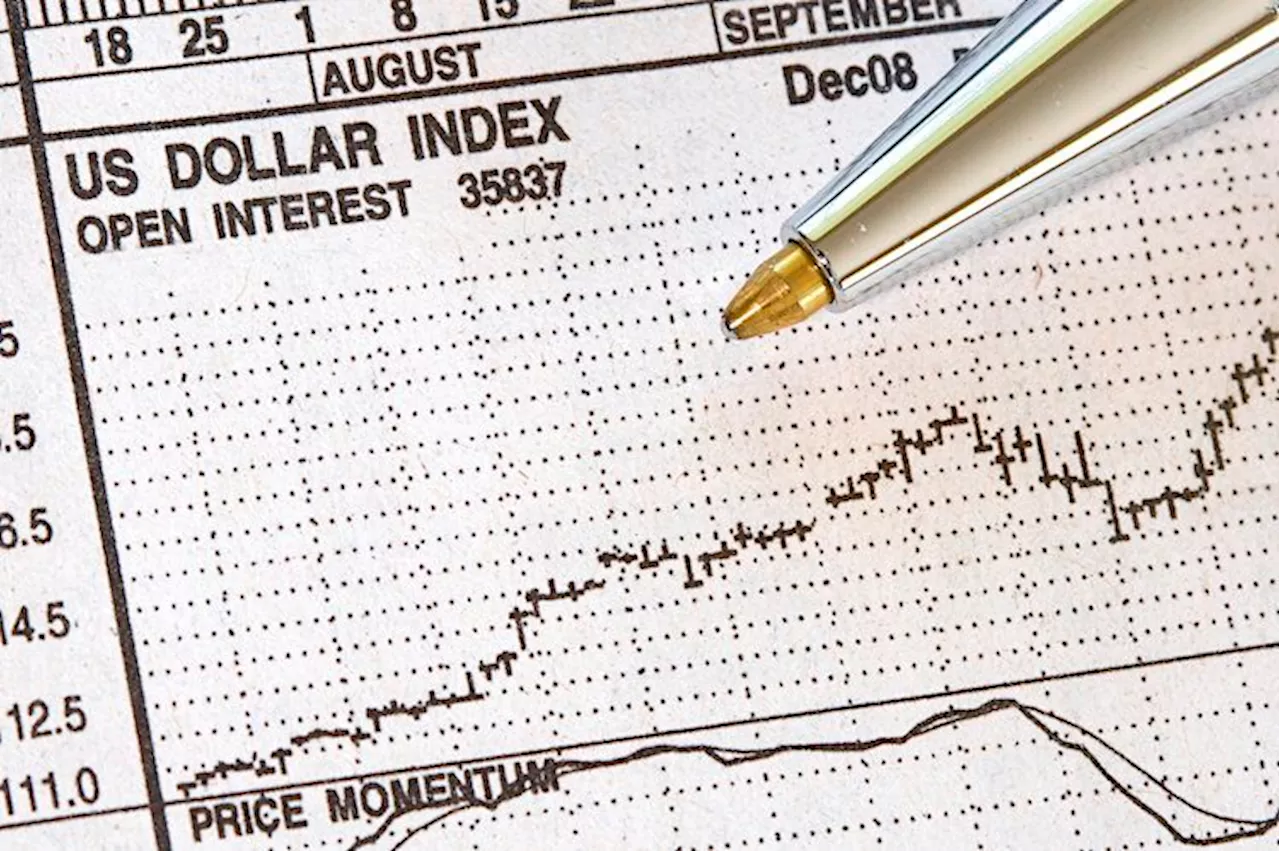

The Dollar Index is on the rise, potentially reaching 111 before peaking. The Euro dipped but recovered, remaining vulnerable to further decline. Other currencies like EURINR, AUDUSD, and Pound show bearish trends. Key economic indicators, including US PPI and CPI data, are expected to influence market movements. US Treasury yields remain elevated, and global stock indices exhibit varied performance.

The Dollar Index is rising as expected and has a scope to test 111 before getting topped out. The Euro had slipped even below 1.02 before rising back from there. Stil the pair can be vulnerable to fall further towards 1.01 in the near term.

continues to remain stable within its earlier range of 156-158. on a break below 160 can get dragged to 156 on the downside. The upside is capped at 164.

DOLLAR INDEX EURO EURINR AUDUSD BOND YIELDS INFLATION US ECONOMY

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/CAD rises above 1.4400 as US Dollar Index rallies toward two-year highsUSD/CAD continues its winning streak for the fourth successive session, trading around 1.4420 during the Asian hours on Friday.

USD/CAD rises above 1.4400 as US Dollar Index rallies toward two-year highsUSD/CAD continues its winning streak for the fourth successive session, trading around 1.4420 during the Asian hours on Friday.

Read more »

Meme Index: The First Decentralized Meme Coin Index Investing PlatformMeme Index is revolutionizing meme coin investing with a decentralized platform that allows users to buy baskets of meme coins grouped by volatility. The platform offers a unique advantage over individual meme coins by positioning itself as a meme coin infrastructure investment.

Meme Index: The First Decentralized Meme Coin Index Investing PlatformMeme Index is revolutionizing meme coin investing with a decentralized platform that allows users to buy baskets of meme coins grouped by volatility. The platform offers a unique advantage over individual meme coins by positioning itself as a meme coin infrastructure investment.

Read more »

Dollar Index Strengthens, Euro Dips, and Markets Show Mixed SignalsThe Dollar Index remains strong above key support levels, with potential for further gains towards 110-111. The Euro is expected to decline towards 1.03 or lower. Other currency pairs show volatility, while USDJPY has the potential to rise past 160. Bonds and stock markets exhibit mixed performance, with US Treasury yields rising sharply and the Dow Jones declining.

Dollar Index Strengthens, Euro Dips, and Markets Show Mixed SignalsThe Dollar Index remains strong above key support levels, with potential for further gains towards 110-111. The Euro is expected to decline towards 1.03 or lower. Other currency pairs show volatility, while USDJPY has the potential to rise past 160. Bonds and stock markets exhibit mixed performance, with US Treasury yields rising sharply and the Dow Jones declining.

Read more »

Dollar Index Hovers Near Key Resistance as Markets Await Non-Farm Payrolls ReportThe Dollar Index faces key resistance levels ahead of the Non-Farm Payrolls report. Markets are cautiously anticipating the data, with forecasts suggesting a potential slowdown in job growth. A strong report could solidify the dollar's rally, while weaker data might trigger speculation about a Fed policy pivot.

Dollar Index Hovers Near Key Resistance as Markets Await Non-Farm Payrolls ReportThe Dollar Index faces key resistance levels ahead of the Non-Farm Payrolls report. Markets are cautiously anticipating the data, with forecasts suggesting a potential slowdown in job growth. A strong report could solidify the dollar's rally, while weaker data might trigger speculation about a Fed policy pivot.

Read more »

Dollar Index Soars to Two-Year HighThe US Dollar Index reached a new two-year high on the first trading day of the new year, driven by strong US economic performance, expectations of continued interest rate hikes, and a flight to safety amid global uncertainty.

Dollar Index Soars to Two-Year HighThe US Dollar Index reached a new two-year high on the first trading day of the new year, driven by strong US economic performance, expectations of continued interest rate hikes, and a flight to safety amid global uncertainty.

Read more »

US Economic Outlook Brightens as Leading Index Rises for First Time in Nearly Three YearsThe Conference Board's Leading Economic Index increased 0.3 percent in November, marking a turnaround after nearly three years of declines. The rise, surpassing economists' forecasts, was attributed to a rally in equities, a resurgence in building permits, and gains in the labor market. Analysts link the positive shift to optimism sparked by President-elect Donald Trump's victory and his promises of tax cuts, deregulation, and infrastructure investment.

US Economic Outlook Brightens as Leading Index Rises for First Time in Nearly Three YearsThe Conference Board's Leading Economic Index increased 0.3 percent in November, marking a turnaround after nearly three years of declines. The rise, surpassing economists' forecasts, was attributed to a rally in equities, a resurgence in building permits, and gains in the labor market. Analysts link the positive shift to optimism sparked by President-elect Donald Trump's victory and his promises of tax cuts, deregulation, and infrastructure investment.

Read more »