PacWest Bancorp.'s stock could rebound as fears around regional banks ease, according to Piper Sandler.

PacWest Bancorp has withstood large withdrawals in deposits, and the regional bank stock is now set up for a rebound, according to Piper Sander. Analyst Matthew Clark reiterated his overweight rating on the stock in a Wednesday evening note, saying the company appeared to be on solid footing despite recent deposit outflows.

mountain PacWest's stock has dropped sharply since the failure of SVB. The company also said Wednesday that deposits have stabilized and that it had decided against a capital raise. Piper Sandler has a price target of $33 per share for PacWest, which is more than 200% above where the stock closed on Wednesday. To be sure, there will be some earnings impact from the deposit outflows, Clark wrote. The stock was trading above $40 per share a year ago.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

PacWest decides not to raise additional capital after getting private backer and federal loansPacWest Bancorp stock fell 13% in premarket trade Wednesday after it said it continues to have “solid liquidity” after borrowing from the federal government...

PacWest decides not to raise additional capital after getting private backer and federal loansPacWest Bancorp stock fell 13% in premarket trade Wednesday after it said it continues to have “solid liquidity” after borrowing from the federal government...

Read more »

PacWest falls 10% after regional bank discloses deposit outflows, additional liquidityThe bank said Wednesday that it now has $27.1 billion in deposits, which is down from $33.9 billion at the end of December.

PacWest falls 10% after regional bank discloses deposit outflows, additional liquidityThe bank said Wednesday that it now has $27.1 billion in deposits, which is down from $33.9 billion at the end of December.

Read more »

PacWest shares sink despite liquidity liftShares are down for PacWest after subsidiary Pacific Western Bank said deposits are stable after receiving 1.4 billion from investment firm Atlas SP Partners.

PacWest shares sink despite liquidity liftShares are down for PacWest after subsidiary Pacific Western Bank said deposits are stable after receiving 1.4 billion from investment firm Atlas SP Partners.

Read more »

PacWest slides as the California-based bank logs 20% drop in depositsPacWest sinks 11% as the California bank borrows cash following a 20% drop in deposits

Read more »

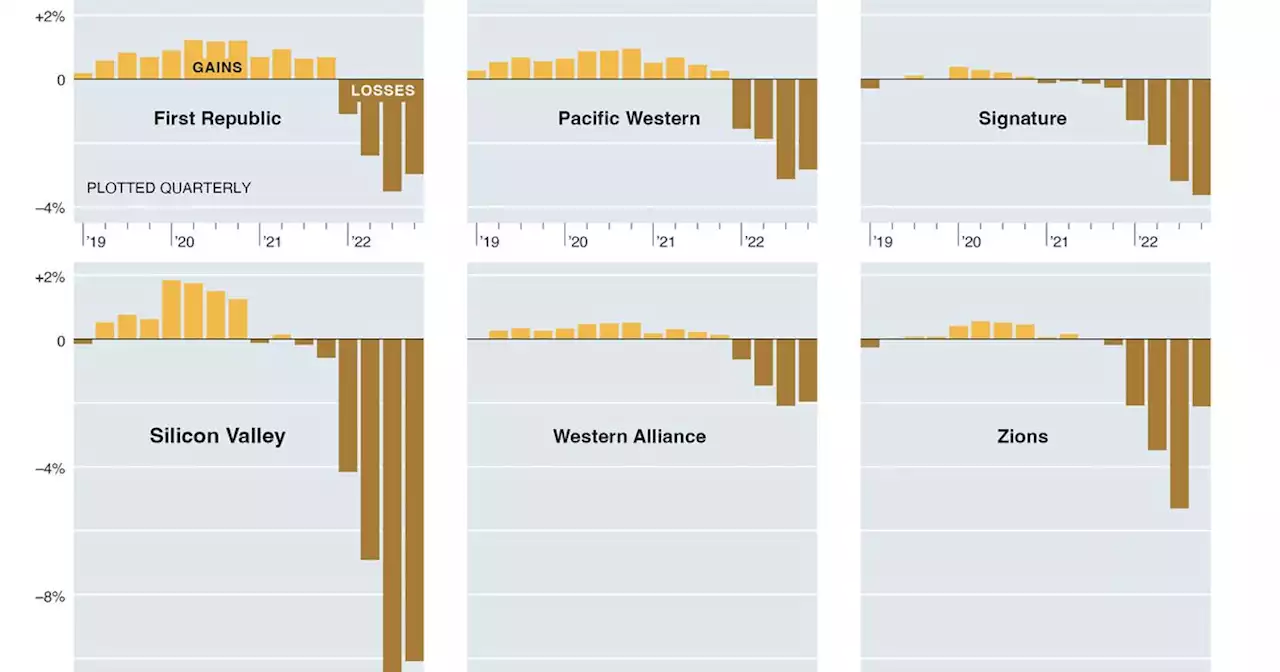

From SVB to Signature to Zions, why people are worried about banksFifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

From SVB to Signature to Zions, why people are worried about banksFifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

Read more »

SVB's implosion leads founders to reevaluate VC relationshipsThe SVB fallout has been a wake up call for startup founders. Many are rethinking their VC relationships: 'There's certain people I wouldn't want to take money from now.'

Read more »