The Bank expanded its intervention to help pension funds again on Tuesday by buying up index-linked gilts, a day after increasing the daily amount it can spend on long-dated gilts.

Gilt yields, the interest rate payable on government bonds, rose on Monday, near the 5% highs of 27 September, the day before the Bank made its first intervention.They fell when news of the latest operation was announced but long-dated yields later rose higher again.

It is hoped the decision to again expand purchasing to index-linked gilts will"act as a further backstop to restore orderly market conditions", the Bank said.The pound, which had fallen back against the dollar for a fifth day earlier on Tuesday, was eight tenths of a cent higher at $1.1130.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

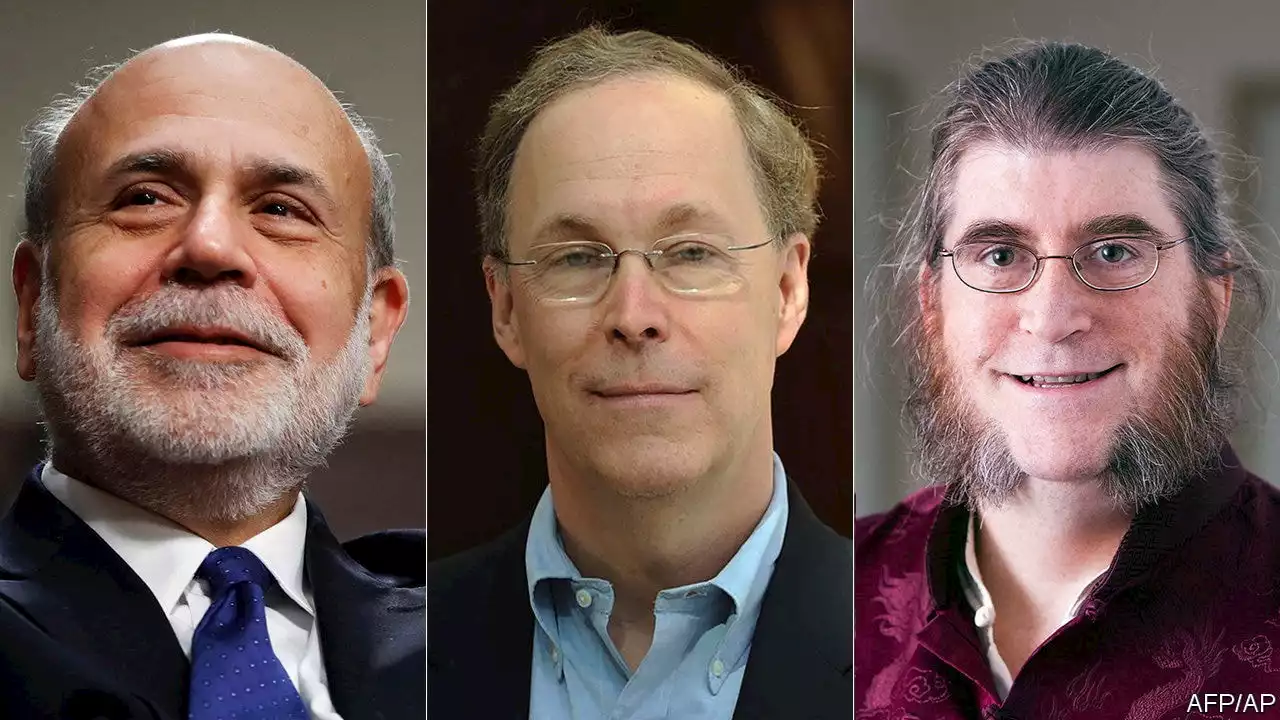

Three economists win the Nobel for their work on bank runsResearch by Ben Bernanke, Douglas Diamond and Philip Dybvig was largely vindicated by the failure of the banks in 2008

Three economists win the Nobel for their work on bank runsResearch by Ben Bernanke, Douglas Diamond and Philip Dybvig was largely vindicated by the failure of the banks in 2008

Read more »

Economists win Nobel prize for work on bank runsWhen the global financial crisis struck in 2008, economists were forced to respond to criticism that they had ignored the banking system. This year’s prize honours three economists who had, in fact, spent the previous decades examining banking instability

Economists win Nobel prize for work on bank runsWhen the global financial crisis struck in 2008, economists were forced to respond to criticism that they had ignored the banking system. This year’s prize honours three economists who had, in fact, spent the previous decades examining banking instability

Read more »

Ulster Bank survey: NI economy continues to contractAll sectors in Northern Ireland's economy reported a fall in activity for the fifth month in a row, according to the latest UlsterBank survey

Ulster Bank survey: NI economy continues to contractAll sectors in Northern Ireland's economy reported a fall in activity for the fifth month in a row, according to the latest UlsterBank survey

Read more »

All the confirmed UK bank holidays for 2022 and 2023There is also the possibility of an extra one

All the confirmed UK bank holidays for 2022 and 2023There is also the possibility of an extra one

Read more »

Bank of England prepared to raise daily gilt purchases in final week of £65bn scheme\n\t\t\tExpert insights, analysis and smart data help you cut through the noise to spot trends,\n\t\t\trisks and opportunities.\n\t\t\n\t\tJoin over 300,000 Finance professionals who already subscribe to the FT.

Read more »

The Bank of England hits panic button yet again with emergency bond-buying planThe central bank is attempting to stop tumbling government bond prices causing a market collapse

The Bank of England hits panic button yet again with emergency bond-buying planThe central bank is attempting to stop tumbling government bond prices causing a market collapse

Read more »