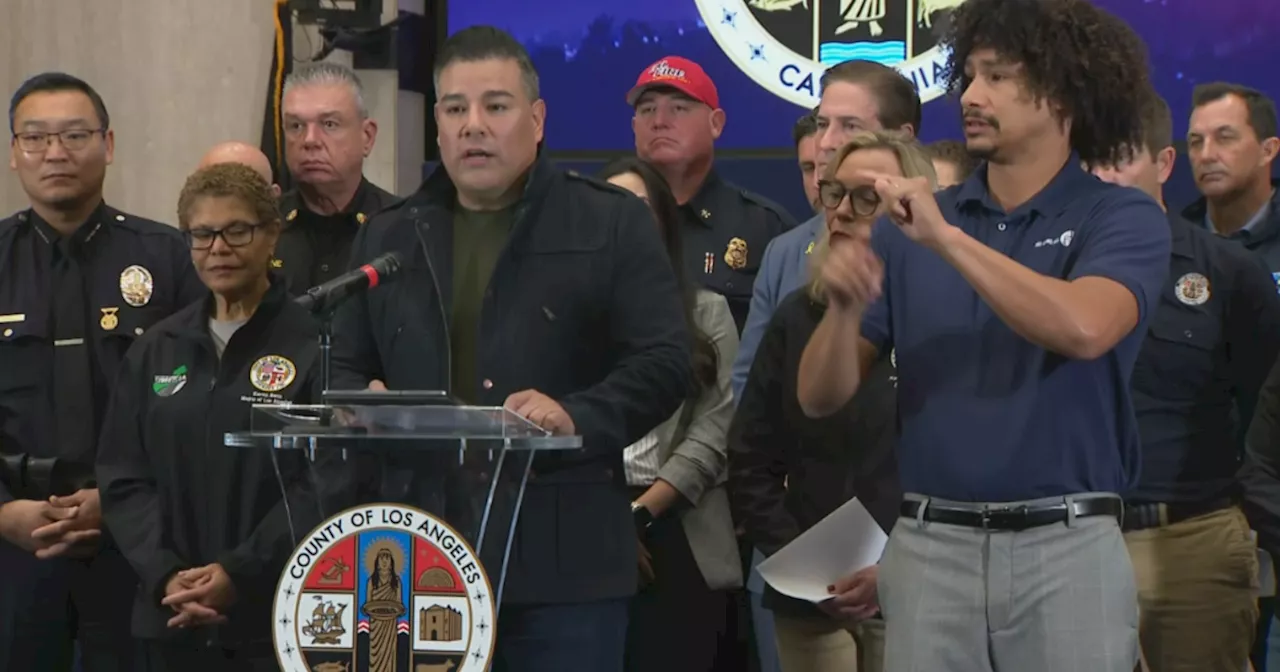

California Insurance Commissioner Ricardo Lara has broadened the emergency protections offered to Southern California residents affected by recent wildfires. The expanded moratorium on insurance non-renewals and cancellations now covers a wider range of zip codes impacted by the blazes.

California Insurance Commissioner Ricardo Lara expanded the emergency protections offered by his recent moratorium for Southern California residents impacted by wildfires. Lara added new zip codes to the mandatory one-year moratorium on insurance non-renewals and cancellations. The updated protections now cover residents in the zip codes affected by the Palisades, Eaton, Hurst, Lidia, Sunset, and Woodley fires, along with adjacent zip codes.

'I am using my moratorium powers to prevent insurance companies from canceling or non-renewing policies in wildfire-impacted areas, so people don't face the added stress of finding new insurance during this horrific event,' Lara stated. 'My staff and I are working on all fronts to make sure wildfire victims get the benefits they are entitled to, and they get it as soon as possible.' Last Thursday, Lara issued his initial wave of protections following the outbreak of the Palisades and Eaton fires. Homeowners who received a non-renewal notice from their insurance company between October 9th and January 7th will be covered under Lara's moratorium. 'Your insurance company should do the right thing and retain you as a valued policyholder,' Lara urged. Lara also appealed to insurers to extend their 60-day grace period for homeowners to pay their insurance premiums. To assist residents facing challenges with their health insurance, Lara issued a notice to all California health insurers, instructing them to submit emergency plans to his department. 'These plans must detail how they're going to ensure that consumers can continue to access essential medical care and obtain their medications in the wake of these disasters,' Lara explained. Lara's final element in his Sustainable Insurance Strategy is also now in effect and enforceable. His office stated that it is the 'state's largest insurance reform in 30 years.' 'The new Net Cost of Reinsurance in Ratemaking Regulation requires insurance companies — for the first time — to increase coverage in high-risk areas, ensuring more options for Californians while limiting the costs passed on to consumers,' according to Lara's office. The Los Angeles District Attorney's Office also announced a new rapid response initiative aimed at combating and prosecuting insurance fraud targeting wildfire survivors

Wildfires Insurance Moratorium California Disaster Relief

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Insurance commissioner expands moratorium protections for Southern California fire areasThe California insurance commissioner expanded the emergency protections covered by his recent moratorium for Southern California residents affected by wildfires.

Insurance commissioner expands moratorium protections for Southern California fire areasThe California insurance commissioner expanded the emergency protections covered by his recent moratorium for Southern California residents affected by wildfires.

Read more »

California Expands Insurance Access for Wildfire-Prone AreasCalifornia is taking steps to expand insurance access for homeowners in wildfire-prone areas. This will prevent them from being dropped by their insurance companies, but critics argue it will lead to increased premiums.

California Expands Insurance Access for Wildfire-Prone AreasCalifornia is taking steps to expand insurance access for homeowners in wildfire-prone areas. This will prevent them from being dropped by their insurance companies, but critics argue it will lead to increased premiums.

Read more »

California Insurance Commissioner Urges Wildfire Victims to Be Cautious With ClaimsCalifornia Insurance Commissioner Ricardo Lara advises residents whose homes or businesses were damaged by recent wildfires to avoid signing anything immediately. He emphasizes safety, staying away from affected areas, and taking time to assess their situation before making decisions about insurance claims.

California Insurance Commissioner Urges Wildfire Victims to Be Cautious With ClaimsCalifornia Insurance Commissioner Ricardo Lara advises residents whose homes or businesses were damaged by recent wildfires to avoid signing anything immediately. He emphasizes safety, staying away from affected areas, and taking time to assess their situation before making decisions about insurance claims.

Read more »

California Insurance Commissioner Offers Advice to Wildfire VictimsCalifornia Insurance Commissioner Ricardo Lara advises residents affected by the wildfires on reimbursement options, insurance coverage for evacuation expenses, and steps to take if they are uninsured.

California Insurance Commissioner Offers Advice to Wildfire VictimsCalifornia Insurance Commissioner Ricardo Lara advises residents affected by the wildfires on reimbursement options, insurance coverage for evacuation expenses, and steps to take if they are uninsured.

Read more »

California Insurance Commissioner Imposes Moratorium on Non-Renewals and Cancellations for Fire-Affected ResidentsIn response to the devastating wildfires in Southern California, California Insurance Commissioner Ricardo Lara has issued a mandatory one-year moratorium on non-renewals and cancellations for homeowners impacted by the fires. The moratorium aims to protect residents from losing their insurance coverage during this challenging time.

California Insurance Commissioner Imposes Moratorium on Non-Renewals and Cancellations for Fire-Affected ResidentsIn response to the devastating wildfires in Southern California, California Insurance Commissioner Ricardo Lara has issued a mandatory one-year moratorium on non-renewals and cancellations for homeowners impacted by the fires. The moratorium aims to protect residents from losing their insurance coverage during this challenging time.

Read more »

California Insurance Commissioner Bans Policy Cancellations for Fire-Affected HomeownersFollowing the devastating Palisades and Eaton fires, California Insurance Commissioner Ricardo Lara has implemented a one-year ban on insurance cancellations for affected homeowners. He urges victims to gather documentation and be wary of fraudulent assistance offers.

California Insurance Commissioner Bans Policy Cancellations for Fire-Affected HomeownersFollowing the devastating Palisades and Eaton fires, California Insurance Commissioner Ricardo Lara has implemented a one-year ban on insurance cancellations for affected homeowners. He urges victims to gather documentation and be wary of fraudulent assistance offers.

Read more »