CNBC Daily Open delivers a comprehensive update on global market trends, highlighting the impact of President Trump's tariff policy, Netflix's impressive financial performance, and the ongoing debate surrounding AI investment.

This report is from today's CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. A consortium of technology giants, including OpenAI, Oracle, and SoftBank, has pledged to invest a substantial sum in artificial intelligence (AI) infrastructure within the United States. Their initial commitment stands at $100 billion, with the potential to escalate to $500 billion over the next four years.

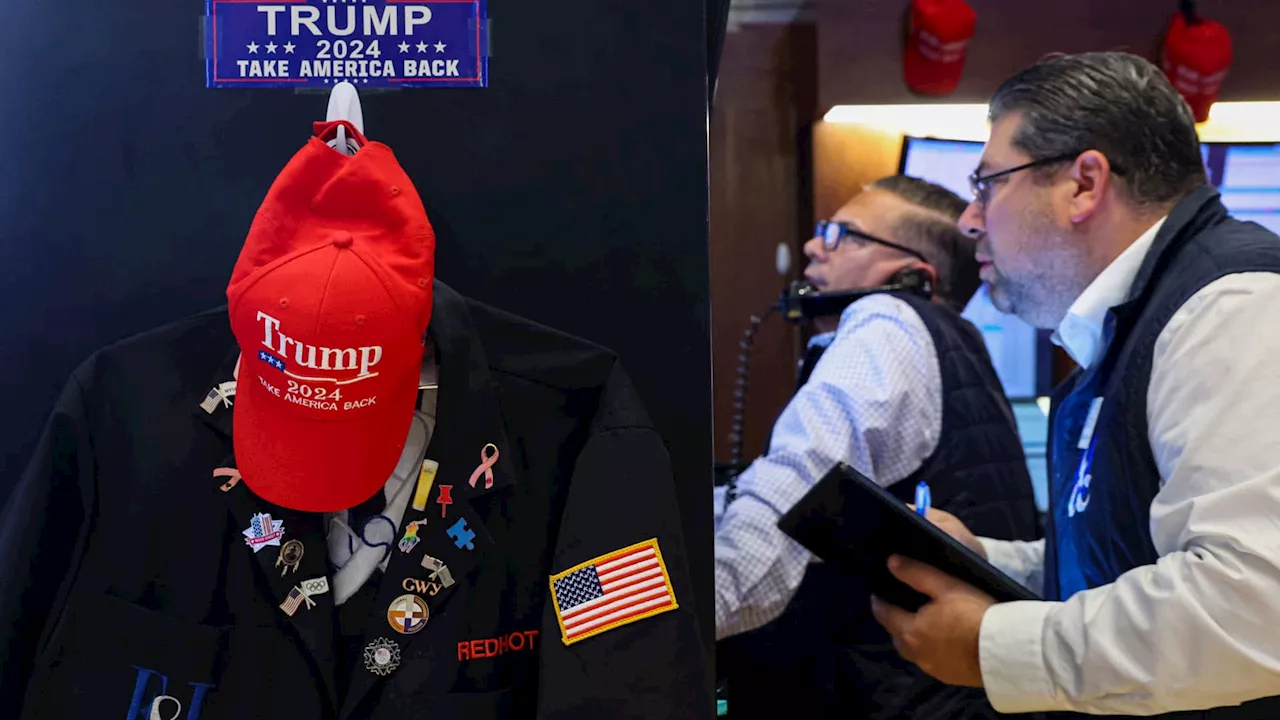

Simultaneously, Netflix has witnessed a remarkable surge in its stock price following the release of stellar quarterly results. The company exceeded both revenue and profit expectations, achieving a significant milestone by surpassing 300 million paid memberships during the quarter. This positive performance fueled investor optimism, pushing the stock higher. Global market sentiment remains somewhat mixed. While Asian markets displayed contrasting trends, with Japan and South Korea experiencing gains, Chinese markets retreated into negative territory. The U.S. stock market continues to hover near record highs, yet the investment landscape presents a complex interplay of contradictory signals that investors grapple to reconcile. Analysts observe a prevailing tendency among investors to bet on the more optimistic scenarios, even when some indicators suggest a more cautious approach. This sentiment is exemplified by President Donald Trump's recent rhetoric regarding tariffs. Notably, during his inauguration, President Trump proclaimed, 'Tariffs are the most beautiful words to me in the dictionary.' During his campaign, he had threatened to impose a global tariff range of 10% to 20% and a staggering 60% tariff specifically on Chinese imports. However, on his first day back in the Oval Office, President Trump refrained from enacting any new levies, easing investor anxieties. Economists at Goldman Sachs note that while Trump's initial pronouncements on tariffs were more conciliatory than anticipated, the long-term implications remain uncertain. They caution that the tariff issue could escalate in the future, potentially leading to unintended consequences for both the U.S. and global economies

Artificial Intelligence Global Markets Tariff Policy Netflix Stock Market

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

News Roundup: Ukraine War, Trump, Netflix, Markets and MoreA roundup of today's news covering the war in Ukraine, Donald Trump's legal challenges, Netflix releases, stock market performance, and scientific advancements.

News Roundup: Ukraine War, Trump, Netflix, Markets and MoreA roundup of today's news covering the war in Ukraine, Donald Trump's legal challenges, Netflix releases, stock market performance, and scientific advancements.

Read more »

Global Markets Decline Amid Uncertainty Over Trump PoliciesGlobal markets experienced a broad decline on Thursday, spurred by anxieties surrounding the potential impact of Donald Trump's policies. Investors remain cautious as they await details on Trump's economic agenda, including his stance on trade, tariffs, and fiscal policy.

Global Markets Decline Amid Uncertainty Over Trump PoliciesGlobal markets experienced a broad decline on Thursday, spurred by anxieties surrounding the potential impact of Donald Trump's policies. Investors remain cautious as they await details on Trump's economic agenda, including his stance on trade, tariffs, and fiscal policy.

Read more »

Global Markets Surge as Investor Sentiment Shifts Towards Trump 2.0The global market experienced significant gains this week, fueled by a combination of factors, including the stability of benchmark lending rates, strong performance in the financial sector, and anticipation of policy changes under President Trump's second term. Investors are cautiously optimistic about the potential for growth under Trump 2.0, while also acknowledging the inherent risks associated with any significant change.

Global Markets Surge as Investor Sentiment Shifts Towards Trump 2.0The global market experienced significant gains this week, fueled by a combination of factors, including the stability of benchmark lending rates, strong performance in the financial sector, and anticipation of policy changes under President Trump's second term. Investors are cautiously optimistic about the potential for growth under Trump 2.0, while also acknowledging the inherent risks associated with any significant change.

Read more »

European Markets Open Flat Amid Trump Inauguration and Global ConcernsEuropean markets began the week with minimal changes as investors awaited US President-elect Donald Trump's inauguration. Global concerns linger over Trump's planned tariffs on imported goods, which economists predict could fuel inflation and impact US consumers. Meanwhile, the World Economic Forum in Davos commences, bringing together political and business leaders to discuss economic growth, artificial intelligence, and other pressing issues.

European Markets Open Flat Amid Trump Inauguration and Global ConcernsEuropean markets began the week with minimal changes as investors awaited US President-elect Donald Trump's inauguration. Global concerns linger over Trump's planned tariffs on imported goods, which economists predict could fuel inflation and impact US consumers. Meanwhile, the World Economic Forum in Davos commences, bringing together political and business leaders to discuss economic growth, artificial intelligence, and other pressing issues.

Read more »

Trump's Statement Sends Dollar Lower, Global Markets ReactTrump's announcement regarding a hold on tariffs immediately weakened the US Dollar against major currencies. The Dollar Index dipped below 108.75, with potential support around 108.00-107.75. Global markets saw various reactions, including the Euro's rise, volatile EURINR, and USDJPY's dip back towards support. Analysts provided insights on AUDUSD, Pound, EURJPY, USDCNY, and USDINR, outlining potential movements based on current trends. The report also touched upon US Treasury yields, German yields, and global indices like the Dow Jones, DAX, Nifty, Nikkei, and Shanghai Composite. Finally, it discussed the impact on crude, gold, silver, copper, and natural gas prices.

Trump's Statement Sends Dollar Lower, Global Markets ReactTrump's announcement regarding a hold on tariffs immediately weakened the US Dollar against major currencies. The Dollar Index dipped below 108.75, with potential support around 108.00-107.75. Global markets saw various reactions, including the Euro's rise, volatile EURINR, and USDJPY's dip back towards support. Analysts provided insights on AUDUSD, Pound, EURJPY, USDCNY, and USDINR, outlining potential movements based on current trends. The report also touched upon US Treasury yields, German yields, and global indices like the Dow Jones, DAX, Nifty, Nikkei, and Shanghai Composite. Finally, it discussed the impact on crude, gold, silver, copper, and natural gas prices.

Read more »

Trump's Economic Agenda Shakes Global MarketsCNBC Daily Open analyzes President Trump's first 100 days in office and his impact on the global economy. His focus on protectionism, deregulation, and a restrictive immigration policy has sent shockwaves through markets.

Trump's Economic Agenda Shakes Global MarketsCNBC Daily Open analyzes President Trump's first 100 days in office and his impact on the global economy. His focus on protectionism, deregulation, and a restrictive immigration policy has sent shockwaves through markets.

Read more »