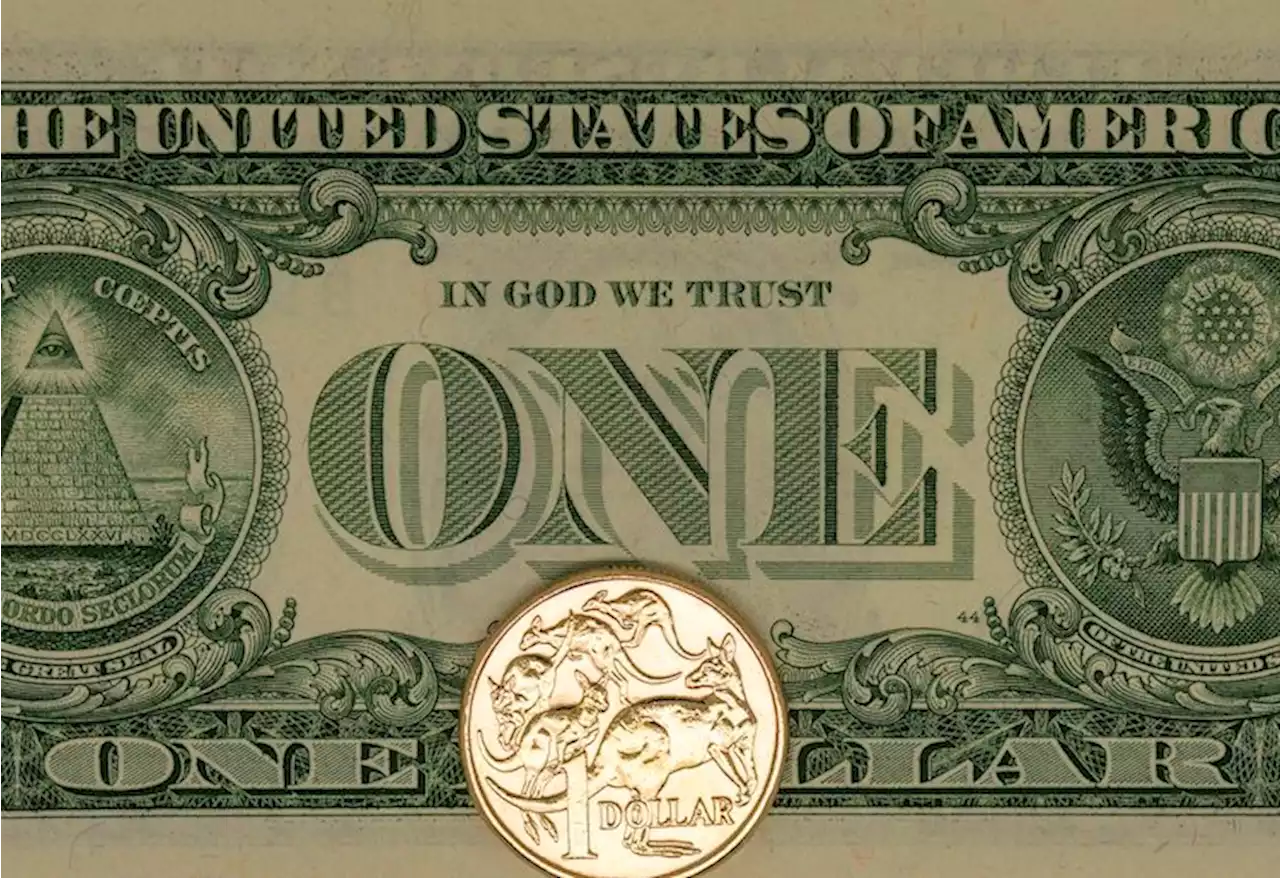

USD Index: Rally to extend further toward key inflection point at 106.15/62 – Credit Suisse DollarIndex Banks

remains well supported and above the 55-Day Moving Average at 103.47. Analysts at Credit Suisse look for DXY rally to extend further to its 200-DMA and 38.2% retracement of its fall from October.“We continue to look for a deeper recovery to 105.63 and then the 38.2% retracement of the 2022/2023 fall and 200-DMA at 106.15/62. Our bias for now remains to look for this to cap to define the top of a broader range.

“Below the 55-DMA at 103.47 would suggest the recovery may already be coming to an end but with a break below 102.59 seen needed to clear the way for a retest of the 100.82 YTD low.”Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

Read more »

Any signs of BoC complacency can drive USD/CAD to Oct highs near 1.4000 – Credit SuisseAs for today’s BoC decision, economists at Credit Suisse think markets can react to any signs of complacency in forward guidance by pushing USD/CAD to

Any signs of BoC complacency can drive USD/CAD to Oct highs near 1.4000 – Credit SuisseAs for today’s BoC decision, economists at Credit Suisse think markets can react to any signs of complacency in forward guidance by pushing USD/CAD to

Read more »

EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit SuisseEUR/USD stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse

EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit SuisseEUR/USD stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse

Read more »

USD Index appears cautious around 104.30 ahead of PowellThe USD Index (DXY), which gauges the greenback vs. a basket of its main rivals, exchanges gains with losses around 104.30 ahead of the opening bell i

USD Index appears cautious around 104.30 ahead of PowellThe USD Index (DXY), which gauges the greenback vs. a basket of its main rivals, exchanges gains with losses around 104.30 ahead of the opening bell i

Read more »

USD Index to extend its slump below 105 on cautious Fed Chair Powell – MUFGToday’s semi-annual testimony from Fed Chair Powell will be important in determining whether the US Dollar can regain upward momentum in the week ahea

USD Index to extend its slump below 105 on cautious Fed Chair Powell – MUFGToday’s semi-annual testimony from Fed Chair Powell will be important in determining whether the US Dollar can regain upward momentum in the week ahea

Read more »

USD Index Price Analysis: Support remains around 104.00DXY regains some composure and prints decent gains near 104.70 on Tuesday. So far, the continuation of the range bound theme seems the most likely sce

USD Index Price Analysis: Support remains around 104.00DXY regains some composure and prints decent gains near 104.70 on Tuesday. So far, the continuation of the range bound theme seems the most likely sce

Read more »