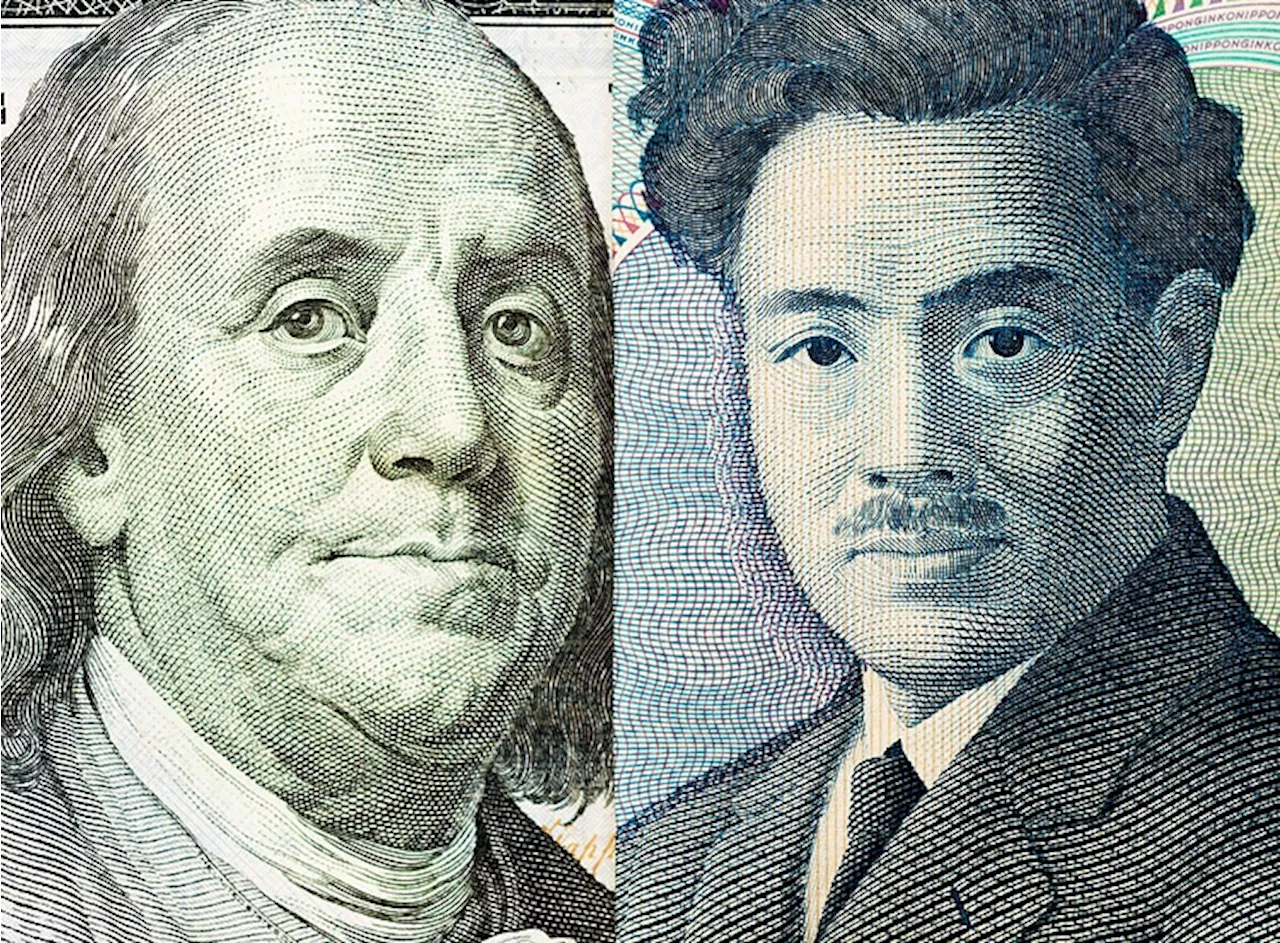

Binance expands its trading options with new Japanese Yen (JPY) pairs, including XLM/JPY. This move is anticipated to increase Stellar's visibility in the Japanese market and drive trading volume.

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions.

We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available. major crypto exchange Binance has announced the listing of new JPY trading pairs, including XLM/JPY. This move is expected to increase Stellar's exposure in the Japanese market, providing a boost to its trading volumes and overall market presence.t by Binance, the move aims to expand its list of trading choices on Binance Spot and improve users' trading experience. The new JPY trading pairs will be introduced in two batches. The first batch, which includes XLM/JPY, will be launched Jan. 9 at 8 a.m. UTC alongside APT/JPY, PEPE/JPY and SUI/JPY. The second batch will be launched Jan. 16 at 8 a.m. UTC, including IOTX/JPY and SEI/JPY.Dogecoin (DOGE) Breakout in, But There's a Catch; Massive XRP Battle Incoming, Stellar Lumens' (XLM) New Price Support IncomingTo further encourage trading, Binance has announced a zero-maker fee promotion for the new JPY spot trading pairs. The promotion period for XLM/JPY will last from Jan. 9 to Feb. 9.This move is expected to boost liquidity and trading activity for Stellar (XLM) in the Japanese markets. Japanese Yen (JPY) is Japan's official currency, and according to Binance's announcement, can be deposited or withdrawn by Binance Japan users only. Increased accessibility to XLM through its JPY pair could lead to higher trading volumes and greater adoption of Stellar in the region. At the time of writing, XLM was up 1.19% in the last 24 hours to $0.455 and up 36.35% in the last seven day

BINANCE XLM STELLAR JPY JAPANESE MARKET

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY: Fed and/or BoJ’s pace slowdown may affect USD/JPY’s movesUSD/JPY eased lower this morning after PPI came in higher than expected.

USD/JPY: Fed and/or BoJ’s pace slowdown may affect USD/JPY’s movesUSD/JPY eased lower this morning after PPI came in higher than expected.

Read more »

USD/JPY refreshes two-day high at 150.80 as Japanese Yen weakens across the boardThe USD/JPY pair posts a fresh two-day high at 150.80 in the North American session on Monday.

USD/JPY refreshes two-day high at 150.80 as Japanese Yen weakens across the boardThe USD/JPY pair posts a fresh two-day high at 150.80 in the North American session on Monday.

Read more »

USD/JPY Price Forecast: Soars past 154.00, ignoring upbeat Japanese dataThe USD/JPY extended its gains as the Japanese Yen (JPY) remains the laggard in the G10 FX complex.

USD/JPY Price Forecast: Soars past 154.00, ignoring upbeat Japanese dataThe USD/JPY extended its gains as the Japanese Yen (JPY) remains the laggard in the G10 FX complex.

Read more »

EUR/JPY Climbs on BoJ Rate Hike Uncertainty, Japanese Yen TumblesThe EUR/JPY exchange rate surged to around 164.25 in Tuesday's early European session, fueled by uncertainty surrounding the Bank of Japan's (BoJ) next interest rate hike. The Japanese Yen weakened as investors await clues on the timing of a potential BoJ rate adjustment. Meanwhile, strong PMI data from Eurozone economies supported the Euro. The upcoming release of the Eurozone's HICP inflation data is expected to influence market expectations for the European Central Bank's (ECB) future interest rate decisions.

EUR/JPY Climbs on BoJ Rate Hike Uncertainty, Japanese Yen TumblesThe EUR/JPY exchange rate surged to around 164.25 in Tuesday's early European session, fueled by uncertainty surrounding the Bank of Japan's (BoJ) next interest rate hike. The Japanese Yen weakened as investors await clues on the timing of a potential BoJ rate adjustment. Meanwhile, strong PMI data from Eurozone economies supported the Euro. The upcoming release of the Eurozone's HICP inflation data is expected to influence market expectations for the European Central Bank's (ECB) future interest rate decisions.

Read more »

USD/JPY Weakening Amidst Japanese Intervention Warnings and Fed's Slower Rate Cut OutlookThe USD/JPY pair fell to around 157.30 on Friday, losing 0.21% as Japanese authorities warned about potential intervention against excessive currency moves. The Federal Reserve signaled a slower pace of rate cuts, which could support the USD in the near term. Japanese markets are closed for the rest of the week, while traders await the US ISM Manufacturing PMI for December. The Bank of Japan's (BoJ) policy outlook remains uncertain, potentially capping the JPY's upside. The BoJ's quarterly report on regional economic conditions, due next week, may shed light on its next policy decision.

USD/JPY Weakening Amidst Japanese Intervention Warnings and Fed's Slower Rate Cut OutlookThe USD/JPY pair fell to around 157.30 on Friday, losing 0.21% as Japanese authorities warned about potential intervention against excessive currency moves. The Federal Reserve signaled a slower pace of rate cuts, which could support the USD in the near term. Japanese markets are closed for the rest of the week, while traders await the US ISM Manufacturing PMI for December. The Bank of Japan's (BoJ) policy outlook remains uncertain, potentially capping the JPY's upside. The BoJ's quarterly report on regional economic conditions, due next week, may shed light on its next policy decision.

Read more »

USD/JPY Retreats on Stronger Japanese Inflation Data and Risk-Off SentimentThe USD/JPY currency pair declined on Friday, driven by stronger-than-expected Japanese inflation data and a global risk-off mood. Although the Bank of Japan maintained its short-term interest rate target, rising inflation pressures suggest a potential interest rate hike in the coming months, boosting the Japanese Yen's appeal as a safe haven.

USD/JPY Retreats on Stronger Japanese Inflation Data and Risk-Off SentimentThe USD/JPY currency pair declined on Friday, driven by stronger-than-expected Japanese inflation data and a global risk-off mood. Although the Bank of Japan maintained its short-term interest rate target, rising inflation pressures suggest a potential interest rate hike in the coming months, boosting the Japanese Yen's appeal as a safe haven.

Read more »