Bank CEOs led by JPMorgan Chase CEO Jamie Dimon have lambasted the proposed Basel Endgame regulation since it was unveiled last year.

A top Federal Reserve official on Tuesday unveiled changes to a proposed set of U.S. banking regulations that roughly cuts in half the extra capital that the largest institutions will need.

Instead, officials at the Fed, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. have agreed to resubmit the massive proposal with a more modest 9% increase to big bank capital, according to prepared remarks from Fed vice chair for supervision Michael Barr.

Banks Breaking News: Investing Investment Strategy Breakingnewsglobal Jpmorgan Chase & Co Jamie Dimon Business News

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Federal Reserve unveils toned-down banking regulation in victory for Wall StreetBank CEOs led by JPMorgan Chase CEO Jamie Dimon have lambasted the proposed Basel Endgame regulation since it was unveiled last year.

Federal Reserve unveils toned-down banking regulation in victory for Wall StreetBank CEOs led by JPMorgan Chase CEO Jamie Dimon have lambasted the proposed Basel Endgame regulation since it was unveiled last year.

Read more »

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month. Consumer prices are thought to have risen just 0.

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month. Consumer prices are thought to have risen just 0.

Read more »

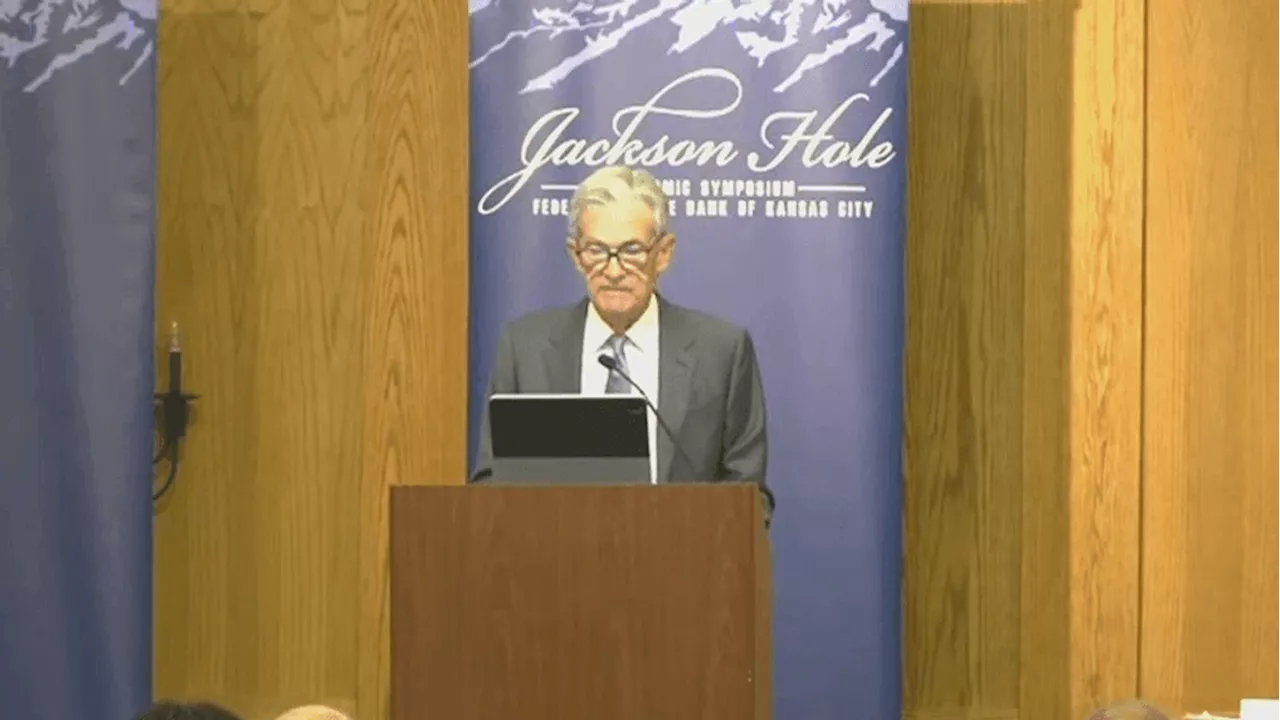

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Read more »

Federal Reserve Chair Jerome Powell says 'the time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high, Chair Jerome Powell said Friday.

Federal Reserve Chair Jerome Powell says 'the time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high, Chair Jerome Powell said Friday.

Read more »

Federal Reserve scenarios: More twists and turns to comeHaving priced a high chance of an inter-meeting Fed rate cut last week, interest rate expectations have moderated in the wake of better data and calming words from Fed officials.

Federal Reserve scenarios: More twists and turns to comeHaving priced a high chance of an inter-meeting Fed rate cut last week, interest rate expectations have moderated in the wake of better data and calming words from Fed officials.

Read more »

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month.

Inflation likely stayed low last month as Federal Reserve edges closer to cutting ratesIf the Federal Reserve needs any further evidence that the worst price spike in four decades is steadily easing, it’s likely to come Wednesday, when the government is expected to report that inflation cooled further last month.

Read more »