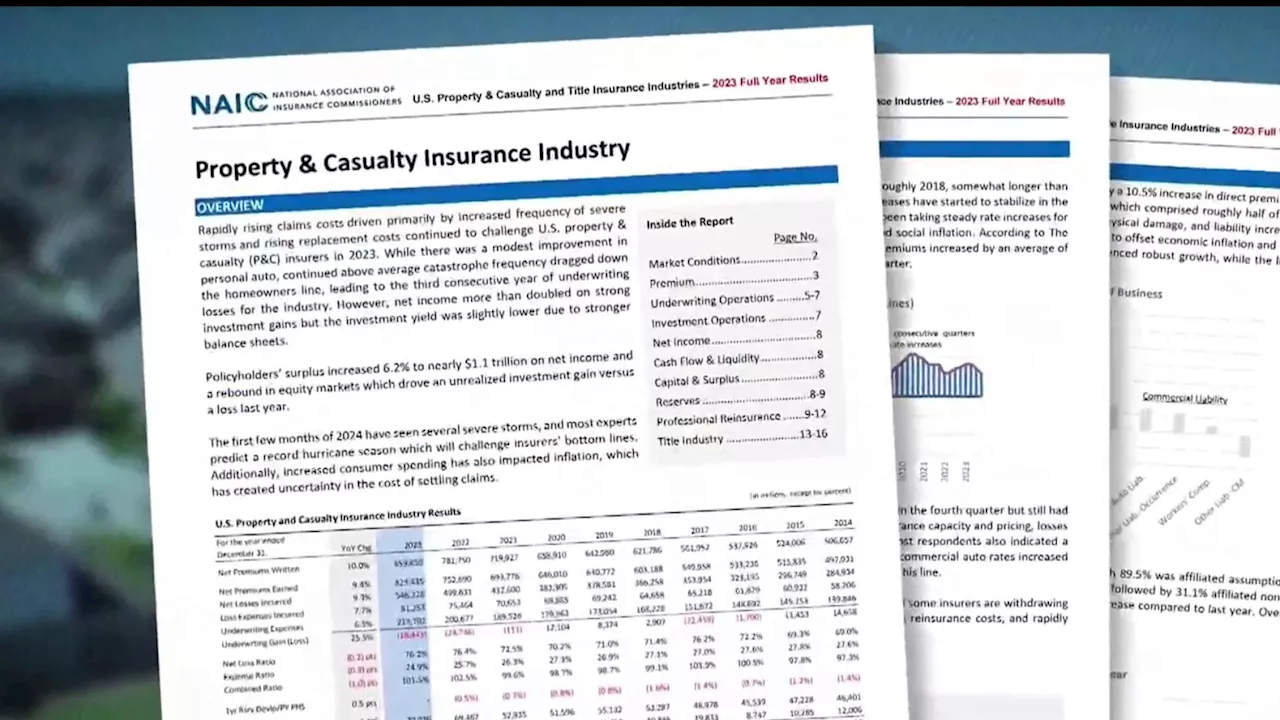

Insurance companies in California will be required to offer home coverage in high-risk wildfire areas to continue operating in the state. The new regulation, announced by Insurance Commissioner Ricardo Lara, mandates a gradual increase in coverage over several years. In exchange for this requirement, insurers will be allowed to pass on reinsurance costs to consumers.

SACRAMENTO, Calif. — Insurance companies that stopped providing home coverage to hundreds of thousands of Californians in recent years as wildfires became more destructive will have to again provide policies in fire-prone areas if they want to keep doing business in California under a state regulation announced Monday.The rule will require home insurers to offer coverage in high-risk areas, something the state has never done, Insurance Commissioner Ricardo Lara's office said in a statement.

Insurance companies had said that because they can’t consider climate change in their rates, many opted to either pause or restrict new business in the state. The new rule to include climate change in rates will take effect later this week.

CALIFORNIA INSURANCE WILDFIRES REGULATION REINSURANCE

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Farmers Insurance promises to write more California home insurance policies ahead of planned reformsThe company committed to writing 9,500 new policies each month.

Farmers Insurance promises to write more California home insurance policies ahead of planned reformsThe company committed to writing 9,500 new policies each month.

Read more »

Farmers Insurance Expands Homeowner Policies in California Amidst Insurance ReformToday on AirTalk, we discuss Farmers Insurance's decision to increase homeowner policies written for California residents, exploring the implications of this move within the broader context of insurance reform in the state. We also delve into the hot topic of holiday office parties, debating whether plus ones should be allowed, and examine the growing trend of teenagers' constant online presence. Plus, renowned Jazz musician Arturo Sandoval joins us to talk about his latest album and his honors from the Kennedy Center for Performing Arts.

Farmers Insurance Expands Homeowner Policies in California Amidst Insurance ReformToday on AirTalk, we discuss Farmers Insurance's decision to increase homeowner policies written for California residents, exploring the implications of this move within the broader context of insurance reform in the state. We also delve into the hot topic of holiday office parties, debating whether plus ones should be allowed, and examine the growing trend of teenagers' constant online presence. Plus, renowned Jazz musician Arturo Sandoval joins us to talk about his latest album and his honors from the Kennedy Center for Performing Arts.

Read more »

Farmers Insurance Expands Coverage in California Amidst Insurance ReformAirTalk discusses Farmers Insurance's decision to increase homeowner policies in California, exploring the impact of insurance reform proposals and the future of home insurance in the state.

Farmers Insurance Expands Coverage in California Amidst Insurance ReformAirTalk discusses Farmers Insurance's decision to increase homeowner policies in California, exploring the impact of insurance reform proposals and the future of home insurance in the state.

Read more »

California’s home insurance crisis: Which Bay Area neighborhoods have lost the most coverageBeleaguered residents in neighborhoods with high numbers of policy non-renewals are skeptical as the California Department of Insurance finalizes regulation reforms aimed at making insurers offer a…

California’s home insurance crisis: Which Bay Area neighborhoods have lost the most coverageBeleaguered residents in neighborhoods with high numbers of policy non-renewals are skeptical as the California Department of Insurance finalizes regulation reforms aimed at making insurers offer a…

Read more »

California issues landmark rules to improve home insurance marketCalifornia's Department of Insurance released rules meant to encourage insurers to write more policies in high-fire-risk areas by using computer modeling.

California issues landmark rules to improve home insurance marketCalifornia's Department of Insurance released rules meant to encourage insurers to write more policies in high-fire-risk areas by using computer modeling.

Read more »

Texas Homeowners Allege Forced Bundling to Keep InsuranceA North Texas homeowner claims her insurance company forced her to bundle her home and auto insurance to renew her policy. Sally Little says Farmers Insurance told her they wouldn't renew her homeowner's policy without adding a personal auto policy. Little isn't alone, as the Texas Department of Insurance (TDI) has received 37 complaints this year about Farmers requiring bundling for home policy renewals. Farmers Insurance argues the bundling guideline is part of their risk strategy and customers without homes who have auto policies wouldn't be affected.

Texas Homeowners Allege Forced Bundling to Keep InsuranceA North Texas homeowner claims her insurance company forced her to bundle her home and auto insurance to renew her policy. Sally Little says Farmers Insurance told her they wouldn't renew her homeowner's policy without adding a personal auto policy. Little isn't alone, as the Texas Department of Insurance (TDI) has received 37 complaints this year about Farmers requiring bundling for home policy renewals. Farmers Insurance argues the bundling guideline is part of their risk strategy and customers without homes who have auto policies wouldn't be affected.

Read more »