Progressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

Federal regulators shut down Silicon Valley Bank on Friday, two days after the nation's 16th-largest federally insured bank announced that it needed to raise more than $2.2 billion to remain solvent, which sent its stock price plunging over 60% in 48 hours. On Sunday evening, they also announced the closure of Signature Bank while revealing plans to make customers of both financial institutions whole. The Silicon Valley Bank failure is the second-largest in U.S.

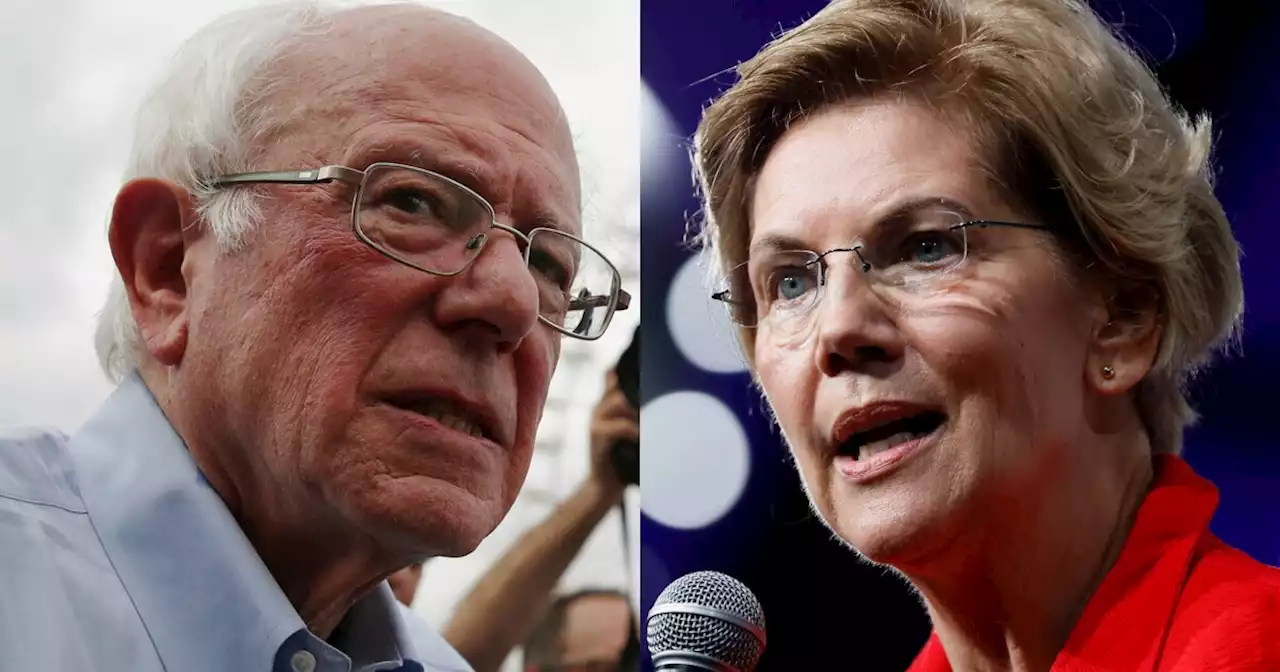

"Had Congress and the Federal Reserve not rolled back the stricter oversight, SVB and Signature would have been subject to stronger liquidity and capital requirements to withstand financial shocks. They would have been required to conduct regular stress tests to expose their vulnerabilities and shore up their businesses," she wrote."But because those requirements were repealed, when an old-fashioned bank run hit S.V.B.

The Vermont senator then quoted a 2018 Congressional Budget Office report predicting that the bill would"increase the likelihood that a large financial firm with assets of between $100 billion and $250 billion would fail."Rep. Alexandria Ocasio-Cortez echoed Sanders's and Warren's sentiments, tweeting Saturday:"The regulators were there until SVB lobbied Congress to remove the guardrails that prevent this kind of crisis in the first place. Warnings were everywhere.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Read more »

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

Read more »

SVB collapse: Director of failed bank was author of Dodd-Frank reform lawFormer Rep. Barney Frank (D-MA), who famously co-authored the 2010 Dodd-Frank financial reform law in response to the 2008 financial crisis, served as a director of Signature Bank, which failed Sunday.

SVB collapse: Director of failed bank was author of Dodd-Frank reform lawFormer Rep. Barney Frank (D-MA), who famously co-authored the 2010 Dodd-Frank financial reform law in response to the 2008 financial crisis, served as a director of Signature Bank, which failed Sunday.

Read more »

Democrats Blame SVB Collapse On Trump-Era Regulatory Rollbacks—But GOP Opposes Stricter RulesTrump’s spokesperson accused Democrats of trying to “gaslight the public to evade responsibility.”

Democrats Blame SVB Collapse On Trump-Era Regulatory Rollbacks—But GOP Opposes Stricter RulesTrump’s spokesperson accused Democrats of trying to “gaslight the public to evade responsibility.”

Read more »

![]() Liberals blame Trump for Silicon Valley Bank collapse citing 2018 bipartisan billLiberals took to social media to place blame on former President Trump after FDIC regulators shut down Silicon Valley Bank on Friday after it lost $2 billion.

Liberals blame Trump for Silicon Valley Bank collapse citing 2018 bipartisan billLiberals took to social media to place blame on former President Trump after FDIC regulators shut down Silicon Valley Bank on Friday after it lost $2 billion.

Read more »

SVB's lightning collapse stuns banking industry By Reuters*SVB'S 48-HOUR LIGHTING COLLAPSE STUNS BANKING INDUSTRY - $SIVB

SVB's lightning collapse stuns banking industry By Reuters*SVB'S 48-HOUR LIGHTING COLLAPSE STUNS BANKING INDUSTRY - $SIVB

Read more »