In response to the devastating wildfires in Southern California, California Insurance Commissioner Ricardo Lara has issued a mandatory one-year moratorium on non-renewals and cancellations for homeowners impacted by the fires. The moratorium aims to protect residents from losing their insurance coverage during this challenging time.

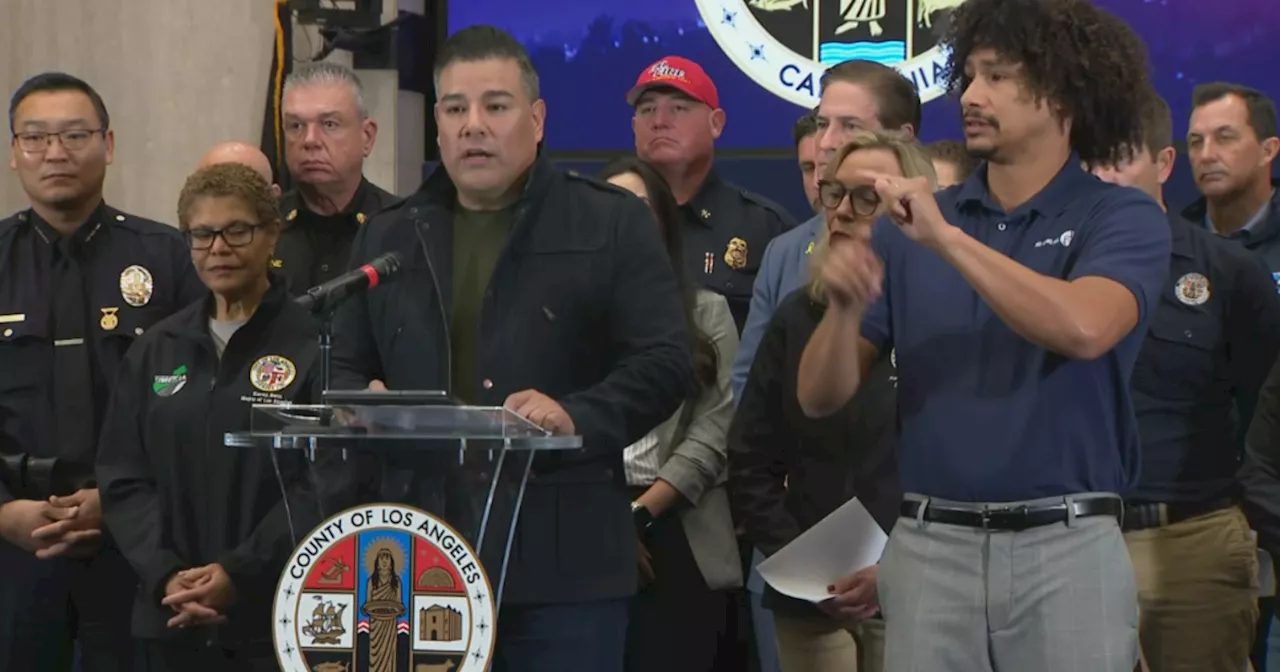

The California insurance commissioner issued a mandatory one-year moratorium on non-renewals and cancellations to protect Southern California residents affected by the recent fires. At a news conference on Friday, Commissioner Ricardo Lara said his primary concern is to make sure residents who are affected by the fires get the full insurance benefits they are entitled to.

'Last night I issued a bulletin to protect homeowners affected by the Palisades and Eaton fires from non-renewals and cancellations by your insurance companies for one year,' Lara said.Lara issued the moratorium on Thursday as the region continues to be wrecked by several fires that have burned over 36,000 acres. His moratorium applies to the zip codes around the Palisades and Eaton fires as well as adjacent areas. It will cover homeowners even if their homes weren't destroyed or damaged. 'I'm also calling on insurance companies to suspend any pending non-renewals and cancellations that homeowners received before these fires started,' Lara said. 'This means that if you received a non-renewal from your homeowner's insurance between Oct. 9 and Jan. 7, essentially 90 days, your insurance company should do the right thing and retain you as a valued policyholder.'Lara's moratorium comes as thousands of Los Angeles homeowners were dropped by insurers before the Palisades Fire erupted. CNS MoneyWatch reported that about 1,600 policies in the Pacific Palisades area were dropped by State Farm in July. To provide additional support to those affected, Lara called on insurers to extend their 60-day grace period for homeowners to pay their insurance premiums. At the conference, Lara said people are also facing issues with health insurance. He has issued a notice to all California health insurers directing them to submit emergency plans to his department. 'These plans must detail how they're going to ensure that consumers can continue to access essential medical care and obtain their medications in the wake of these disasters,' Lara said. Beyond just helping homeowners, Lara intends to introduce new legislation to protect business owners in his moratorium law. His office will be hosting two free insurance support workshops. One will be in Santa Monica on Jan. 18 and 19 the second will be hosted in Pasadena on Jan. 25 and 26

Wildfires California Insurance Moratorium Homeowners Coverage

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

California Insurance Commissioner Urges Wildfire Victims to Be Cautious With ClaimsCalifornia Insurance Commissioner Ricardo Lara advises residents whose homes or businesses were damaged by recent wildfires to avoid signing anything immediately. He emphasizes safety, staying away from affected areas, and taking time to assess their situation before making decisions about insurance claims.

California Insurance Commissioner Urges Wildfire Victims to Be Cautious With ClaimsCalifornia Insurance Commissioner Ricardo Lara advises residents whose homes or businesses were damaged by recent wildfires to avoid signing anything immediately. He emphasizes safety, staying away from affected areas, and taking time to assess their situation before making decisions about insurance claims.

Read more »

California Insurance Commissioner Offers Advice to Wildfire VictimsCalifornia Insurance Commissioner Ricardo Lara advises residents affected by the wildfires on reimbursement options, insurance coverage for evacuation expenses, and steps to take if they are uninsured.

California Insurance Commissioner Offers Advice to Wildfire VictimsCalifornia Insurance Commissioner Ricardo Lara advises residents affected by the wildfires on reimbursement options, insurance coverage for evacuation expenses, and steps to take if they are uninsured.

Read more »

Farmers Insurance promises to write more California home insurance policies ahead of planned reformsThe company committed to writing 9,500 new policies each month.

Farmers Insurance promises to write more California home insurance policies ahead of planned reformsThe company committed to writing 9,500 new policies each month.

Read more »

Farmers Insurance Expands Homeowner Policies in California Amidst Insurance ReformToday on AirTalk, we discuss Farmers Insurance's decision to increase homeowner policies written for California residents, exploring the implications of this move within the broader context of insurance reform in the state. We also delve into the hot topic of holiday office parties, debating whether plus ones should be allowed, and examine the growing trend of teenagers' constant online presence. Plus, renowned Jazz musician Arturo Sandoval joins us to talk about his latest album and his honors from the Kennedy Center for Performing Arts.

Farmers Insurance Expands Homeowner Policies in California Amidst Insurance ReformToday on AirTalk, we discuss Farmers Insurance's decision to increase homeowner policies written for California residents, exploring the implications of this move within the broader context of insurance reform in the state. We also delve into the hot topic of holiday office parties, debating whether plus ones should be allowed, and examine the growing trend of teenagers' constant online presence. Plus, renowned Jazz musician Arturo Sandoval joins us to talk about his latest album and his honors from the Kennedy Center for Performing Arts.

Read more »

Farmers Insurance Expands Coverage in California Amidst Insurance ReformAirTalk discusses Farmers Insurance's decision to increase homeowner policies in California, exploring the impact of insurance reform proposals and the future of home insurance in the state.

Farmers Insurance Expands Coverage in California Amidst Insurance ReformAirTalk discusses Farmers Insurance's decision to increase homeowner policies in California, exploring the impact of insurance reform proposals and the future of home insurance in the state.

Read more »

New California insurance rule will increase coverage in fire-prone areasUnder a new insurance regulation that just got approved this week, California Insurance Commissioner Ricardo Lara said homeowners should have an easier time buying fire insurance, even in fire-prone areas.

New California insurance rule will increase coverage in fire-prone areasUnder a new insurance regulation that just got approved this week, California Insurance Commissioner Ricardo Lara said homeowners should have an easier time buying fire insurance, even in fire-prone areas.

Read more »