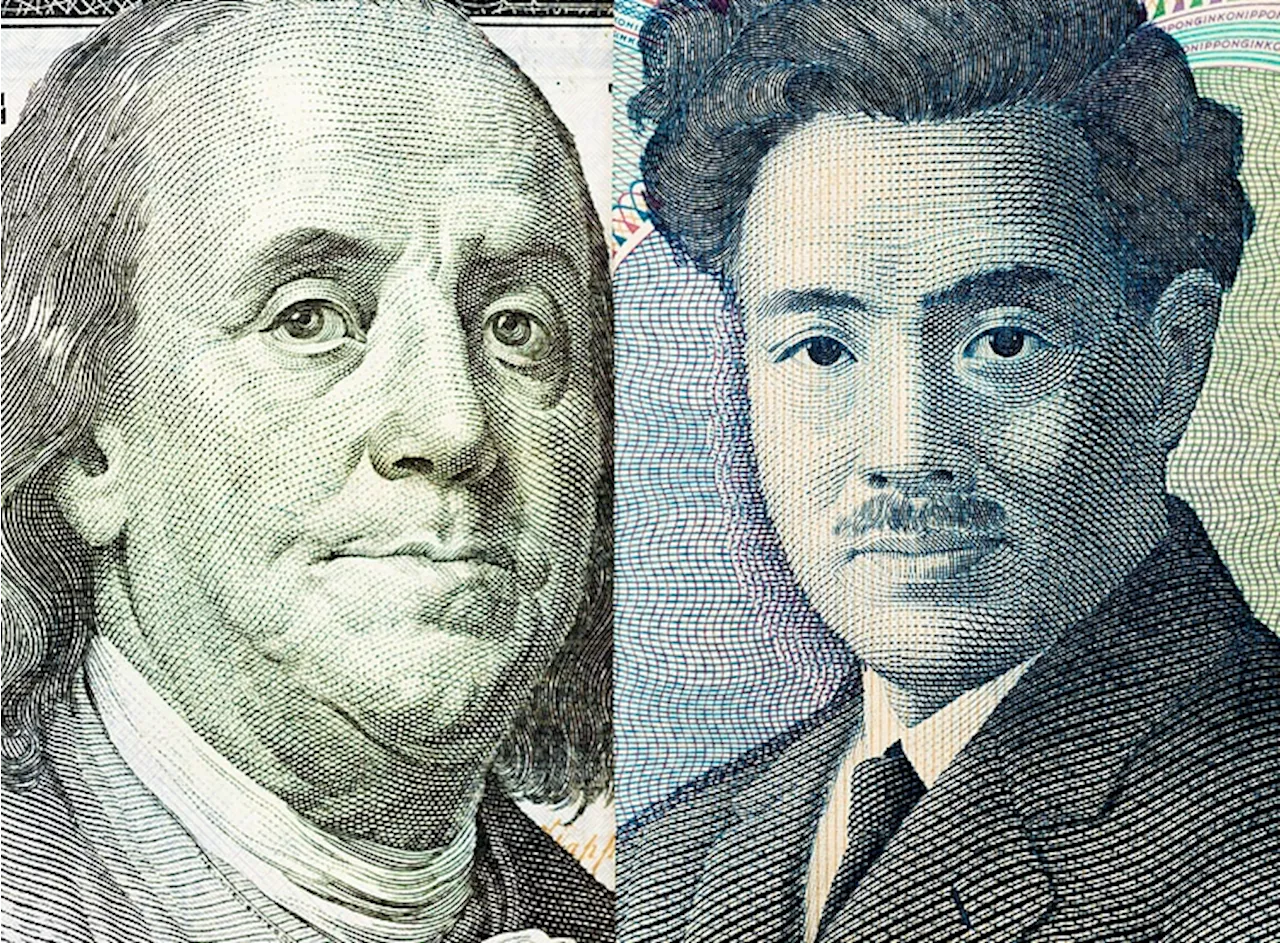

The USD/JPY currency pair declined on Friday, driven by stronger-than-expected Japanese inflation data and a global risk-off mood. Although the Bank of Japan maintained its short-term interest rate target, rising inflation pressures suggest a potential interest rate hike in the coming months, boosting the Japanese Yen's appeal as a safe haven.

USD/JPY attracts some intraday sellers after stronger inflation figures from Japan. The risk-off mood and retreating US bond yields also benefit the lower-yielding JPY. The divergent Fed-BoJ outlook should limit losses ahead of the US PCE Price Index. The USD/JPY pair retreats following an intraday uptick to the 158.00 neighborhood, or a five-month peak and continues losing ground through the early European session on Friday.

As investors look past the Bank of Japan (BoJ) monetary policy update on Thursday, strong inflation data from Japan, along with the risk-off mood, benefits the safe-haven Japanese Yen (JPY) and exerts some pressure on the currency pair. The BoJ decided to keep the short-term rate target unchanged at the end of the December policy meeting and offered few clues on how soon it could push up borrowing costs. That said, a government report showed that Japan's National Consumer Price Index (CPI) rose more than expected in November and keeps the door open for a potential rate hike in January or March. In fact, the Japan Statistics Bureau reported that the National CPI climbed 2.9% YoY in November compared to the 2.3% previous reading. Additional details revealed that the National CPI ex Fresh food arrived at 2.7% YoY versus 2.3% in October and was above the 2.6% market expectations. Moreover, CPI ex Fresh Food, Energy rose 2.7% YoY in November versus the 2.3% increase recorded in the previous month. This points to a sustained uptick in inflation and might force the BoJ to hike interest rates again early in 2025, which, in turn, provides some respite to the JPY bulls. Apart from this, the global flight to safety, amid the looming US government shutdown, drives some haven flows towards the JPY and drags the USD/JPY pair further below the 157.00 mark on the last day of the week. The US House of Representatives failed to pass A spending bill to fund the government on Thursday, raising the risk of a partial shutdown at the end of the day on Frida

USDJPY Japanese Yen Inflation Risk-Off Bank Of Japan

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/JPY edges lower after stronger-than-expected Japanese inflation, stimulus packageUSD/JPY is trading a touch lower in the 154.30s on Friday as the Japanese Yen (JPY) strengthens against the US Dollar (USD) due to the release of higher-than-expected Japanese macroeconomic data, and Tokyo’s announcement of a $250 billion economic stimulus package.

USD/JPY edges lower after stronger-than-expected Japanese inflation, stimulus packageUSD/JPY is trading a touch lower in the 154.30s on Friday as the Japanese Yen (JPY) strengthens against the US Dollar (USD) due to the release of higher-than-expected Japanese macroeconomic data, and Tokyo’s announcement of a $250 billion economic stimulus package.

Read more »

USD/JPY: Fed and/or BoJ’s pace slowdown may affect USD/JPY’s movesUSD/JPY eased lower this morning after PPI came in higher than expected.

USD/JPY: Fed and/or BoJ’s pace slowdown may affect USD/JPY’s movesUSD/JPY eased lower this morning after PPI came in higher than expected.

Read more »

USD/JPY refreshes two-day high at 150.80 as Japanese Yen weakens across the boardThe USD/JPY pair posts a fresh two-day high at 150.80 in the North American session on Monday.

USD/JPY refreshes two-day high at 150.80 as Japanese Yen weakens across the boardThe USD/JPY pair posts a fresh two-day high at 150.80 in the North American session on Monday.

Read more »

USD/JPY Price Forecast: Soars past 154.00, ignoring upbeat Japanese dataThe USD/JPY extended its gains as the Japanese Yen (JPY) remains the laggard in the G10 FX complex.

USD/JPY Price Forecast: Soars past 154.00, ignoring upbeat Japanese dataThe USD/JPY extended its gains as the Japanese Yen (JPY) remains the laggard in the G10 FX complex.

Read more »

Gold retreats further with amid higher US yields and an stronger USDGold rally fails at around $2,720 and pares previous gains amid higher US yields.

Gold retreats further with amid higher US yields and an stronger USDGold rally fails at around $2,720 and pares previous gains amid higher US yields.

Read more »

GBP/USD retreats from multi-week top, slides below 1.2700 on stronger USDThe GBP/USD pair attracts some sellers on the first day of a new week and reverses a major part of Friday's positive move to mid-1.2700s, or a nearly three-week high.

GBP/USD retreats from multi-week top, slides below 1.2700 on stronger USDThe GBP/USD pair attracts some sellers on the first day of a new week and reverses a major part of Friday's positive move to mid-1.2700s, or a nearly three-week high.

Read more »