High prices and high-interest rates are hurting vulnerable consumers.

Subprime consumers are falling behind on their credit-card bills. From Generation Z and millennials to Generation X and baby boomers, credit-card delinquency rates have been trending upwards for four generations of borrowers since January 2020, reaching a new high in August, according to new data from VantageScore.

The Fed focuses on delinquencies where borrowers have fallen past due 30 days or more. It defines large banks as those with $300 million or more in assets, while smaller banks are those outside of the largest 100 commercial banks. More than 80% of U.S. consumers had credit cards last year, with nearly half carrying a balance, according to Federal Reserve data.

With a 24% average APR on credit cards, falling behind could push those lower-income workers into bankruptcy, Gill said. “It’s a very dangerous situation currently, especially for low-wage workers.” What’s worse, consumers could end up paying late-payment fees of up to $35 per month if they default on their payments, and an APR of up to 30%, according to LendingTree.

All of this comes at a bad time. Consumers, particularly low-income Americans, are under pressure. Student-loan repayments resume in October after the pandemic-era moratorium and interest rates are at a 22-year high. While the Fed has signaled it’s not likely to raise rates again imminently, inflation is still above the Fed’s 2% target rate.

Lenders, including credit-card issuers, are now tightening their lending standards, and this tends to be felt most by subprime consumers, Rossman added. As a result, they are more likely to turn to alternative avenues of credit, such as borrowing from friends and family and using fintech apps to request advances on their future paychecks to cover basic living expenses, he added.If all of this sounds familiar, it’s because we’ve been here before.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Yankees give up on pitcher they paid high to get and high to sitThe New York Yankees and Detroit Tigers continue their four-game series on Tuesday night at Comerica Park.

Yankees give up on pitcher they paid high to get and high to sitThe New York Yankees and Detroit Tigers continue their four-game series on Tuesday night at Comerica Park.

Read more »

Forex Today: Market volatility to remain high on German inflation report and high-tier US dataHere is what you need to know on Wednesday, August 30: The US Dollar holds its ground early Wednesday after suffering large losses against its rivals

Forex Today: Market volatility to remain high on German inflation report and high-tier US dataHere is what you need to know on Wednesday, August 30: The US Dollar holds its ground early Wednesday after suffering large losses against its rivals

Read more »

Padua Franciscan High School named first internationally accredited high school in U.S.Known for its innovative curriculum and foreign exchange program, Padua Franciscan High School recently took a step forward on the international stage.

Padua Franciscan High School named first internationally accredited high school in U.S.Known for its innovative curriculum and foreign exchange program, Padua Franciscan High School recently took a step forward on the international stage.

Read more »

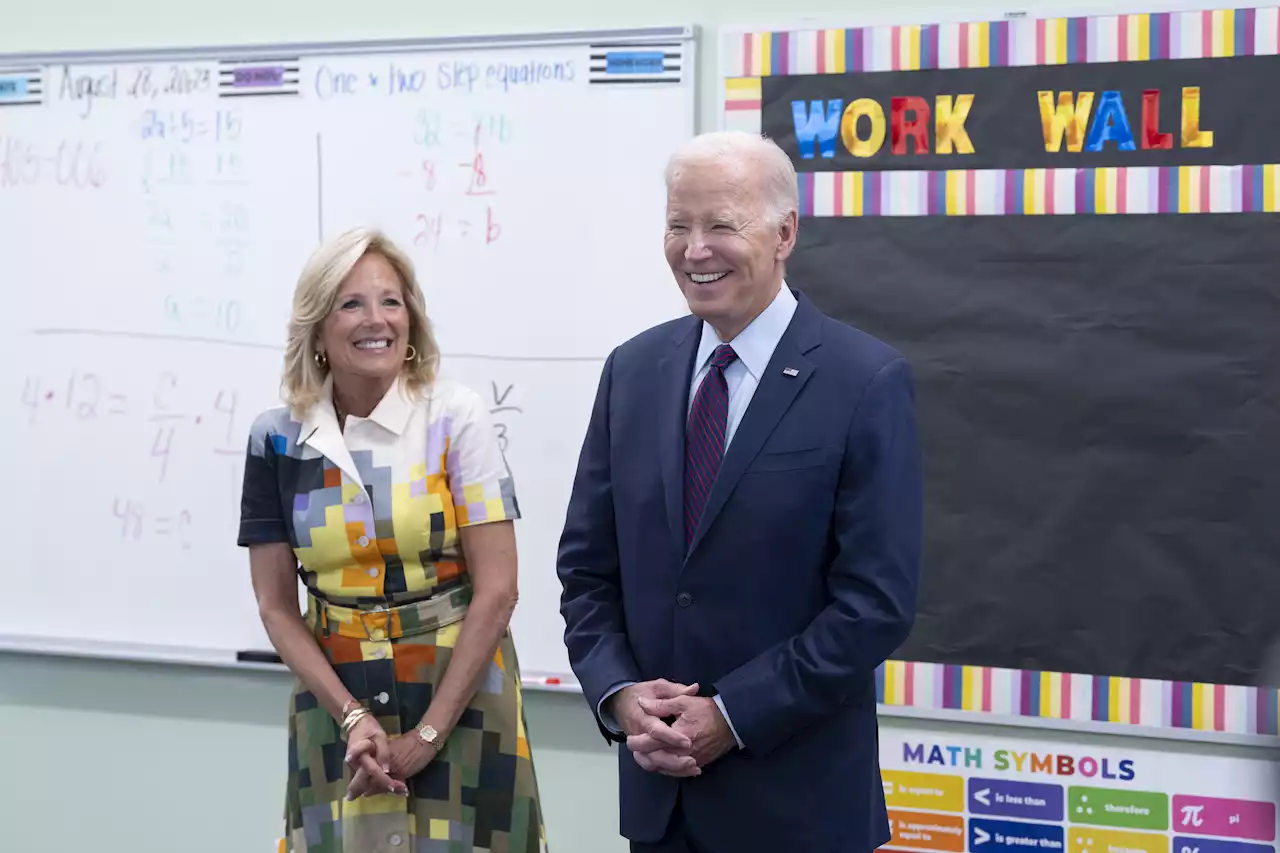

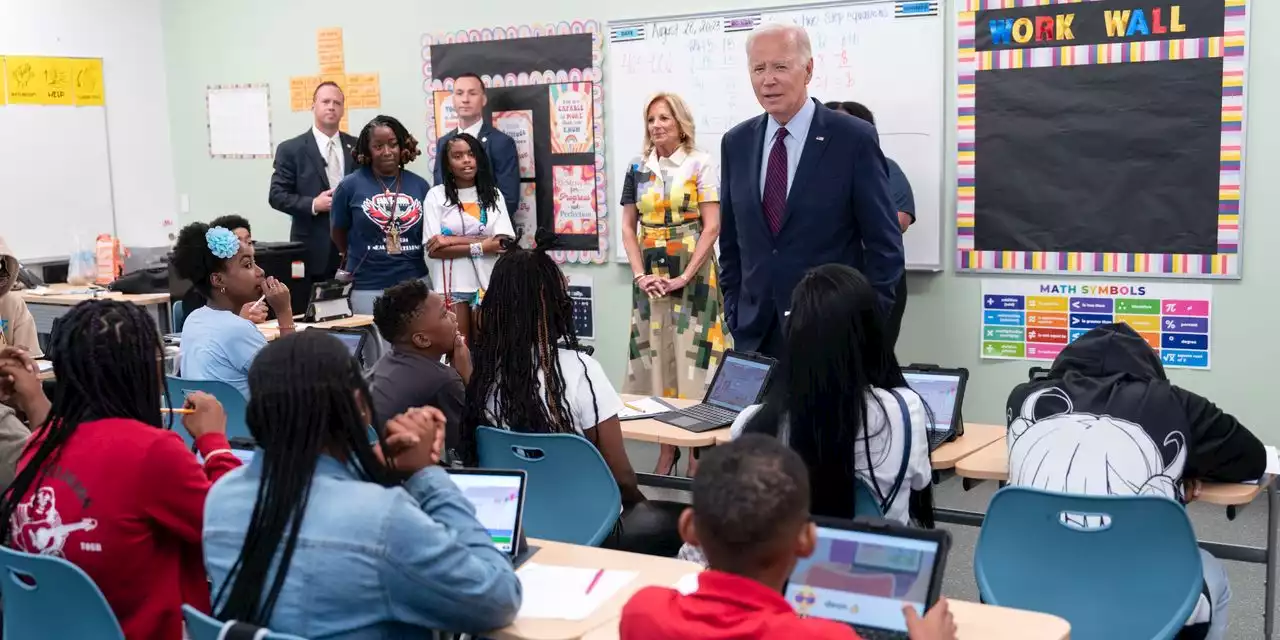

Biden slammed for taking credit for reopening schools: 'Will take years for students to dig out'The Wall Street Journal accused President Biden of 'rewriting history' after he took credit for reopening schools after the COVID-19 pandemic closures.

Biden slammed for taking credit for reopening schools: 'Will take years for students to dig out'The Wall Street Journal accused President Biden of 'rewriting history' after he took credit for reopening schools after the COVID-19 pandemic closures.

Read more »

Kim Zolciak Sued By Credit Card Company for More than $150,000More financial woes for Kim Zolciak, a credit card company is going after her for more than $150,000 ... filing a lawsuit the same day Kroy Biermann filed for divorce.

Kim Zolciak Sued By Credit Card Company for More than $150,000More financial woes for Kim Zolciak, a credit card company is going after her for more than $150,000 ... filing a lawsuit the same day Kroy Biermann filed for divorce.

Read more »

| Biden Rewrites the History of Covid School ClosingsThe President takes credit for reopening he did nothing to help.

| Biden Rewrites the History of Covid School ClosingsThe President takes credit for reopening he did nothing to help.

Read more »