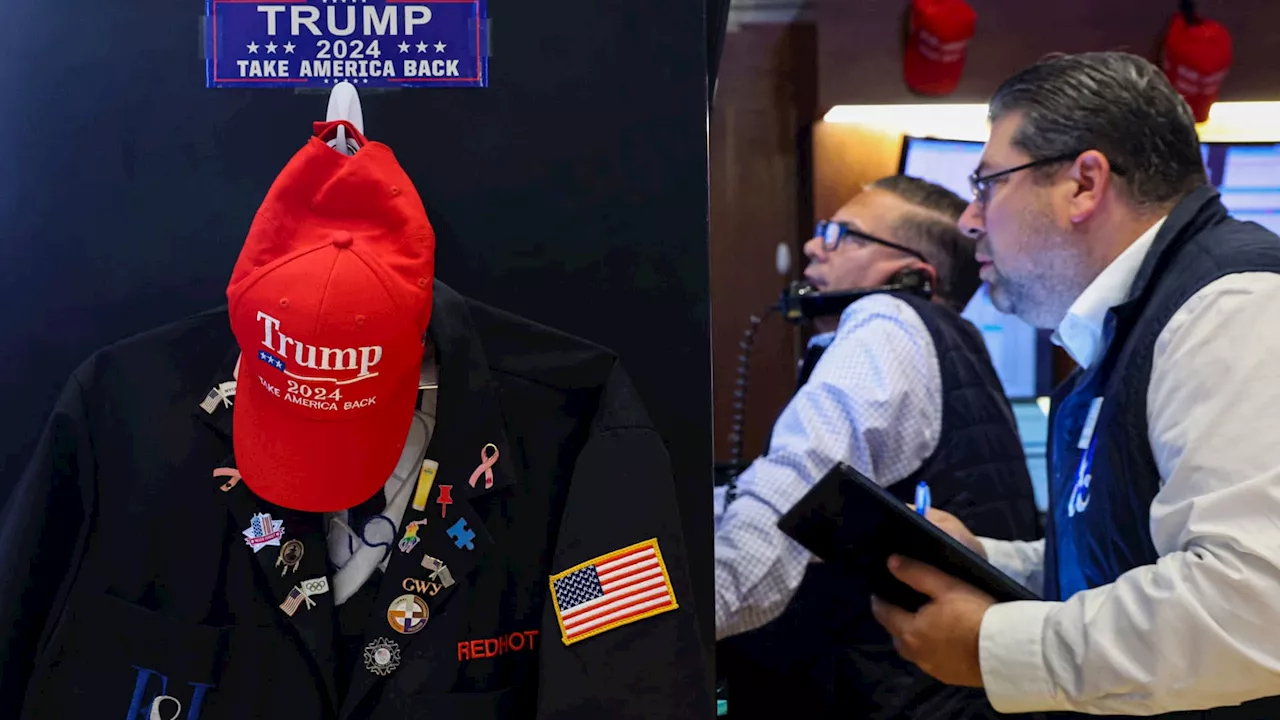

The global market experienced significant gains this week, fueled by a combination of factors, including the stability of benchmark lending rates, strong performance in the financial sector, and anticipation of policy changes under President Trump's second term. Investors are cautiously optimistic about the potential for growth under Trump 2.0, while also acknowledging the inherent risks associated with any significant change.

This report originates from today's CNBC Daily Open, our international markets newsletter designed to keep investors informed about crucial market developments, regardless of their location. Interested in receiving these updates directly? Subscribe today.Today's global markets witnessed a notable shift, with the benchmark lending rates remaining unchanged on Friday. Amidst this stability, the S&P 500 surged to its highest point since December 31st.

Mainland China's CSI 300 index also experienced a positive uptick, adding around 0.5% as Beijing maintained its loan prime rates.On a global scale, Oxfam reported a dramatic surge in billionaire wealth, jumping to an estimated $15 trillion from $13 trillion in 2024. This marks the second-largest annual increase in billionaire wealth since Oxfam began tracking such figures. The organization predicts that with the current acceleration in wealth accumulation among the ultra-rich, there will be at least five trillionaires within a decade.Investor sentiment is also closely tied to upcoming policy changes, particularly those implemented in the early days of a new presidency. These policies, particularly those concerning tariffs and corporate regulations, can significantly influence stock market trends extending far beyond the immediate future.In recent weeks, the market has exhibited a cautious response to the anticipated policies of the new president. The S&P 500, which initially surged above the significant 6,000 level following the previous presidential election victory, has largely erased its gains and returned to pre-election levels. However, as the new president prepares to take office, investors are beginning to position themselves based on his anticipated agenda. Stock performance finally ended last week on a positive note, marking their first weekly gain of the year.The financial sector played a pivotal role in this upward trend, with better-than-expected earnings reports from major banks propelling their share prices higher. Shares of Goldman Sachs, for instance, climbed 8% during the same period. Overall, the financial sector rallied more than 6% last week, outperforming the S&P 500. Trump's presidency is anticipated to provide further momentum for bank stocks. Potential drivers include rising business and consumer confidence, the extension of tax cuts, and deregulation within the financial industry. Chris Senyek, chief investment strategist at Wolfe Research, expressed this sentiment, stating, 'We still see Financials as the biggest sectoral winner under the Trump administration.'However, investors remain cautious. Any significant change inherently involves increased risks. While the second term of President Trump offers a degree of familiarity, as the 'two' indicates, uncertainty still persists. To receive the CNBC Daily Open report every morning and stay informed about global market movements, subscribe today

Global Markets S&P 500 Benchmark Lending Rates Billionaires Wealth Inequality President Trump Financial Sector Investor Sentiment Risk

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Global Markets Roundup: Honda Merger, UK GDP Growth, and MicroStrategy's Bitcoin SurgeThis news roundup covers a range of global market developments, including the announcement of a merger between two major companies, positive economic growth in the UK, and MicroStrategy's success in the cryptocurrency market.

Global Markets Roundup: Honda Merger, UK GDP Growth, and MicroStrategy's Bitcoin SurgeThis news roundup covers a range of global market developments, including the announcement of a merger between two major companies, positive economic growth in the UK, and MicroStrategy's success in the cryptocurrency market.

Read more »

Global Markets Update: Honda Merger, UK Economic Growth, MicroStrategy's Bitcoin SurgeCNBC Daily Open delivers a roundup of global market news, including the Honda-Taiwan Semiconductor merger, revised UK GDP figures, and MicroStrategy's soaring stock price fueled by its bitcoin investments.

Global Markets Update: Honda Merger, UK Economic Growth, MicroStrategy's Bitcoin SurgeCNBC Daily Open delivers a roundup of global market news, including the Honda-Taiwan Semiconductor merger, revised UK GDP figures, and MicroStrategy's soaring stock price fueled by its bitcoin investments.

Read more »

Global Markets Wrap: Bitcoin Surge, AI Race Heats Up, and S&P's SlowdownThis report covers key market movements, including Bitcoin's rally, the AI competition between tech giants, and the S&P 500's performance in 2024. It also touches on the impact of the US election on crypto and the potential for a year-end rally.

Global Markets Wrap: Bitcoin Surge, AI Race Heats Up, and S&P's SlowdownThis report covers key market movements, including Bitcoin's rally, the AI competition between tech giants, and the S&P 500's performance in 2024. It also touches on the impact of the US election on crypto and the potential for a year-end rally.

Read more »

Global Markets in Focus: Samsung's Surge, India's Allure, and Inflation FearsThis report highlights key market movements, including Samsung Electronics' strong performance despite controversies, India's attractiveness as an investment destination, and rising inflation concerns. It also touches on the impact of the ISM report on market sentiment and shifts in Federal Reserve rate cut expectations.

Global Markets in Focus: Samsung's Surge, India's Allure, and Inflation FearsThis report highlights key market movements, including Samsung Electronics' strong performance despite controversies, India's attractiveness as an investment destination, and rising inflation concerns. It also touches on the impact of the ISM report on market sentiment and shifts in Federal Reserve rate cut expectations.

Read more »

Global Markets Surge as Inflation Fears MountCNBC Daily Open reports on the global market upswing, highlighting South Korea's Kospi surge fueled by Samsung Electronics. Meanwhile, concerns over rising inflation are impacting markets, with the ISM price index hitting its highest level since January 2024.

Global Markets Surge as Inflation Fears MountCNBC Daily Open reports on the global market upswing, highlighting South Korea's Kospi surge fueled by Samsung Electronics. Meanwhile, concerns over rising inflation are impacting markets, with the ISM price index hitting its highest level since January 2024.

Read more »

Global Markets Surge on Tech Optimism and Inflation ConcernsCNBC Daily Open reports on a surge in global markets fueled by tech optimism, particularly in South Korea, and rising inflation concerns. The report highlights Samsung Electronics' stock performance and Anthropic's funding round, while also analyzing the implications of the December ISM report's inflation reading.

Global Markets Surge on Tech Optimism and Inflation ConcernsCNBC Daily Open reports on a surge in global markets fueled by tech optimism, particularly in South Korea, and rising inflation concerns. The report highlights Samsung Electronics' stock performance and Anthropic's funding round, while also analyzing the implications of the December ISM report's inflation reading.

Read more »