Jio Financial's assets mostly comprise of a 6% stake in parent Reliance. Yet Mukesh Ambani has plans to float it as soon as September. How it’s valued will signal whether investors reckon he can shake up lending, says ShritamaBose

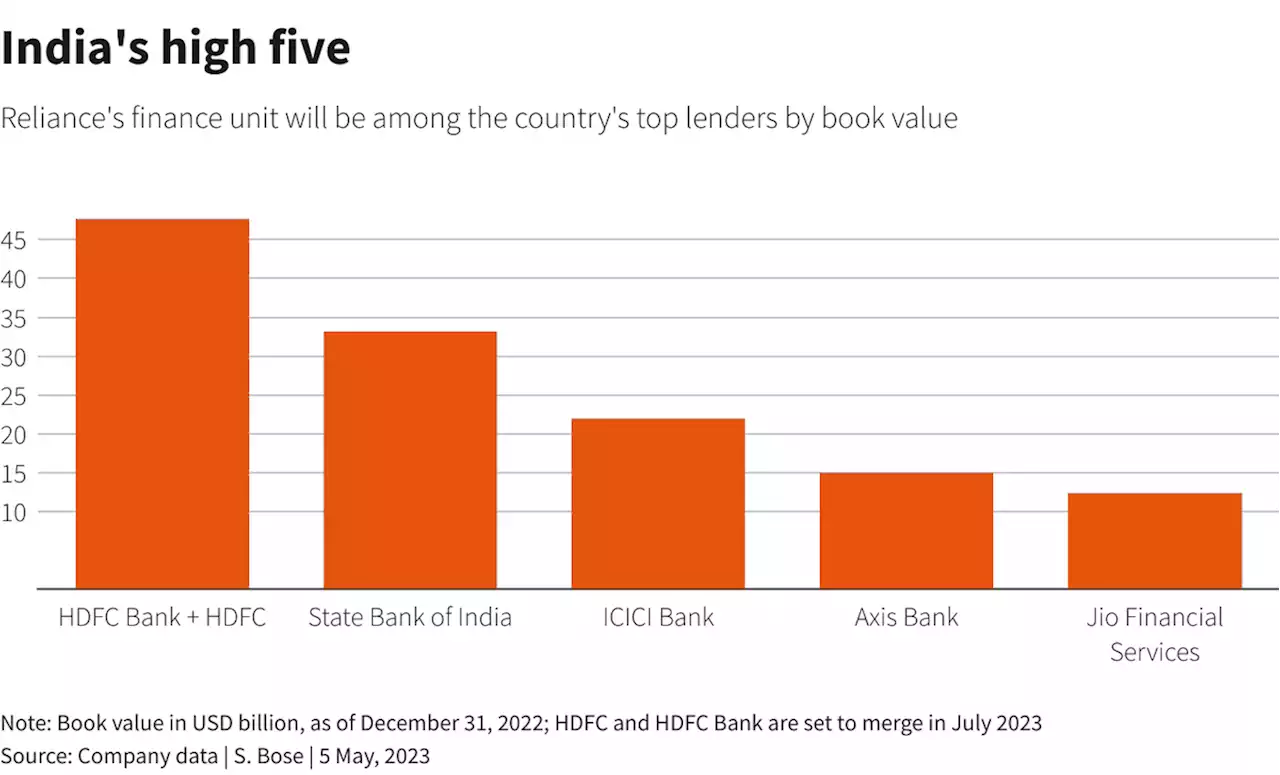

Jio Financial could be listed as soon as September. Yet it is barely up and running, with just $244 million of loans as of March 2022. Its assets mostly comprise a 6% stake in its parent – worth about $12 billion at current market prices; that alone is large enough to make the entity among the top five Indian lenders by book value.The attraction for new shareholders, though, is the potential for Jio to disrupt India’s $1.7 trillion small-loans market.

That’s why analysts at Jefferies reckon the upstart lender can scale up the business rapidly enough to challenge incumbents – and why they thus ascribe a multiple of four to the $1.7 billion book value of Jio’s nascent core financing business. That’s high, putting it nearly on par with where $61 billion mortgage giant Housing Development Finance Corporation

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gene-edited calf may reduce reliance on antimicrobials against cattle diseaseCattle worldwide face major health threats from a highly infectious viral disease that decades of vaccinations and other precautions have failed to contain. Federal, private-sector and University of Nebraska-Lincoln scientists are collaborating on a new line of defense, by producing a gene-edited calf resistant to the virus.

Gene-edited calf may reduce reliance on antimicrobials against cattle diseaseCattle worldwide face major health threats from a highly infectious viral disease that decades of vaccinations and other precautions have failed to contain. Federal, private-sector and University of Nebraska-Lincoln scientists are collaborating on a new line of defense, by producing a gene-edited calf resistant to the virus.

Read more »

Gov. Hobbs says lack of federal preparedness for Title 42 end increases reliance on local servicesTucson Bishop Edward Weisenburger spoke with PatParrisTV at Casa Alitas, saying they're expecting many people to rely on them for help once admitted into the U.S. this week. Full story .

Gov. Hobbs says lack of federal preparedness for Title 42 end increases reliance on local servicesTucson Bishop Edward Weisenburger spoke with PatParrisTV at Casa Alitas, saying they're expecting many people to rely on them for help once admitted into the U.S. this week. Full story .

Read more »

Breakingviews - Aramco’s dividend largesse contains a hard logicSaudi Aramco’s first-quarter net profit may be off by a fifth compared with a year earlier, but it’s also being more generous to shareholders. On top of an existing dividend programme that saw the company hand out $20 billion to investors between January and March, the $2 trillion oil behemoth said on Tuesday it plans to introduce a “performance-linked” payout policy that aims to distribute between 50% and 70% of annual free cash flow. That could work out to up to $18 billion a year, Royal Bank of Canada analysts reckon.

Breakingviews - Aramco’s dividend largesse contains a hard logicSaudi Aramco’s first-quarter net profit may be off by a fifth compared with a year earlier, but it’s also being more generous to shareholders. On top of an existing dividend programme that saw the company hand out $20 billion to investors between January and March, the $2 trillion oil behemoth said on Tuesday it plans to introduce a “performance-linked” payout policy that aims to distribute between 50% and 70% of annual free cash flow. That could work out to up to $18 billion a year, Royal Bank of Canada analysts reckon.

Read more »

Breakingviews - Omaha man sails into Florida’s imperfect stormIt’s easy to see Nebraskan Warren Buffett turning into Florida man – geographically speaking more so than the irrational internet meme version. The Sunshine State’s insurance industry is a mess, and Hurricane Ian only compounded the problems. This imperfect storm suits the Berkshire Hathaway CEO’s investing style.

Breakingviews - Omaha man sails into Florida’s imperfect stormIt’s easy to see Nebraskan Warren Buffett turning into Florida man – geographically speaking more so than the irrational internet meme version. The Sunshine State’s insurance industry is a mess, and Hurricane Ian only compounded the problems. This imperfect storm suits the Berkshire Hathaway CEO’s investing style.

Read more »

Breakingviews - Amazon applies therapy to retailAmazon.com is rolling out a new program to sell toys through mobile games while pushing incentives of $10 to get customers to pick up their stuff rather than have it delivered. Little wonder why. Rising costs and customers battered by inflation are hampering Amazon’s efforts to get its retail division on a path to sustainable profitability. These measures are unlikely to help.

Breakingviews - Amazon applies therapy to retailAmazon.com is rolling out a new program to sell toys through mobile games while pushing incentives of $10 to get customers to pick up their stuff rather than have it delivered. Little wonder why. Rising costs and customers battered by inflation are hampering Amazon’s efforts to get its retail division on a path to sustainable profitability. These measures are unlikely to help.

Read more »

Breakingviews - EU debt’s credibility problem is worseningThe European Union’s debt credibility is suffering from rising doubts, as well as rising rates. While yields are up across the 27-nation bloc, its jointly issued bonds now trade above those of France instead of roughly parallel. To close the spread the EU needs a shift in investor mindsets, and to make good on some revenue-raising promises.

Breakingviews - EU debt’s credibility problem is worseningThe European Union’s debt credibility is suffering from rising doubts, as well as rising rates. While yields are up across the 27-nation bloc, its jointly issued bonds now trade above those of France instead of roughly parallel. To close the spread the EU needs a shift in investor mindsets, and to make good on some revenue-raising promises.

Read more »