Auto insurance premiums in California are surging at an alarming rate, far outpacing even the national average. While homeowners have been grappling with rising insurance costs and policy cancellations, motorists are facing a similar crisis.

Ananda Neil stands in front of his 2022 Hyundai Santa Fe along Webster Street on Tuesday, Dec. 17, 2024, in Oakland, Calif. (Aric Crabb/Bay Area News Group)Over the past year, Oakland grocery store manager Ananda Neil has received updates on his auto insurance policy with mounting dread. When his six-month, per-mile policy for his 2022 Hyundai Santa Fe renewed in October 2023, it edged up from $77.19 to $83.39 a month and 15.5 to 16.7 cents a mile. But in April, it leaped to $167.

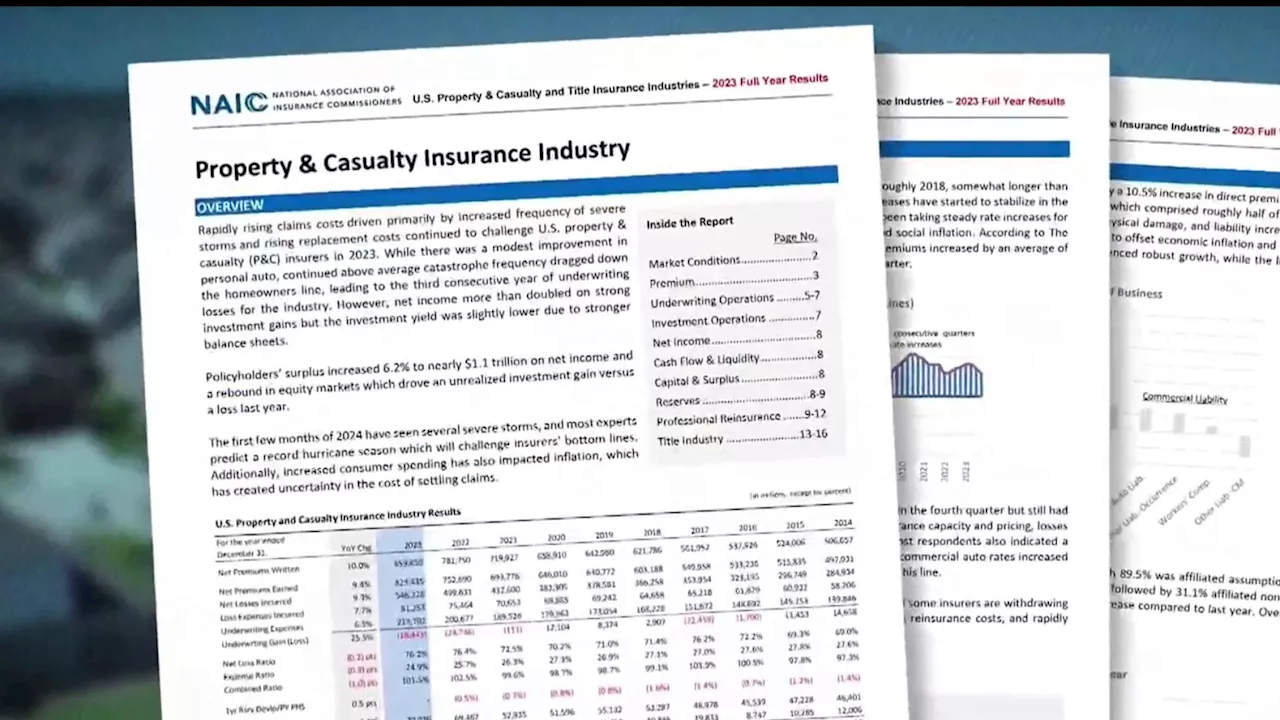

75 a month and 37 cents a mile.“The few insurance companies willing to write a policy were just as much if not more, so I kept my policy with Lemonade,” said Neil, who, despite driving less to reduce cost, said his monthly bill “more than doubled in the last seven months” from about $250 to $550, topping his monthly $453.52 lease payment for the vehicle. Ananda Neil sits in the driver seat of his 2022 Hyundai Santa Fe along Webster Street on Tuesday, Dec. 17, 2024, in Oakland, Calif. (Aric Crabb/Bay Area News Group) While there’s been much attention to rapidly rising insurance costs and policy non-renewals for California homeowners, the state also has seen increasing rates for auto coverage. Auto insurance rates across the U.S. and in California began rising last year, and though they leveled off nationally this summer, they’ve continued to climb in California, according to the latest Insurify analysis. In January 2021, the U.S. and California average annual auto insurance premium was about $1,500. But by November this year, the national average for a full-coverage policy reached $2,315 while California’s jumped to $2,536, according to the latest Bankrate analysis of average rates provided by insurance data firm Quadrant Information Services. California requires motorists to at least carry liability insurance for damage they might cause to others, and for that, the state’s average cost of $670 is slightly below the national average of $678. But that, too, is about to change next yea

AUTO INSURANCE CALIFORNIA RISING COSTS INSURANCE PREMIUMS MOTORISTS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

California Homeowners Face Soaring Insurance CostsHome insurance premiums are skyrocketing in California, forcing residents like Carolina Villaseca to switch providers. Despite living in a safe area, Villaseca saw her insurance costs increase by over 200%. This issue is causing widespread concern and skepticism towards proposed regulation reforms aimed at making insurance more affordable.

California Homeowners Face Soaring Insurance CostsHome insurance premiums are skyrocketing in California, forcing residents like Carolina Villaseca to switch providers. Despite living in a safe area, Villaseca saw her insurance costs increase by over 200%. This issue is causing widespread concern and skepticism towards proposed regulation reforms aimed at making insurance more affordable.

Read more »

Farmers Insurance Expands Homeowner Policies in California Amidst Insurance ReformToday on AirTalk, we discuss Farmers Insurance's decision to increase homeowner policies written for California residents, exploring the implications of this move within the broader context of insurance reform in the state. We also delve into the hot topic of holiday office parties, debating whether plus ones should be allowed, and examine the growing trend of teenagers' constant online presence. Plus, renowned Jazz musician Arturo Sandoval joins us to talk about his latest album and his honors from the Kennedy Center for Performing Arts.

Farmers Insurance Expands Homeowner Policies in California Amidst Insurance ReformToday on AirTalk, we discuss Farmers Insurance's decision to increase homeowner policies written for California residents, exploring the implications of this move within the broader context of insurance reform in the state. We also delve into the hot topic of holiday office parties, debating whether plus ones should be allowed, and examine the growing trend of teenagers' constant online presence. Plus, renowned Jazz musician Arturo Sandoval joins us to talk about his latest album and his honors from the Kennedy Center for Performing Arts.

Read more »

Farmers Insurance promises to write more California home insurance policies ahead of planned reformsThe company committed to writing 9,500 new policies each month.

Farmers Insurance promises to write more California home insurance policies ahead of planned reformsThe company committed to writing 9,500 new policies each month.

Read more »

Farmers Insurance Expands Coverage in California Amidst Insurance ReformAirTalk discusses Farmers Insurance's decision to increase homeowner policies in California, exploring the impact of insurance reform proposals and the future of home insurance in the state.

Farmers Insurance Expands Coverage in California Amidst Insurance ReformAirTalk discusses Farmers Insurance's decision to increase homeowner policies in California, exploring the impact of insurance reform proposals and the future of home insurance in the state.

Read more »

Texas Homeowners Allege Forced Bundling to Keep InsuranceA North Texas homeowner claims her insurance company forced her to bundle her home and auto insurance to renew her policy. Sally Little says Farmers Insurance told her they wouldn't renew her homeowner's policy without adding a personal auto policy. Little isn't alone, as the Texas Department of Insurance (TDI) has received 37 complaints this year about Farmers requiring bundling for home policy renewals. Farmers Insurance argues the bundling guideline is part of their risk strategy and customers without homes who have auto policies wouldn't be affected.

Texas Homeowners Allege Forced Bundling to Keep InsuranceA North Texas homeowner claims her insurance company forced her to bundle her home and auto insurance to renew her policy. Sally Little says Farmers Insurance told her they wouldn't renew her homeowner's policy without adding a personal auto policy. Little isn't alone, as the Texas Department of Insurance (TDI) has received 37 complaints this year about Farmers requiring bundling for home policy renewals. Farmers Insurance argues the bundling guideline is part of their risk strategy and customers without homes who have auto policies wouldn't be affected.

Read more »

Texas Homeowner Claims Insurance Company Forced Bundling to Renew PolicyA North Texas homeowner alleges that her insurance company, Farmers, threatened to non-renew her homeowner's policy unless she bundled it with an auto policy, even though she already has auto insurance with another provider. The Texas Department of Insurance reports 37 complaints this year from Farmers policyholders regarding this bundling requirement. Farmers Insurance Exchange filed new underwriting guideline rules for review in Texas, which remain pending. Farmers maintains that this bundling guideline is part of its risk management strategy and would not apply to customers with auto policies but no homes.

Texas Homeowner Claims Insurance Company Forced Bundling to Renew PolicyA North Texas homeowner alleges that her insurance company, Farmers, threatened to non-renew her homeowner's policy unless she bundled it with an auto policy, even though she already has auto insurance with another provider. The Texas Department of Insurance reports 37 complaints this year from Farmers policyholders regarding this bundling requirement. Farmers Insurance Exchange filed new underwriting guideline rules for review in Texas, which remain pending. Farmers maintains that this bundling guideline is part of its risk management strategy and would not apply to customers with auto policies but no homes.

Read more »