The one-year Loan Prime Rate, which serves as a benchmark for corporate loans, was reduced from 3.7% to 3.65%, the People's Bank of China (PBOC) said in a statement.

BEIJING - China's central bank on Monday cut benchmark loan rates in an attempt to boost an economy battered by the government's strict zero-COVID policy and a slump in the property market.

Analysts had expected cuts to the LPR rates, but said they may not be enough to rescue the property sector - which is estimated to account for as much as a quarter of China's GDP. "However, homebuyers with existing mortgages will have to wait until the start of next year for the change to affect them."

With property firms struggling to manage mountains of debt, fears have swirled since last year that the sector's troubles could spread to the rest of the economy.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Sundowns midfielder closing in on loan moveAs reported by the Siya crew last month, talented midfielder Pule Maraisane is understood to have completed his loan move from Mamelodi Sundowns to Marumo Gallants. SLSiya Read more:

Sundowns midfielder closing in on loan moveAs reported by the Siya crew last month, talented midfielder Pule Maraisane is understood to have completed his loan move from Mamelodi Sundowns to Marumo Gallants. SLSiya Read more:

Read more »

Global stocks mostly fall amid central bank concernsEuropean and US stocks mostly fell on Friday, with investors focused firmly on central bank interest rate hikes as the US dollar rallied.

Global stocks mostly fall amid central bank concernsEuropean and US stocks mostly fell on Friday, with investors focused firmly on central bank interest rate hikes as the US dollar rallied.

Read more »

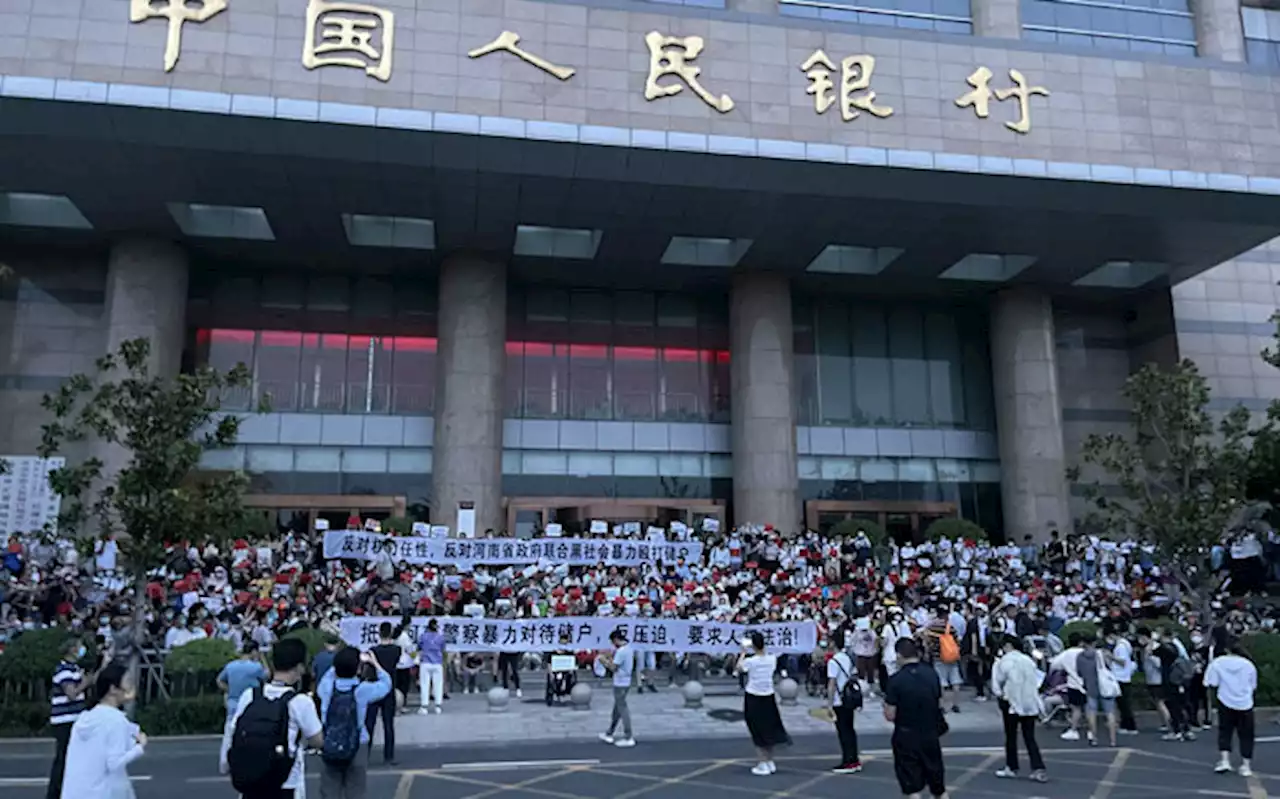

China banks to repay more customers after protestsChinese regulators offered repayments to more customers of rural banks whose withdrawals were frozen.

China banks to repay more customers after protestsChinese regulators offered repayments to more customers of rural banks whose withdrawals were frozen.

Read more »

PAUL MASHATILE: Recovery may be slow and imperceptible but it is under wayThere are green shoots for our economy that could lead to sustained and shared growth

Read more »

Eskom warns of possible Stage 2 weekend blackoutsEskom says it could implement Stage 2 power cuts at short notice.

Eskom warns of possible Stage 2 weekend blackoutsEskom says it could implement Stage 2 power cuts at short notice.

Read more »

Crack open the piggy bankSA's conservative and cash-flush banks may ensure decent shareholder returns, even if economic growth disappoints.

Read more »