Fifteen years ago, the world careened into a devastating financial crisis, precipitated by the collapse of the American housing market. Today, a different culprit is stressing the financial system: rapidly rising interest rates.

The sudden collapses of Silicon Valley Bank and Signature Bank — the biggest bank failures since the Great Recession — have put the precariousness of lenders in stark relief. First Republic Bank was forced to seek a lifeline this past week, receiving tens of billions of dollars from other banks. And fears about the stability of the banking system hit Credit Suisse, the battered European giant.

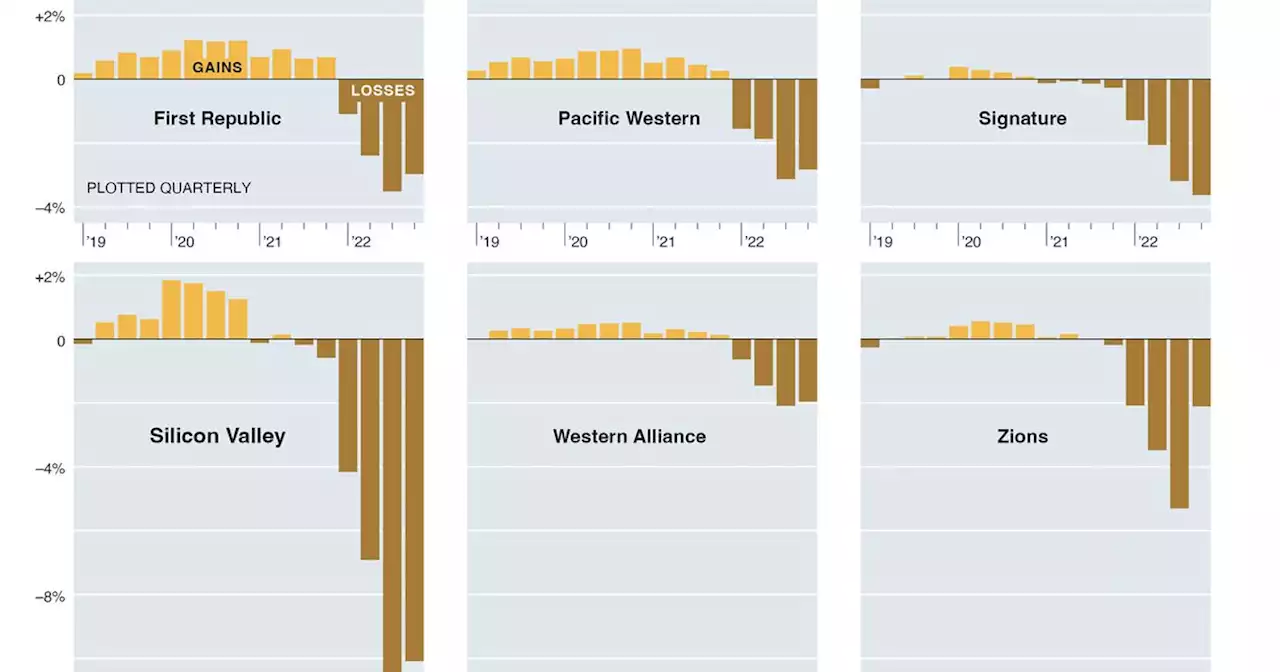

Those losses set off alarms with investors and some of the bank’s customers. If the rest of SVB’s balance sheet was riddled with similar money-losing assets, would the bank be able to come up with enough money to repay its depositors? Those losses had the potential to chew through more than one-third of banks’ so-called capital buffers, which are meant to protect depositors from losses, according to Fitch Ratings. The thinner a bank’s capital buffers, the greater its customers’ risk of losing money and the more likely investors and customers are to flee.

The Federal Reserve and other regulators are rushing to reassure everyone. Last weekend, the Fed announced a program that offers loans of up to one year to banks using the banks’ government bonds and certain other assets as collateral. But banks gobbled up a whopping $153 billion in loans through the Fed’s traditional lending program. That was up from less than $5 billion a week earlier and was the largest amount borrowed in a week since the 2008 financial crisis.On Wednesday, Swiss authorities had to vow to protect the giant bank Credit Suisse as concerns about its stability swirled. The next day, the U.S.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Credit Suisse, SVB, Signature Bank: What you need to knowUBS Group AG is in emergency talks to buy fellow Swiss banking giant Credit Suisse as authorities try to stave off turmoil when global markets reopen on Monday, with reports saying UBS has offered to pay more than $2 billion.

Credit Suisse, SVB, Signature Bank: What you need to knowUBS Group AG is in emergency talks to buy fellow Swiss banking giant Credit Suisse as authorities try to stave off turmoil when global markets reopen on Monday, with reports saying UBS has offered to pay more than $2 billion.

Read more »

Elizabeth Warren calls for investigation into downfall of SVB, Signature BankSen. Elizabeth Warren is calling for an investigation of what led to the collapse of Silicon Valley Bank and Signature bank this month, demanding answers from the FDIC.

Elizabeth Warren calls for investigation into downfall of SVB, Signature BankSen. Elizabeth Warren is calling for an investigation of what led to the collapse of Silicon Valley Bank and Signature bank this month, demanding answers from the FDIC.

Read more »

SLR Investment stock rises 2% after company sees no impact from SVB, Signature Bank debacleSLR Investment Corp. late Monday said that, following a “thorough review,” the failures of Silicon Valley Bank and Signature Bank won’t impact the company’s...

SLR Investment stock rises 2% after company sees no impact from SVB, Signature Bank debacleSLR Investment Corp. late Monday said that, following a “thorough review,” the failures of Silicon Valley Bank and Signature Bank won’t impact the company’s...

Read more »

Report: Nearly Half of 'Climate Change' Companies in U.S. Banked with Failed SVBHalf of the companies in the U.S. devoted to climate change and biotech banked with the now-failed Silicon Valley Bank (SVB).

Report: Nearly Half of 'Climate Change' Companies in U.S. Banked with Failed SVBHalf of the companies in the U.S. devoted to climate change and biotech banked with the now-failed Silicon Valley Bank (SVB).

Read more »

LPs are divided on how VCs responded to the SVB crisisInvestors in venture funds reveal how they felt VCs handled the Silicon Valley Bank fallout: one was privately frustrated, while another was impressed

Read more »

What's Next for Crypto After SVB, Silvergate Concerns?Lyn Alden, founder of Lyn Alden Investment Strategy, joins 'All About Bitcoin' to discuss the future of the U.S. Federal Reserve, with a focus on its assets and liabilities. Plus, insights on the central bank's upcoming interest rate decision.

What's Next for Crypto After SVB, Silvergate Concerns?Lyn Alden, founder of Lyn Alden Investment Strategy, joins 'All About Bitcoin' to discuss the future of the U.S. Federal Reserve, with a focus on its assets and liabilities. Plus, insights on the central bank's upcoming interest rate decision.

Read more »