CAD to

Read more »

EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit SuisseEUR/USD stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse

EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit SuisseEUR/USD stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse

Read more »

USD Index: Rally to extend further toward key inflection point at 106.15/62 – Credit SuisseThe US Dollar Index (DXY) remains well supported and above the 55-Day Moving Average (DMA) at 103.47. Analysts at Credit Suisse look for DXY rally to

USD Index: Rally to extend further toward key inflection point at 106.15/62 – Credit SuisseThe US Dollar Index (DXY) remains well supported and above the 55-Day Moving Average (DMA) at 103.47. Analysts at Credit Suisse look for DXY rally to

Read more »