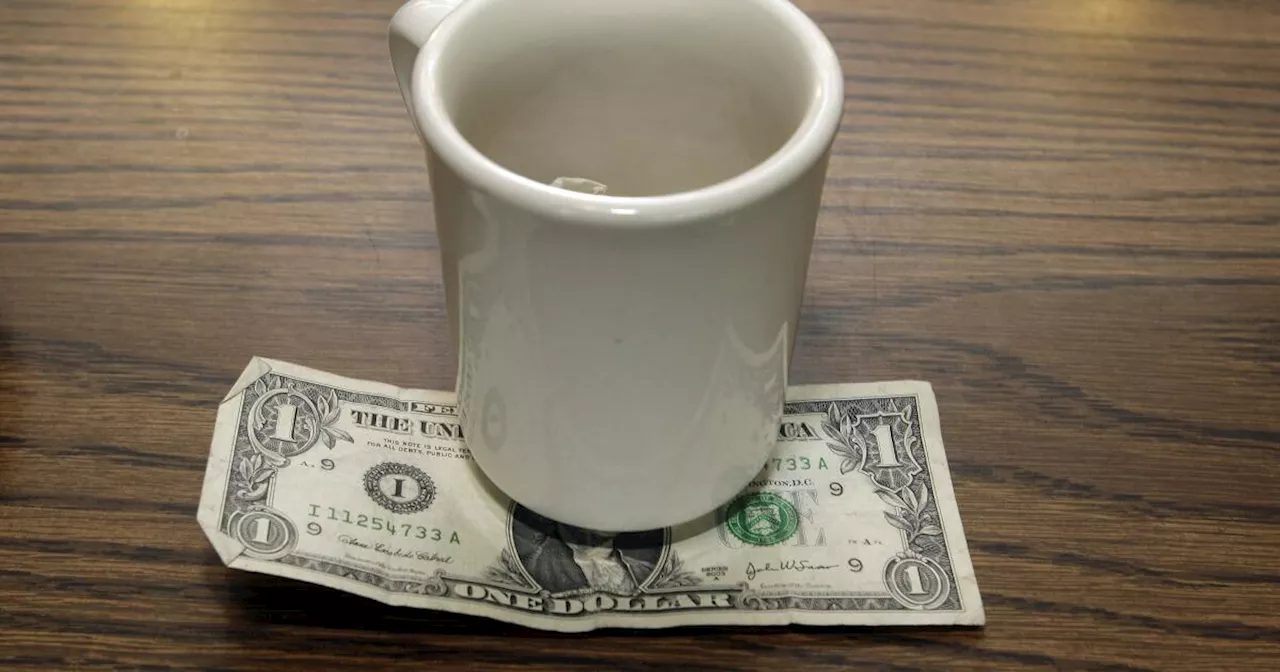

A proposed bill to eliminate federal taxes on tipped income has generated both excitement and skepticism. While service workers like Chris Lopez initially welcomed the idea, concerns have emerged about its potential impact on the federal budget and the long-term benefits for individuals.

On a good night, Chris Lopez, a bartender and server in Southern California for eight years, can make $200 to $400 in tips. So when the 31-year-old, who lives in Orange, first heard the news about President-elect Donald Trump’s campaign promise of “no tax on tips,” he got excited. “That’s a great idea,” he thought to himself. But when he found out more about the proposal, he wondered if he would benefit at all.

In June, Trump told rally goers in Las Vegas — a city with the highest proportion of restaurant, hotel and casino workers in the country — that, if elected, he would eliminate federal taxes on tipped income. Initially, the news was met with excitement by Lopez and several in the service industry where tips can make a good portion of take-home pay. Democratic opponent Vice President Kamala Harris followed up with a similar no-tax-on-tips promise — also at a rally in Nevada, a critical swing state. In Congress, the no-tax-on-tips idea gained political steam on both sides of the political aisle with bills introduced in the House and the Senate. Sen. Ted Cruz (R-Texas) was the first to introduce the No Tax on Tips Act in July with support of Democratic Sens. Catherine Cortez Masto and Jacky Rosen, of Nevada. The legislation exempts tipped wages from federal income tax, but not payroll taxes, which fund Medicare and Social Security. Around the same time, Rep. Thomas Massie (R-Ky.) introduced a House bill that excludes tips not only from federal income tax but payroll taxes as well. Economists and tax experts have criticized the bills. The Tax Foundation estimates that untaxed tip income could add $107 billion over the next decade to the federal defici

TIPS TAXATION FEDERAL BUDGET SERVICE INDUSTRY ECONOMY

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

DOGE reportedly considers mobile tax-filing app to simplify US tax processThe Department of Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy, may develop a mobile app for filing taxes, aiming to simplify the tax process for Americans.

DOGE reportedly considers mobile tax-filing app to simplify US tax processThe Department of Government Efficiency (DOGE), led by Elon Musk and Vivek Ramaswamy, may develop a mobile app for filing taxes, aiming to simplify the tax process for Americans.

Read more »

World’s 1st ‘fart tax’: Denmark slaps tax on gassy cows to fight climate changeDenmark will impose the world’s first tax on agricultural emissions, including livestock methane, starting in 2030.

World’s 1st ‘fart tax’: Denmark slaps tax on gassy cows to fight climate changeDenmark will impose the world’s first tax on agricultural emissions, including livestock methane, starting in 2030.

Read more »

Spain's lower house approves tax package extending bank windfall taxSpain's lower house approves tax package extending bank windfall tax

Spain's lower house approves tax package extending bank windfall taxSpain's lower house approves tax package extending bank windfall tax

Read more »

Louisiana lawmakers pass income and corporate tax cuts, raising statewide sales tax to pay for itLouisiana’s GOP-dominated legislature passed tax cuts on personal and corporate income on Friday in exchange for a statewide sales tax increase, a mixed bag of success for Gov. Jeff Landry, whose original tax revision plans faced resistance from lawmakers and lobbyists amid hard fiscal realities.

Louisiana lawmakers pass income and corporate tax cuts, raising statewide sales tax to pay for itLouisiana’s GOP-dominated legislature passed tax cuts on personal and corporate income on Friday in exchange for a statewide sales tax increase, a mixed bag of success for Gov. Jeff Landry, whose original tax revision plans faced resistance from lawmakers and lobbyists amid hard fiscal realities.

Read more »

Louisiana lawmakers pass income and corporate tax cuts, raising statewide sales tax to pay for itLouisiana’s GOP-dominated legislature passed tax cuts on personal and corporate income on Friday in exchange for a statewide sales tax increase.

Louisiana lawmakers pass income and corporate tax cuts, raising statewide sales tax to pay for itLouisiana’s GOP-dominated legislature passed tax cuts on personal and corporate income on Friday in exchange for a statewide sales tax increase.

Read more »

Louisiana lawmakers pass income and corporate tax cuts, raising statewide sales tax to pay for itLouisiana’s GOP-dominated legislature passed tax cuts on personal and corporate income on Friday in exchange for a statewide sales tax increase.

Louisiana lawmakers pass income and corporate tax cuts, raising statewide sales tax to pay for itLouisiana’s GOP-dominated legislature passed tax cuts on personal and corporate income on Friday in exchange for a statewide sales tax increase.

Read more »