Banks in China lowered their benchmark lending rates while authorities stepped up support for the property market with additional loans, an attempt at bolstering waning business and consumer sentiment as the economy struggles.

The one-year loan prime rate was cut to 3.65% from 3.7%, the first reduction since January, and lower than the 10 basis-point drop that economists had expected. The five-year rate, a reference for mortgages, was reduced by 15 basis points to 4.3% after being“Asymmetric rate cuts underline the urgency of containing the worsening real estate crisis,” said Tommy Xie, head of Greater China research at Oversea-Chinese Banking Corp.

Banks are flush with cash, but are either unwilling or finding it difficult to finance projects. Credit demand weakened sharply in July, prompting some economists to warn of a “

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

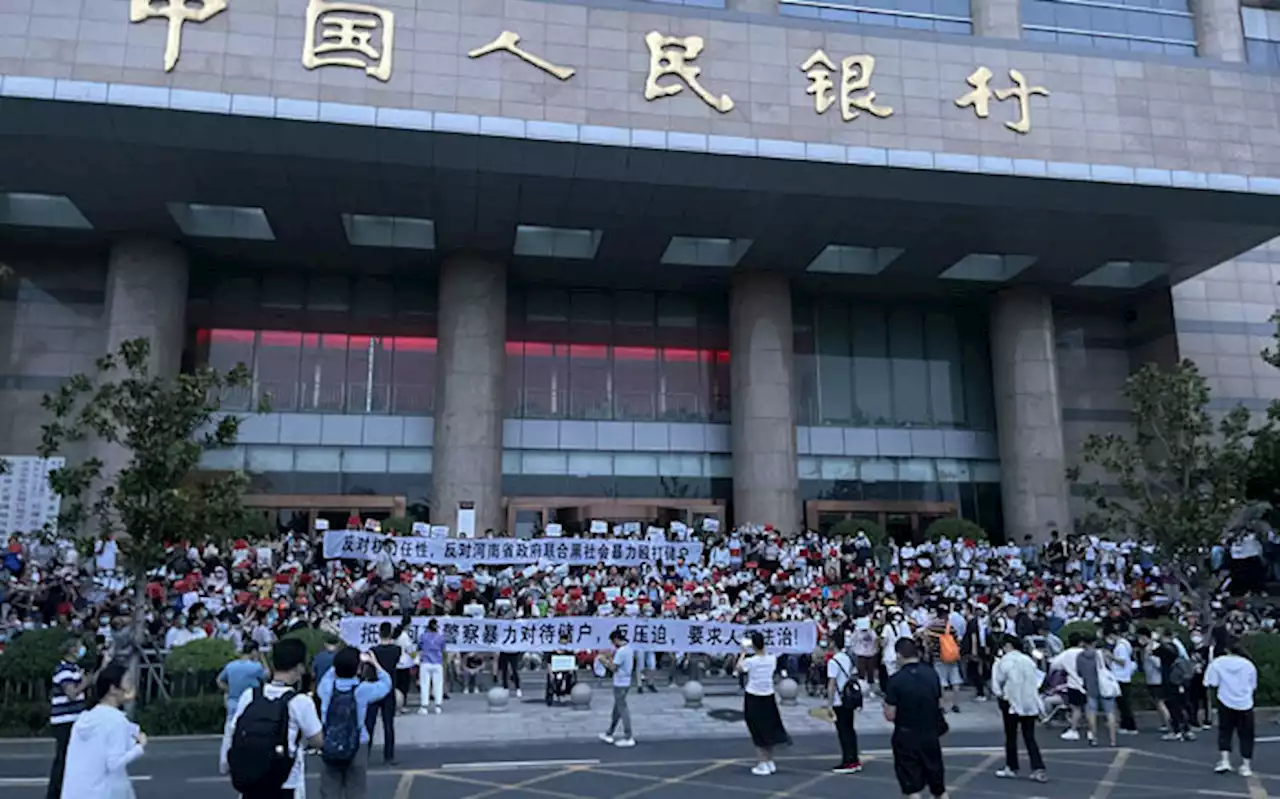

China banks to repay more customers after protestsChinese regulators offered repayments to more customers of rural banks whose withdrawals were frozen.

China banks to repay more customers after protestsChinese regulators offered repayments to more customers of rural banks whose withdrawals were frozen.

Read more »

Banks that fleece the poor and aid corruption should make reparationsSouth African banks, with their excessive performance bonuses, profits and targets at all costs, have undermined the country’s development and been enablers of corruption, writes william_gumede.

Read more »

Crack open the piggy bankSA's conservative and cash-flush banks may ensure decent shareholder returns, even if economic growth disappoints.

Read more »

Suspended contract with Chinese firm costs Transnet more than R3bnRail utility is suing China Railway Rolling Stock Corporation for failing to deliver spares and components

Read more »

China Covid cases jump by 2 200 on tourist-spot flare ups | Fin24China's Taigu district of Jinzhong city in the northern province of Shanxi on Sunday went into a three-day lockdown.

China Covid cases jump by 2 200 on tourist-spot flare ups | Fin24China's Taigu district of Jinzhong city in the northern province of Shanxi on Sunday went into a three-day lockdown.

Read more »

China central bank cuts lending rates to boost economyThe one-year Loan Prime Rate, which serves as a benchmark for corporate loans, was reduced from 3.7% to 3.65%, the People's Bank of China (PBOC) said in a statement.

China central bank cuts lending rates to boost economyThe one-year Loan Prime Rate, which serves as a benchmark for corporate loans, was reduced from 3.7% to 3.65%, the People's Bank of China (PBOC) said in a statement.

Read more »