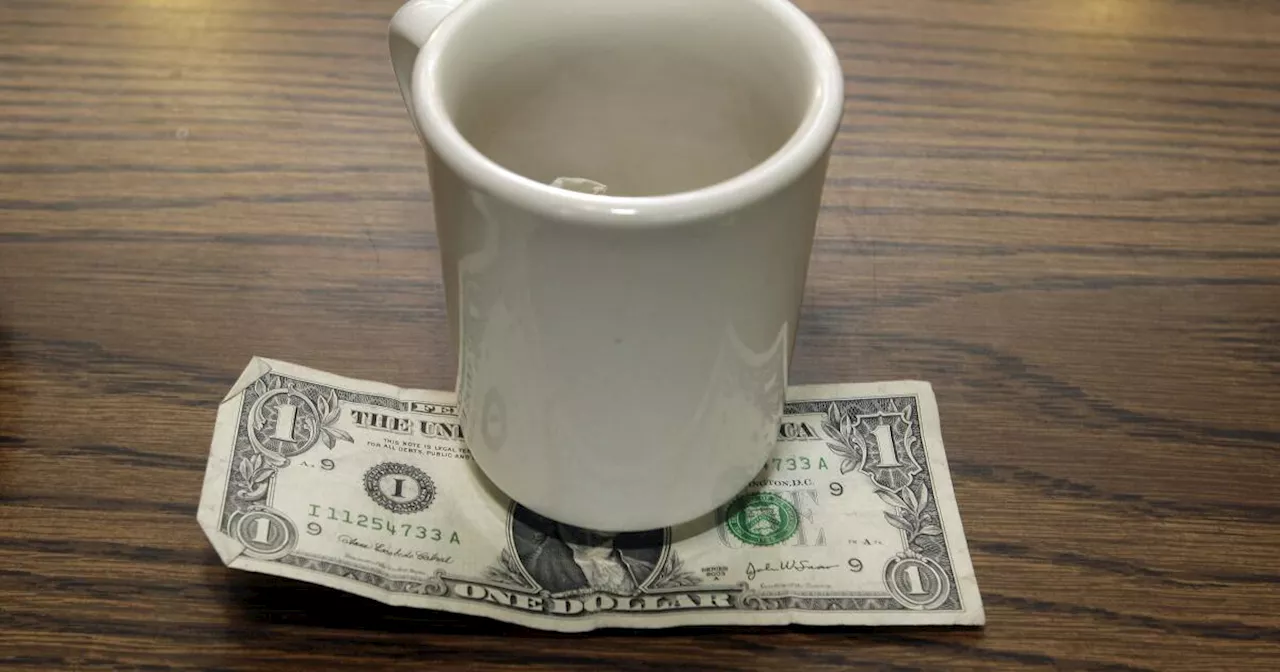

A promise to eliminate taxes on tips, championed by Donald Trump and supported by Kamala Harris, aims to alleviate financial strain on tipped workers. However, the practicality and impact of such a policy remain unclear. While lauded by some, critics argue it would benefit a limited group and raise concerns about Social Security and Medicare.

Cindy Kramer, 38, works well over 60 hours a week juggling four different jobs in Staten Island, New York, to support her child and make ends meet. Two of those jobs are bartending. Like many in the service industry, Kramer is in favor of President-elect Donald Trump ’s campaign promise to eliminate tax on tips, one that Vice President Kamala Harris also endorsed with certain guardrails and which has already seen movement in Congress.

The proposal could also be relatively inexpensive compared to Trump’s broader tax plans. While extending the 2017 tax cuts would be about $4 trillion, in comparison, the Budget Lab at Yale University estimates no tax on tips could cost anywhere from $60 billion to $200 billion over 10 years. Thorny issues While not every tipped worker meets the threshold for owing income taxes, every worker in America pays payroll tax on their first dollar of income.

Economics Tipped Workers Tax Policy Donald Trump Social Security Minimum Wage

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Washington State Democrats Leak Tax Plan With Proposed Firearms Tax and Property Tax IncreasesWashington state Democrats accidentally emailed their sweeping revenue plans, including proposals for an 11% tax on firearms and ammunition, reclassifying storage unit rentals as retail transactions, and lifting property tax levy lids for some residents, to all members of the state Senate. The leak included a PowerPoint presentation with talking points advising lawmakers on how to communicate the tax plan to constituents.

Washington State Democrats Leak Tax Plan With Proposed Firearms Tax and Property Tax IncreasesWashington state Democrats accidentally emailed their sweeping revenue plans, including proposals for an 11% tax on firearms and ammunition, reclassifying storage unit rentals as retail transactions, and lifting property tax levy lids for some residents, to all members of the state Senate. The leak included a PowerPoint presentation with talking points advising lawmakers on how to communicate the tax plan to constituents.

Read more »

Navarro Claims Trump Policies Won't Boost Inflation or DeficitsPeter Navarro, a top trade advisor to President-elect Donald Trump, asserts that Trump's proposed tariffs and tax cuts will not lead to increased inflation or federal deficits. Navarro attributes the inflation during the Biden administration to 'fiscal irresponsibility.' He points to Trump's previous tariffs on China, steel, aluminum, and other products as evidence that these policies do not contribute to inflation. Navarro also notes Trump's plan for further tax cuts, including reductions in the corporate tax rate, elimination of taxes on tips and Social Security benefits, and extension of existing tax cuts.

Navarro Claims Trump Policies Won't Boost Inflation or DeficitsPeter Navarro, a top trade advisor to President-elect Donald Trump, asserts that Trump's proposed tariffs and tax cuts will not lead to increased inflation or federal deficits. Navarro attributes the inflation during the Biden administration to 'fiscal irresponsibility.' He points to Trump's previous tariffs on China, steel, aluminum, and other products as evidence that these policies do not contribute to inflation. Navarro also notes Trump's plan for further tax cuts, including reductions in the corporate tax rate, elimination of taxes on tips and Social Security benefits, and extension of existing tax cuts.

Read more »

Hospice parents campaign against NI tax rise that threatens careJulia's House warns that the planned National Insurance tax rise could jeopardise the hospice's future.

Hospice parents campaign against NI tax rise that threatens careJulia's House warns that the planned National Insurance tax rise could jeopardise the hospice's future.

Read more »

No Tax on Tips: A Promise with Unclear BenefitsA proposed bill to eliminate federal taxes on tipped income has generated both excitement and skepticism. While service workers like Chris Lopez initially welcomed the idea, concerns have emerged about its potential impact on the federal budget and the long-term benefits for individuals.

No Tax on Tips: A Promise with Unclear BenefitsA proposed bill to eliminate federal taxes on tipped income has generated both excitement and skepticism. While service workers like Chris Lopez initially welcomed the idea, concerns have emerged about its potential impact on the federal budget and the long-term benefits for individuals.

Read more »

Maximize Your 2024 Tax Savings: 8 Expert TipsThis article provides eight expert-recommended tips to help you minimize your 2024 tax burden. It covers maximizing retirement contributions, leveraging HSAs, and other strategies for saving money.

Maximize Your 2024 Tax Savings: 8 Expert TipsThis article provides eight expert-recommended tips to help you minimize your 2024 tax burden. It covers maximizing retirement contributions, leveraging HSAs, and other strategies for saving money.

Read more »

Tax Tips to Make the New Year EasierGet ahead of your taxes by taking advantage of these strategies before the year ends.

Tax Tips to Make the New Year EasierGet ahead of your taxes by taking advantage of these strategies before the year ends.

Read more »