The crisis that struck the US banking system over the weekend had many causes, but one factor was the 2018 decision to ease rules that keep big-but-not-quite-mega-banks out of trouble. johnsfoley explains.

U.S. President Joe Biden delivers remarks on the banking crisis after the collapse of Silicon Valley Bank and Signature Bank, in the Roosevelt Room at the White House in Washington, D.C., U.S. March 13, 2023. REUTERS/Evelyn Hocksteinhad many causes. But one factor was the 2018 decision to ease rules that keep big-but-not-quite-mega-banks out of trouble. Among its supporters were officials who still serve today, like Federal Reserve Chair Jay Powell.

After the 2008 crisis, Congress bound up the financial system with rules to prevent bank death spirals. Five years ago on Tuesday, the Senate passed a bill to water them down. The idea was to avoid the one-size-fits-all problem. The legislation known as the Dodd-Frank Act was, politicians and lobbyists contended, strangling smaller and less complex lenders by treating them like the giant institutions that jeopardized the global economy a decade earlier.

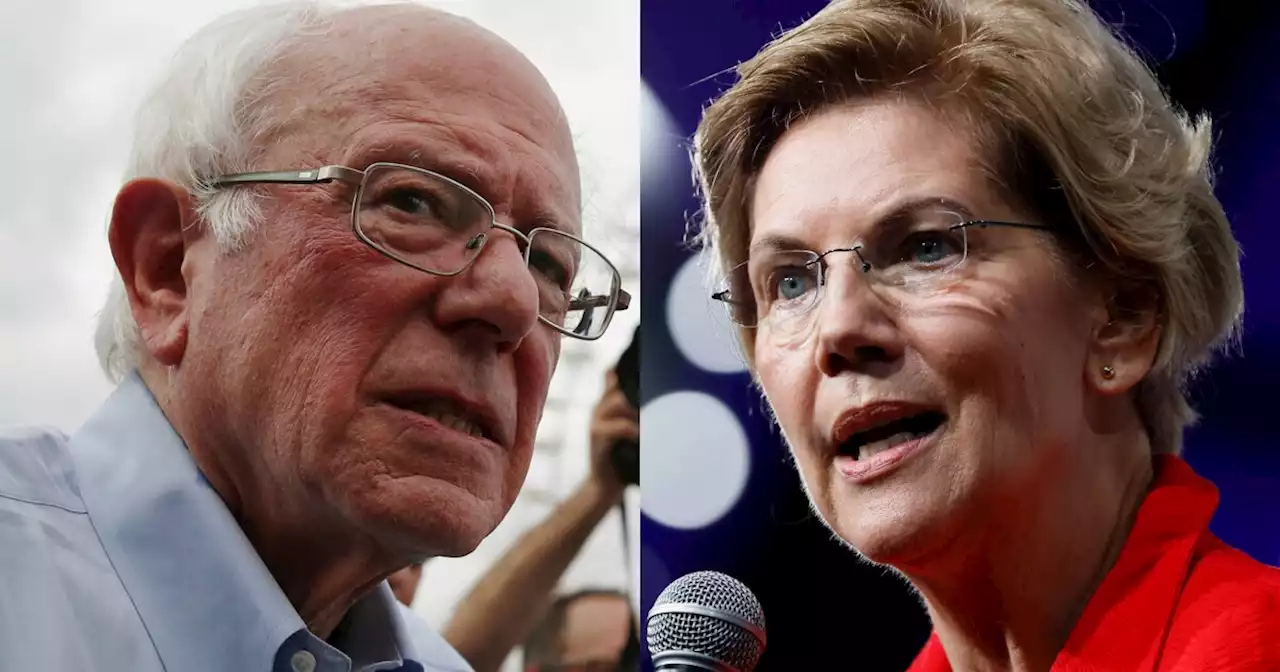

The major financial authorities – the Fed, the Federal Deposit Insurance Corp and the Office of the Comptroller of the Currency – applied the lighter touch. The Fed was permitted to retain tough rules for banks with assets over $100 billion, but decided not to. Among the proponents of the central bank’s approach were Powell and his then-deputy Randall Quarles. Among those who opposed it were

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() Liberals blame Trump for Silicon Valley Bank collapse citing 2018 bipartisan billLiberals took to social media to place blame on former President Trump after FDIC regulators shut down Silicon Valley Bank on Friday after it lost $2 billion.

Liberals blame Trump for Silicon Valley Bank collapse citing 2018 bipartisan billLiberals took to social media to place blame on former President Trump after FDIC regulators shut down Silicon Valley Bank on Friday after it lost $2 billion.

Read more »

![]() Silicon Valley Bank collapse puts new spotlight on a 2018 bank deregulation lawThe failure of Silicon Valley Bank and Signature Bank is putting new scrutiny on a 2018 law that rolled back some banking regulations, with some Democrats calling to restore those rules as the feds step in to protect depositors.

Silicon Valley Bank collapse puts new spotlight on a 2018 bank deregulation lawThe failure of Silicon Valley Bank and Signature Bank is putting new scrutiny on a 2018 law that rolled back some banking regulations, with some Democrats calling to restore those rules as the feds step in to protect depositors.

Read more »

SVB collapse: Progressives blame 2018 rollback of Dodd-Frank for bank failuresProgressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

SVB collapse: Progressives blame 2018 rollback of Dodd-Frank for bank failuresProgressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

Read more »

World Cup Anthem Singer Myriam Fares Removes Blackface From 2018 VideoIn a statement to Rolling Stone, a member of Myriam Fares’ management team confirmed that they had “successfully trimmed” footage of Fares in blackface from the 2018 “Goumi.

World Cup Anthem Singer Myriam Fares Removes Blackface From 2018 VideoIn a statement to Rolling Stone, a member of Myriam Fares’ management team confirmed that they had “successfully trimmed” footage of Fares in blackface from the 2018 “Goumi.

Read more »

Former Astros' pitching prospect Jayson Schroeder retires at age 23A second-round pick by Houston in 2018, the righthander never pitched above Class A in...

Read more »

Breakingviews - Bank rescue buys stability at a high priceThe biggest U.S. banks are so tied up in regulatory red tape that they couldn’t cause a crisis if they tried. The 16th largest, though? That’s a different story, based on Sunday’s dramatic rescue of the financial system. Swift action by U.S. agencies has stopped what could have been a crisis, but at a cost.

Breakingviews - Bank rescue buys stability at a high priceThe biggest U.S. banks are so tied up in regulatory red tape that they couldn’t cause a crisis if they tried. The 16th largest, though? That’s a different story, based on Sunday’s dramatic rescue of the financial system. Swift action by U.S. agencies has stopped what could have been a crisis, but at a cost.

Read more »