Friday’s monthly jobs report will likely mark a pivotal moment for the economy and the Federal Reserve.

FILE - A linesman works on power lines under the morning sun, July 12, 2024, in Phoenix. for July — it would heighten worries that the job market is stumbling. The Fed might then seek to deliver a stimulus with a larger-than-usual interest rate cut of a half-percentage point when it meets later this month.If, on the other hand, hiring picked up from July's gain of just 114,000 or if the unemployment rate fell from 4.

Economists have estimated that the government will report Friday that employers added 160,000 jobs in August and that the unemployment rate slipped back to 4.2%. Since hitting a half-century low of 3.4% in April of last year, the jobless rate has risen nearly a full percentage point. Recent economic data has been mixed, elevating the importance of the jobs report, which is among the more comprehensive economic snapshots the government issues. The Labor Department surveys roughly 119,000 businesses and government agencies and 60,000 households each month to compile the employment data., and fewer workers are quitting for new opportunities. In a healthy job market, workers are more likely to quit, usually for new, higher-paying opportunities.

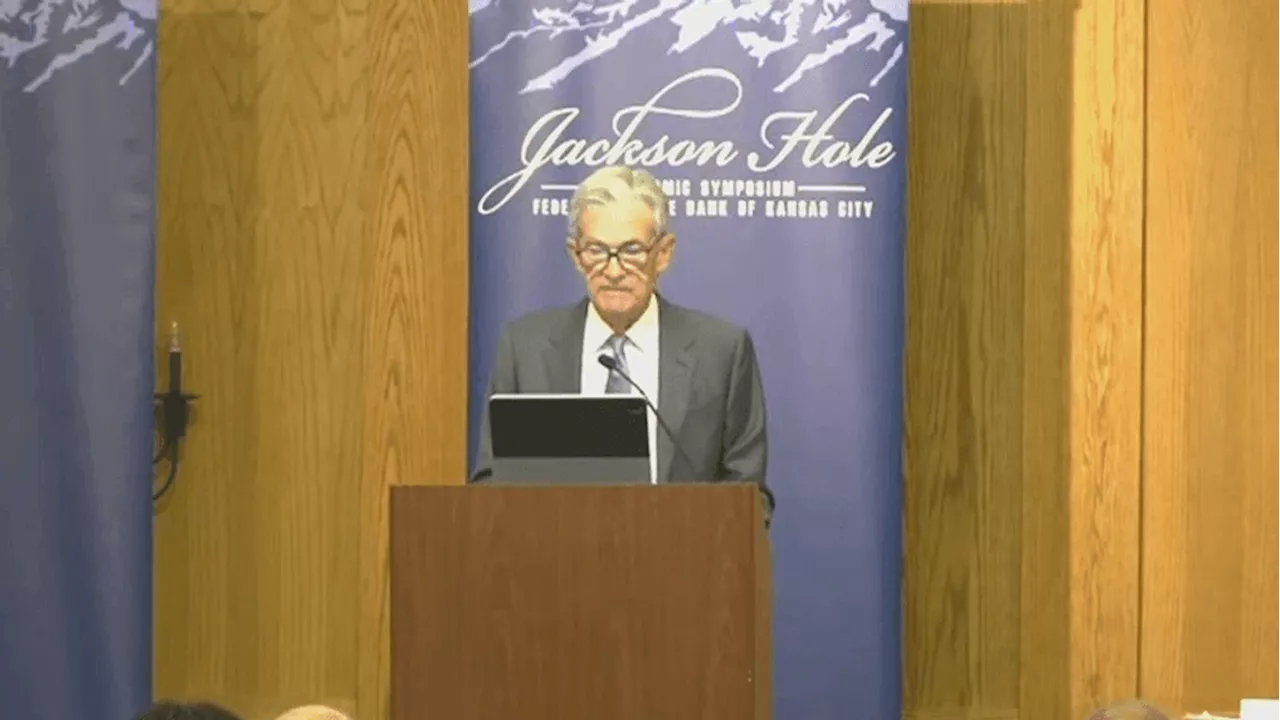

Fed Chair Jerome Powell has made clear that he doesn't want to see the job market weaken further, which is why a particularly poor jobs report might lead the Fed to announce a deep rate cut this month.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Jobs report will help Federal Reserve decide how much to cut interest ratesFriday’s monthly jobs report will likely mark a pivotal moment for the economy and the Federal Reserve. If it shows that hiring was weak in August and that the unemployment rate rose — similar to the unexpectedly soft figures for July — it would heighten worries that the job market is stumbling.

Jobs report will help Federal Reserve decide how much to cut interest ratesFriday’s monthly jobs report will likely mark a pivotal moment for the economy and the Federal Reserve. If it shows that hiring was weak in August and that the unemployment rate rose — similar to the unexpectedly soft figures for July — it would heighten worries that the job market is stumbling.

Read more »

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Read more »

Federal Reserve Chair Jerome Powell says 'the time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high, Chair Jerome Powell said Friday.

Federal Reserve Chair Jerome Powell says 'the time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high, Chair Jerome Powell said Friday.

Read more »

Most Federal Reserve officials ready to cut rates in September if inflation keeps coolingA lower Fed benchmark rate would lead eventually to lower rates for auto loans, mortgages and other forms of consumer borrowing and could also boost stock prices.

Most Federal Reserve officials ready to cut rates in September if inflation keeps coolingA lower Fed benchmark rate would lead eventually to lower rates for auto loans, mortgages and other forms of consumer borrowing and could also boost stock prices.

Read more »

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month.

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month.

Read more »

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month. Consumer prices are thought to have risen just 0.

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month. Consumer prices are thought to have risen just 0.

Read more »