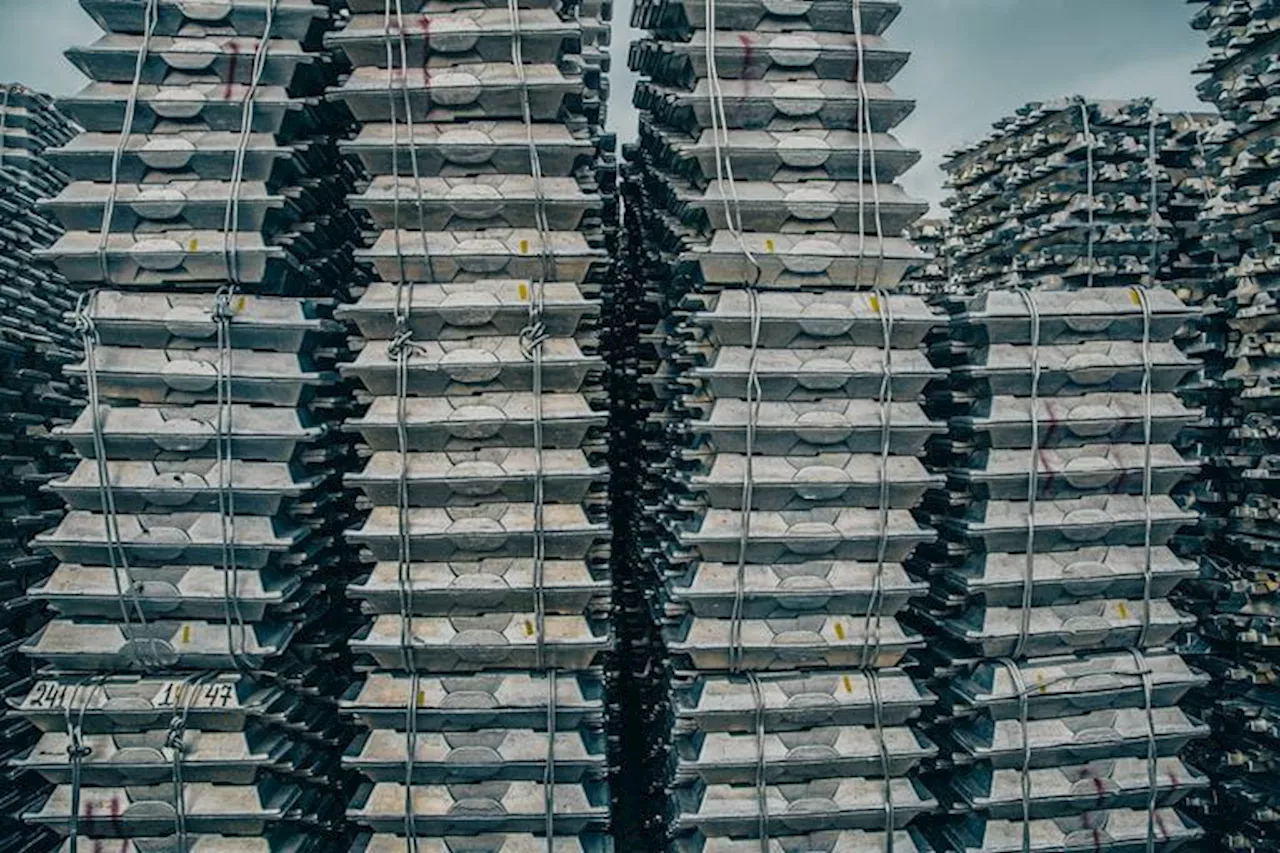

The London Metal Exchange (LME) is facing pushback from financial industry groups over its proposal to require private deals between members and clients to be executed on its Select trading system. The LME aims to increase transparency and liquidity, but critics argue that the mandate will raise costs and stifle competition. The Futures Industry Association (FIA) and the Association for Financial Markets in Europe (AFME) have voiced concerns, and some LME members have also raised the issue with the UK's Financial Conduct Authority (FCA).

Two financial industry groups have raised concerns with the London Metal Exchange about its plans to require private deals between members and clients to be carried out on its own platform, five sources with knowledge of the matter said.

The Futures Industry Association and the Association for Financial Markets in Europe sent a joint letter to the LME laying out members’ concerns in December.LME brokers typically complain about revenue raising moves such as trading and clearing fee hikes and costs of other requirements such as reporting OTC trades.

The LME said its aim is to increase transparency and liquidity and it welcomed feedback “from all LME stakeholders” on a market structure modernization plan announced in September. Initially the LME published a white paper on its proposals. At that time it had planned only to consult on changes to its Rulebook needed to implement the proposals.

FINANCIAL INDUSTRY LONDON METAL EXCHANGE OTC TRADES COMEX MARKET STRUCTURE MODERNIZATION

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Financial Groups Push Back Against LME's OTC Trading PlansTwo industry groups, the Futures Industry Association (FIA) and the Association for Financial Markets in Europe (AFME), have raised concerns with the London Metal Exchange (LME) regarding its proposed mandate for all private deals between members and clients to be conducted on its platform. The LME aims to increase transparency and liquidity by requiring OTC trades on its Select system, a move that contrasts with the approach of COMEX, which does not impose such a requirement. Members are particularly unhappy about the potential revenue implications and argue that the LME's plans could disrupt existing hedging practices.

Financial Groups Push Back Against LME's OTC Trading PlansTwo industry groups, the Futures Industry Association (FIA) and the Association for Financial Markets in Europe (AFME), have raised concerns with the London Metal Exchange (LME) regarding its proposed mandate for all private deals between members and clients to be conducted on its platform. The LME aims to increase transparency and liquidity by requiring OTC trades on its Select system, a move that contrasts with the approach of COMEX, which does not impose such a requirement. Members are particularly unhappy about the potential revenue implications and argue that the LME's plans could disrupt existing hedging practices.

Read more »

LME Approves Hong Kong as Warehouse Delivery Point to Boost China AccessThe London Metal Exchange (LME) has approved Hong Kong as a warehouse delivery point, aiming to enhance access to mainland China, the world's largest metals consumer. This move, a strategic goal since 2012, will allow Hong Kong warehouses to store all six primary metals traded on the LME. Despite higher costs in Hong Kong, investors are drawn to its proximity to China. While no financial incentives have been agreed upon with Hong Kong authorities, LME CEO Matthew Chamberlain believes the warehousing structure will remain economically attractive.

LME Approves Hong Kong as Warehouse Delivery Point to Boost China AccessThe London Metal Exchange (LME) has approved Hong Kong as a warehouse delivery point, aiming to enhance access to mainland China, the world's largest metals consumer. This move, a strategic goal since 2012, will allow Hong Kong warehouses to store all six primary metals traded on the LME. Despite higher costs in Hong Kong, investors are drawn to its proximity to China. While no financial incentives have been agreed upon with Hong Kong authorities, LME CEO Matthew Chamberlain believes the warehousing structure will remain economically attractive.

Read more »

Aluminum to Lead LME Base Metals in 2025 Amid Supply ConcernsAnalysts forecast a supply shortfall for aluminum in 2025, driving its price upward. Zinc, copper, and tin are also expected to see price increases, while nickel remains bearish due to oversupply concerns. The global trade outlook, with rising tariffs, adds uncertainty to the market.

Aluminum to Lead LME Base Metals in 2025 Amid Supply ConcernsAnalysts forecast a supply shortfall for aluminum in 2025, driving its price upward. Zinc, copper, and tin are also expected to see price increases, while nickel remains bearish due to oversupply concerns. The global trade outlook, with rising tariffs, adds uncertainty to the market.

Read more »

Rohit Chopra, CFPB Director, Fired by President TrumpConsumer Financial Protection Bureau Director Rohit Chopra has been abruptly dismissed by President Trump. Chopra, a strong advocate for consumer financial protection, implemented several policies aimed at making the financial system fairer and more competitive, but these actions were met with criticism from the financial industry. His firing is seen as a significant shift in the government's approach to financial regulation.

Rohit Chopra, CFPB Director, Fired by President TrumpConsumer Financial Protection Bureau Director Rohit Chopra has been abruptly dismissed by President Trump. Chopra, a strong advocate for consumer financial protection, implemented several policies aimed at making the financial system fairer and more competitive, but these actions were met with criticism from the financial industry. His firing is seen as a significant shift in the government's approach to financial regulation.

Read more »

American Lung Association Urges Ohio to Raise Cigarette TaxThe American Lung Association is calling for Ohio lawmakers to increase the cigarette tax by $1.50 per pack to combat the damaging effects of tobacco use. This recommendation is highlighted in their 2025 'State of Tobacco Control' report, which assesses state and federal tobacco control policies. The report also criticizes the tobacco industry's efforts to target young people with appealing new products like e-cigarettes disguised as smartphones and flavored nicotine pouches heavily marketed on social media.

American Lung Association Urges Ohio to Raise Cigarette TaxThe American Lung Association is calling for Ohio lawmakers to increase the cigarette tax by $1.50 per pack to combat the damaging effects of tobacco use. This recommendation is highlighted in their 2025 'State of Tobacco Control' report, which assesses state and federal tobacco control policies. The report also criticizes the tobacco industry's efforts to target young people with appealing new products like e-cigarettes disguised as smartphones and flavored nicotine pouches heavily marketed on social media.

Read more »

Tin Market Faces Demand Slump in 2024 Despite Supply HeadwindsTin, initially a star performer in the London Metal Exchange (LME) market, saw its gains dwindle as demand fell short of expectations. While production disruptions in Indonesia and Myanmar raised concerns about supply, the International Tin Association (ITA) revealed a 3.9% slump in tin usage in 2023, primarily driven by weakness in cyclical sectors. Despite supply constraints, LME and Shanghai Futures Exchange (ShFE) stocks remained relatively robust, indicating ample metal availability. The market's outlook hinges on whether demand recovers in 2024 and if Indonesian or Myanmar production rebounds.

Tin Market Faces Demand Slump in 2024 Despite Supply HeadwindsTin, initially a star performer in the London Metal Exchange (LME) market, saw its gains dwindle as demand fell short of expectations. While production disruptions in Indonesia and Myanmar raised concerns about supply, the International Tin Association (ITA) revealed a 3.9% slump in tin usage in 2023, primarily driven by weakness in cyclical sectors. Despite supply constraints, LME and Shanghai Futures Exchange (ShFE) stocks remained relatively robust, indicating ample metal availability. The market's outlook hinges on whether demand recovers in 2024 and if Indonesian or Myanmar production rebounds.

Read more »